This Accounting Alert is issued to circulate Insights into PFRS 17 to explain the key features of the Standard and provide insights into its application and impact.

Introduction

PFRS 17, Insurance Contracts, addresses the accounting for insurance contracts rather than being explicitly aimed at insurance entities. As a result, it applies equally to insurance contracts issued by insurance and non-insurance entities. A non-insurance entity should be considered as any entity whose primary source of business is not the issuance of insurance contracts as defined in PFRS 17, and whose contractual activities are not actively monitored by an insurance regulator.

The significance of PFRS 17's scope for non-insurance entities

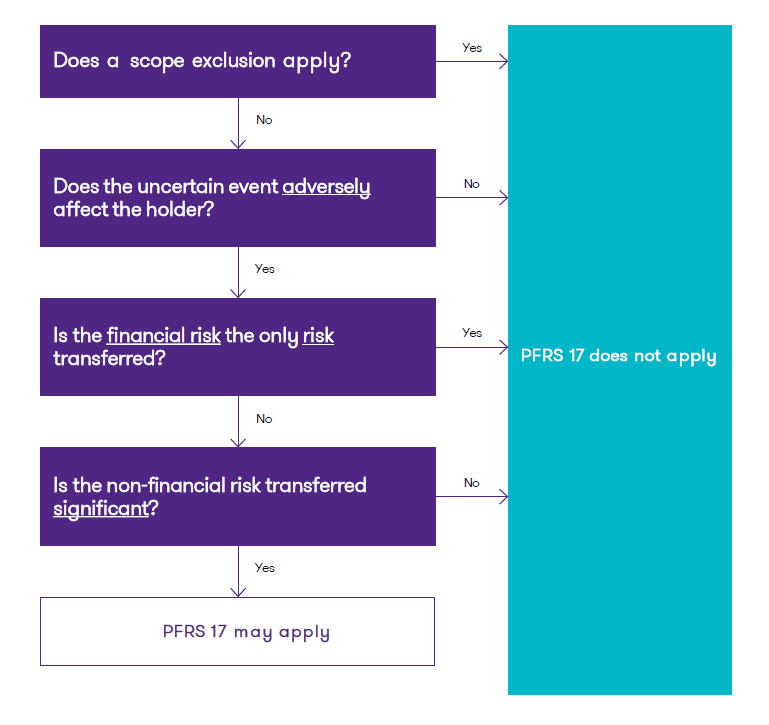

Non-insurance entities that had previously applied PFRS 4 were able to apply their existing accounting policies to insurance contracts that fell within the scope of that Standard. However when applying PFRS 17 they can only apply accounting policies that are permissible under PFRS 17 for any reporting period that begins on or after January 1, 2023. Non-insurance entities need to be alert to the possibility that contracts they have issued (or may issue in the future) might now fall within the scope of the new Standard. This may result in some significant changes. It is recommended that these entities analyze their contracts using the following steps:

![]()

Is the contract covered by one of PFRS 17's scope exceptions?

PFRS 17 includes a number of scope exceptions. This means many non-insurance entities may not have to apply PFRS 17 to the contracts they issue. But these scope exceptions need to be carefully considered because many of them may require a lot of judgement to be exercised. See attached article for the scope exclusions and the standards to which they apply.

How PFRS 17 must be applied when there are no scope exclusions

Where non-insurance entities conclude they have issued contracts within the scope of PFRS 17, then they will need to apply that Standard in full to those contracts.

PFRS 17 requires an entity that issues any insurance contracts to report them in their statement of financial position as the total of:

- the fulfilment cash flows – the current estimates of amounts the insurer expects to collect from premiums and pay out for claims, benefits and expenses, including an adjustment for the timing and financial risks related to those cash flows

- the contractual service margin – the expected profit for providing future insurance coverage (i.e. unearned profit).

Revenue recognized under PFRS 17 is significantly different to the recognition under PFRS 4, and likely different for any portion of contracts not accounted for under PFRS 4. Revenue is no longer linked to written premiums but instead reflects the change in the contract liability covered by consideration.

Closing observations

Non-insurance entities who have not applied insurance accounting in the past are not necessarily exempt from applying insurance accounting in the future. The removal of the unbundling feature of PFRS 4 as well as the stricter measurement requirements set out in PFRS 17 may have a significant impact on the accounting of contracts that meet the definition of an insurance contract. Due to the complexity and time-consuming nature of applying PFRS 17, non-insurance entities (if they have not already done so), must pay careful attention to this Standard to ascertain whether it is applicable or not.

Please see attached article for further information.