This Accounting Alert is issued to circulate Securities and Exchange Commission (SEC) Memorandum Circular (MC) No. 12-2023 dated September 6, 2023, Amendments to Section 39.1.4.1 of the Implementing Rules and Regulation of the Securities Regulation Code, SEC Memorandum Circular No. 13-2023 dated September 12, 2023, Guidelines on Annex C of Rule 12 of the Securities Regulation Code Interpreting the Comparative Periods Required in the Management's Discussion and Analysis and SEC Memorandum Circular No. 14-2023 dated September 19, 2023, Proposed Amendment to Annex C of Rule 12 of the SRC.

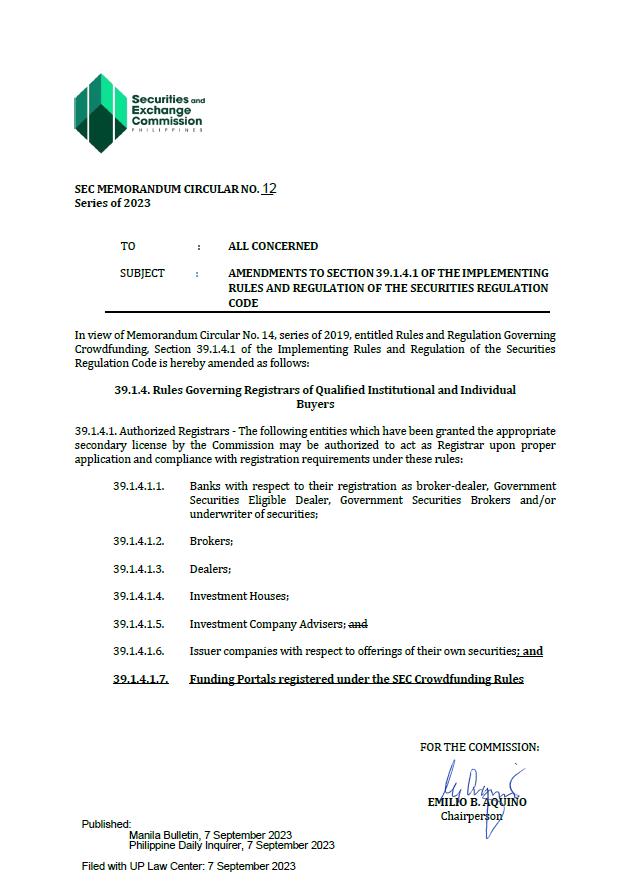

SEC Memorandum Circular No. 12-2023

Executive Summary

In view of the rules and regulations governing crowdfunding, Section 39.1.4 of the Implementing Rules and Regulations (IRR) of the Securities Regulations Code (SRC) is amended.

The Amendment

In the Rules Governing Registrars of Qualified Institutional and Individual Buyers (Section 39.1.4 of the IRR of the SRC), Funding Portals registered under the SEC Crowdfunding Rules are now authorized to act as Registrar upon proper application and compliance with registration requirements. A funding portal is an intermediary which facilitates transactions involving the offer and sale of crowdfunding securities through an online electronic platform.

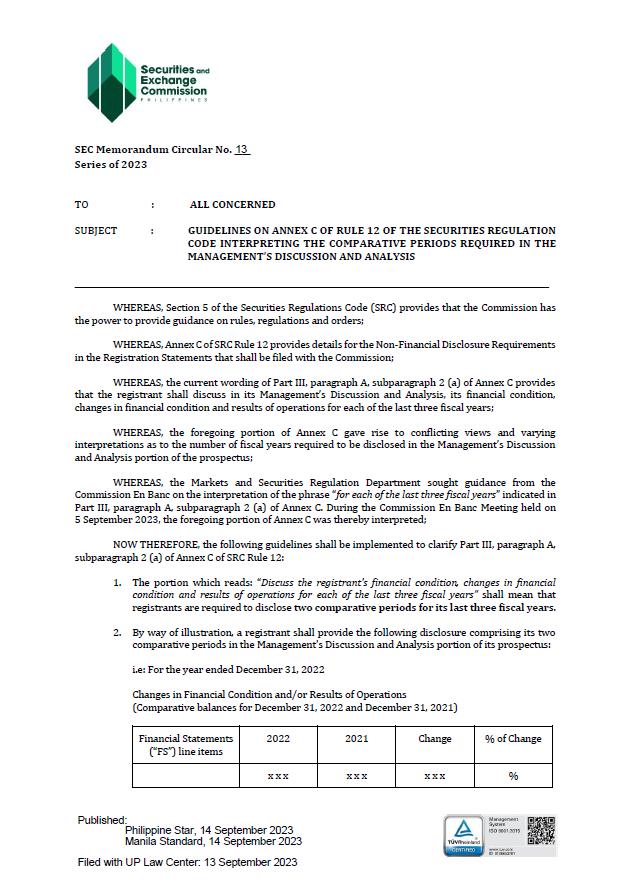

SEC Memorandum Circular No. 13-2023

Executive Summary

The Commission En Banc interpreted the current wording of Part III, paragraph A, subparagraph 2 (a) of Annex C which reads "Discuss the registrant's financial condition, changes in financial condition and results of operations for each of the last three fiscal years". This shall mean that registrants are required to disclose two comparative periods for its last three fiscal years.

The foregoing interpretation shall apply prospectively to registrants required to file required to file registration statements and/or other reportorial documents which include a disclosure of a Management's Discussion and Analysis.

SEC Memorandum Circular No. 14-2023

Executive Summary

Provisions of the non-financial disclosure requirements of the Securities Regulations Code (SRC) as to the description of the registrant and risk factors are hereby amended.

The Amendments

- Business (Description of Registrant) - In discussing the major risk/s involved in each of the businesses of the company and subsidiaries, the Company may include disclosure of the procedures to identify, assess, and manage such risks.

- Registration Statement and Prospectus Provisions (Risk Factors) - In discussing fully the factors that make the offering speculative or risky, the registrant may indicate measures to mitigate the risks mentioned in the registration statement and prospectus.

See attached Memorandum Circulars for further details.