Tax Alerts

13 Apr 20152015

New BIR announcements re: ITR filing (RMC 17 and 18-2015)

The following new rules/procedures have been announced in the above RMCs.

1. On-line filing is deferred for no-payment returns.

2. Taxpayers newly enrolled for eFPS but who have not completed registration with the bank shall electronically file their returns and pay the taxes manually.

3. Use the new eBIRForms Package v4.7.08

4. For taxpayers who have enrolled for the Online eFIRForms but were not successful in lodging their returns through the Offline eBIRForms facility (no email notification, not successfully filed, etc.), they are advised to send their tax return by email following the procedures in Annex D of RMC 14-2015.

Discussion:

1. On-line filing is deferred for no-payment returns. No payment returns can be filed manually with the RDO on or before April 15. The same should however be re-filed electronically on or before June 15, 2015.

The following instances of no-payment returns as clarified under RMC 12-2015 are still exempt from the requirement to register with the Online eBIRForms Facility. Hence, they can prepare their returns either using the Offline eBIRForms Package or the pre-printed forms and file their returns manually:

a. Senior citizens and persons with disability

b. Purely compensation income earners whose taxes have been fully withheld

c. Employees qualified for substituted filing but who opt to file an ITR

2. Taxpayers newly enrolled for eFPS but who have not completed registration with the bank for ePayment shall electronically file their returns using the Offline eBIRForms and pay the tax due manually with the bank. However, they are advised to complete their ePayment registration and must comply with eFile and ePay on all succeeding returns not later than June 15, 2015.

3. Download and use the new eBIRForms Package v4.7.08, uninstall v4.7.07 and below. Use of the older version is Annual ITRs encoded using the older versions can still be viewed and used in the new version. The new version can be downloaded from any of the following:

- http://www.knowyourtaxes.ph

- http://www.dof.gov.ph/?page_id=11827

- Dropbox: http://bit.ly/1ImuMLj

- Direct link: http://ftp.pregi.net/bir/ebirform_package_v4.7.07_ITRv2013.zip

4. If taxpayer was unsuccessful with electronic filing (no notification received, notification says filing was unsuccessful, etc.), taxpayer is advised to re-send the return via email following the procedures in Annex D of RMC 14-2015, as follows:

a. Open the directory ”C:\eBIRForms\IAF_RDO_Copy\” in the computer.

b. Look for the XML file of the encoded ITR with the following naming convention Filename = <9999 9999 9999-XXXXXX-9999.xml> wherein:

i. 9999 9999 9999 – First 12 Digits of the TIN including branch code

ii. XXXXXX – BIR Form Number

iii. 99999999 – Return Period/Taxable Year

iv. .xml – The file type extension

c. Attach the xml file to an email and send to the BIR using the following subject and address:

Form No. E-mail Subject E-mail Address

1700 RDO_1700_TIN_taxable period 1700v2013@bir.gov.ph

1701 RDO_1701_TIN_taxable period 1701v2013@bir.gov.ph

1702EX RDO_1702EX_TIN_taxable period 1702EXv2013@bir.gov.ph

1702MX RDO_1702MX_TIN_taxable period 1702MXv2013@bir.gov.ph

1702RT RDO_1702RT_TIN_taxable period 1702RTv2013@bir.gov.ph

d. If no email notification is received after 2 hours, you can call the BIR office for assistance (02-9818888)

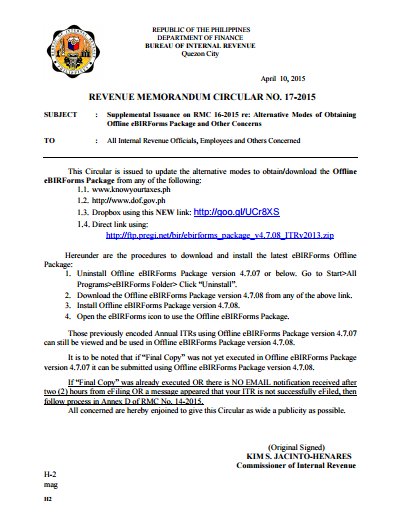

Please access the PDF for a copy of RMC 17-2015.

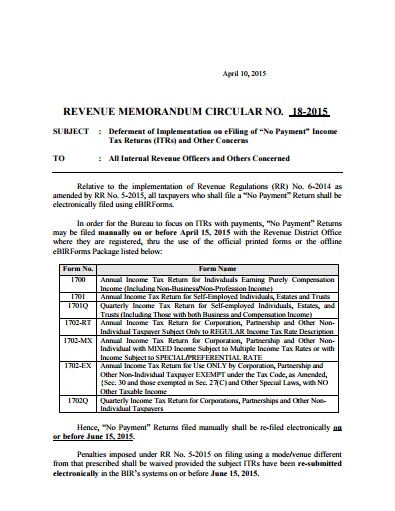

Please access the PDF for a copy of RMC 18-2015.

Contact E-mail:

lina.figueroa@ph.gt.com