This Accounting Alert is issued to circulate Securities and Exchange Commission (SEC or the Commission) Memorandum Circular No 02 (MC/the Circular) series of 2023 dated March 16, 2023.

The Securities and Exchange Commission, in its Memorandum Circular Letter No. 2023-2 dated 16 March 2023, released guidelines in granting of amnesty for non-filing and late filing of GIS and AFS and Non-compliance with SEC MC. No. 28, S. 2020, Schedules for Filing of Annual Financial Statements and General Information Sheet.

Covered Violations

Unless otherwise provided under Section 5 of this Circular, an amnesty on the unassessed (not yet assessed) and/or uncollected fines and penalties by the Commission (already assessed not yet paid) is hereby authorized to be granted to all corporations, including branch offices, representative offices, regional headquarters, and regional operating headquarters of foreign corporation and foundations, for the following violations:

a. Non-filing of GIS for the latest and prior years;

b. Late filing of GIS for the latest and prior years;

c. Non-filing of AFS, including fines for its attachments (i.e., Certificate of Existence of Program/Activity, Non Stock, Non-Profit Organization Forms), for the latest and prior years; and,

d. Late filing of AFS, including fines for its attachments (i.e., Certificate of Existence of Program/Activity, Non Stock, Non-Profit Organization Forms), for the latest and prior years.

In addition to corporations, this shall also cover associations, partnerships, and persons under the jurisdiction and supervision or the Commission, that failed to comply with MC No. 28-2020.

Amnesty Rates

The applicable rates under this Circular will be as follows:

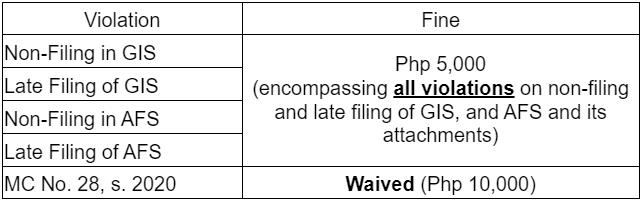

A. Non-Filing and Late Filing of GIS and/or AFS, and MC No. 28 violation:

![]()

The foregoing rate will apply, provided that, the applicant corporation or entity will (i) submit the latest reportorial requirements due at the time of application; and (ii) comply with MC No. 28, S.2020 through the MC28 Submission Portal.

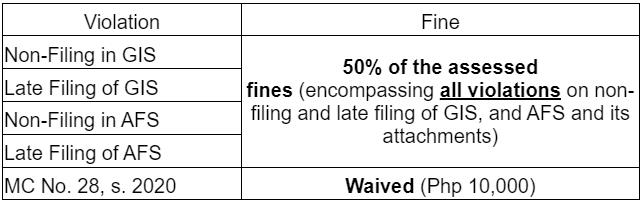

B. Suspended and Revoked Corporations:

![]()

The foregoing rate will apply, subject to the payment of filing/petition fee and the appropriate proceedings to be filed with the Company Registration and Monitoring Department (CRMD) and Extension Offices (EOs) and compliance with the requirements under Secfion 3 of this Circular.

Filing of Application and Supporting Documents

On or before 30 April 2023, the duly authorized representative or resident agent of the corporation (“Applicant”) shall file an Online Expression of Interest Form (“EOI”) (see Annex A in the file attached) via the Electronic Filing and Submission Tool (eFAST).

The Applicant must present proof of his or her authority (e.g., Notarized Secretary’s Certificate or Board Resolution, or written Power of Attorney of the resident agent duly filed with the Commission in compliance with Section 128 of Batas Pambansa Big. 68, or Section 145 of the RCC) with the requirements set out under Section 3 of this Circular.

Issuance of Confirmation of Payment

Corporations, which have fully complied with all the conditions set forth in these rules, including the payment of the relevant fines and penalties, shall be issued with all conditions set forth in these rules, including the payment of the relevant fines and penalties, shall be issued with a Confirmation of Payment for Amnesty on Fines and Penalties arising from the non-filing or late filing of the GIS and/or AFS, and non-compliance with MC No. 28. The amnesty granted under this Circular is final and irrevocable, covering the period/s indicated in the said Confirmation

Exceptions

The following entities are excluded from the coverage of the amnesty under this Circular:

a. Corporations whose securities are listed on the Philippine Stock Exchange (“PSE”);

b. Corporations whose securities are registered but not listed on the PSE;

c. Corporations considered as Public Companies;

d. Corporations with intra-corporate dispute;

e. Corporations with disputed GIS; and,

f. Other corporations covered under Sec. 17.2 of RA No. 8799 or the ”Securities Regulation Code".

Validity

Only those which have filed an amnesty application and secured a PAF through the eFast, and paid through the eSPAYSEC or LBP On-Coll Facility until 30 April 2023 shall be eligible for an amnesty under the Circular. Thereafter, the existing scale of fines and penalties issued by the Commision shall be observed.

See attached Memorandum Circular for further details.