This Accounting Alert is issued to provide an overview of Philippine Accounting Standard (PAS) 36, Impairment of Assets, to assist preparers of financial statements and those charged with the governance of reporting entities understand the requirements set out in PAS 36 and revisit some areas where confusion has been seen in practice.

Overview

PAS 36 prescribes the disclosure requirements when an entity recognises an impairment loss and/or reversal during the reporting period. PAS 36 also requires the disclosure of information used in estimating the recoverable amount where goodwill or indefinite life intangible assets have been allocated to a cash-generating unit (CGU) (or group of CGUs) for impairment review purposes (whether or not any impairment loss or reversal was recognised).

This article sets out further applications, issues and information regarding other standards involving Impairment of Assets - Presentation and Disclosure.

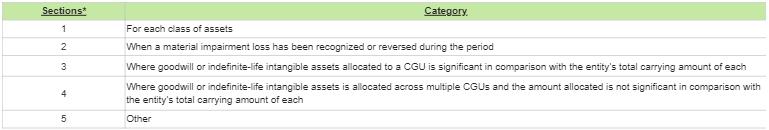

PAS 36 Disclosure Categories

![]()

*Please refer to the attached Accounting Alert article for the details of each disclosure requirements.

Application issues(as noted by regulators) and Select illustrative examples

In recent years, regulators have focused on the PAS 36 disclosure requirements, noting areas where financial statements filed with the various regulators ‘fall short’ in their view.

For the areas of consistent focus by regulators including common criticism and illustrative examples, please refer to the attached Accounting Alert.