The Securities and Exchange Commission (SEC), in its Memorandum Circular (MC) No. 02, series of 2024 has set the deadlines for the filing and submission of the 2023 audited financial statements (AFS) and general information sheet of corporations through the Electronic Filing and Submission Tool (eFAST).

I. Annual Financial Statements (AFS)

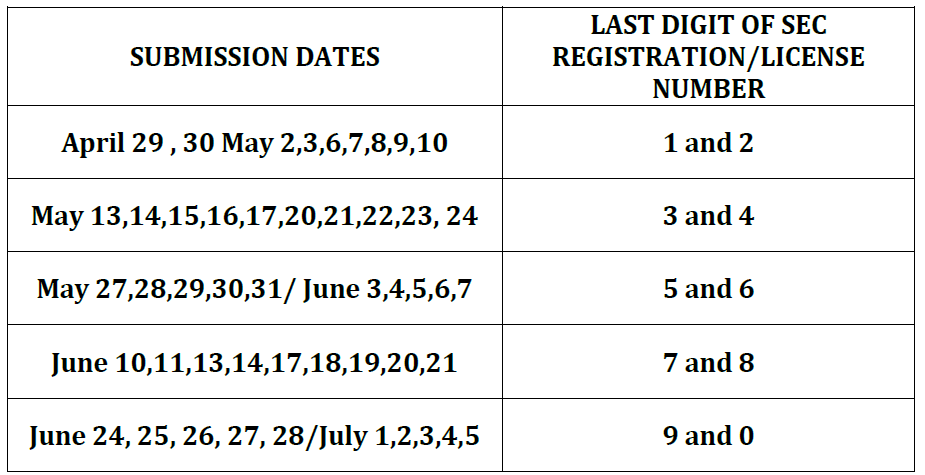

All corporations, including branch offices, representative offices, regional headquarters and regional operating headquarters of foreign corporations whose fiscal year ends on December 31, 2023 shall file their AFS through eFAST based on the last digit of the SEC registration or license number in accordance with the following schedule:

![]()

Late filings or submissions after the due dates provided shall be accepted starting July 8, 2024 and shall be subject to the prescribed penalties which shall be computed from the date of the last day of filing.

For corporations whose fiscal year ends on a date other than December 31, 2023, shall their AFS within 120 calendar days from the end of their respective fiscal years.

Corporations whose securities are listed on the Philippine Stock Exchange (PSE), those whose securities are registered but not listed on the PSE, those considered as public companies and those covered under Section 17.2 of the Securities Regulation Code, shall observe the due date of filing for their AFS, which is within 105 calendar days after the end of their fiscal year, as an attachment to their annual reports. Non-listed registered issuers of securities which filed SEC Form 17-EX for 2024 shall observe the AFS filing period as prescribed in the filing schedule or within 120 calendar days from the end of their fiscal year, as applicable.

II. General Information Sheet (GIS)

All corporations shall file their GIS within 30 calendar days from:

a. Stock Corporations – date of actual annual stockholders’ meeting

b. Non-Stock Corporations – date of actual annual members meeting

c. Foreign Corporations – anniversary date of the issuance of the SEC License.

III. Other reports

All other annual reportorial requirements shall be submitted through eFAST. Other reports not yet accepted through eFAST may be submitted by sending through email at ictdsubmission@sec.gov.ph.

Submission of reports over the counter and/or through mail or courier under the SEC Express Nationwide Submission facility shall no longer be accepted.