This Accounting Alert is issued to circulate Bangko Sentral ng Pilipinas (BSP) Circular No. 1193 dated April 29, 2024, Amendments to Section 911/911-Q of the Manual of Regulations for Banks (MORB)/Manual of Regulations for Non-Bank Financial Institutions (MORNBFI) - Money Laundering (ML)/ Terrorist Financing (TF)/ Proliferation Financing (PF) Risk Reporting and Notification Requirements.

Introduction

The Monetary Board, in its Resolution No. 428 dated 18 April 2024, approved the amendments to the provisions of Section 911 of the MORB and Section 911-Q of the MORNBFI covering the ML/ TF/ PF risk reporting and notification requirements for BSP-supervised financial institutions (BSFIs).

ML/TF/PF Risk Reporting and Notification Requirements

A critical component of a covered person's risk assessment and management process is the timely collection and analysis of relevant data, including risk events. In this regard, covered persons shall submit a report covering data and information on significant risk events arising from ML/ TF/ PF-related incidents or activities that may have a material effect to the covered person and/or the financial system.

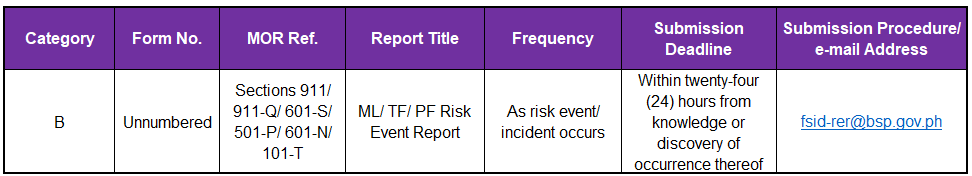

A. Reporting Requirements

Covered persons are required to submit ML/ TF/ PF Risk Event Report to the BSP within twenty-four (24) hours from the date of knowledge or discovery of occurrence (i.e., from the time the event has been known or should have been known by the covered person) of any significant ML/ TF/ PF risk event.

In determining whether an ML/ TF/ PF risk event is significant and reportable, the following shall be considered:

(1) The amount involved represents one (1) percent or more of the covered person's total qualifying capital; or,

(2) Regardless of the amount involved, the covered person has determined that the ML/ TF/ PF-related incident has a material impact on the covered person and/or the financial system, such as those affecting significant number of customers or counterparties, with cross-border element, or those covered/may be widely covered in adverse media reports.

B. Procedures for Reporting to Bangko Sentral

The ML/TF/ PF Risk Event Report shall contain, at a minimum, the following information:

(1) date of knowledge or discovery of occurrence of the event or incident;

(2) brief description of the event/ incident, such as nature, type of the transaction/product, delivery channel used, and amount involved;

(3) initial root cause of the event/ incident, if determined, and response/actions taken/to be taken by the covered person thereto; and,

(4) impact to the covered person based on initial assessment (i.e., in terms of financial/ operational/ reputational losses).

C. Compliance with other Risk Reporting and Notification Requirements

Compliance with ML/TF/PF risk event report shall not preclude covered persons from complying with other existing regulations of the BSP on reporting crimes and losses and event-driven reporting and notification. In case the ML/TF/PF risk event also qualifies as a major cyber-related incident, the submission of event-driven reporting and notification to the BSP will be considered compliance with ML/TF/PF risk event report.

D. Supervisory Enforcement Actions

Non-compliance with the reporting requirements on Risk Event Report will be subject to applicable monetary penalty pursuant to Sections 1102/ 1102-Q, as amended.

Further, consistent with Sections 002/ 002-Q/ 002-S/ 002-P/ 001-N/ 002-T, the BSP may deploy its range of enforcement actions to promote adherence to the requirements set forth in this Section and bring about timely corrective actions.

![]()

Effectivity

This Circular shall take effect fifteen (15) calendar days following its publication either in the Official Gazette or in a newspaper of general publication.

Please see attached circular for further information.