This Accounting Alert is issued to circulate Securities and Exchange Commission (SEC) Memorandum Circular (MC) No. 11-2023 dated August 11, 2023, Amendments on the 2015 Implementing Rules and Regulations of the Securities Regulation Code (The "2015 SRC Rules") and SEC Memorandum Circular No. 16, Series of 2004 Relative to the Settlement Cycle from T+3 to T+2.

Executive Summary

On August 8, 2023, the Commission En Bank resolved to approve the following amendments to the "2015 SRC Rules" and SEC Memorandum Circular (MC) No. 16, series of 2004, relative to the settlement cycle from T+3 to T+2 for Broker Dealers. These amendments shall apply to transactions to be executed starting August 24, 2023.

The Amendments

I. 2015 SRC Rules

Section 1. SRC Rule 49.1.1.5.3 is hereby amended the following:

Computation of Net Liquid Capital (NLC):

In computing NLC, the Equity Eligible for NLC of a Broker Dealer is adjusted by the following, provided, however, that in determining net worth, all long and all short securities position shall be marked to their market value:

a. Adding unrealized profits (or deducting unrealized losses) in the accounts of the Broker Dealer.

b. Deducting fixed assets and assets which cannot be readily converted into cash (less any indebtedness excluded in accordance with SRC Rule 49.1.1.5.2.4 of the Definition of the term Aggregate Indebtedness) including, among other things:

i. Real estate, furniture and fixtures, exchange memberships/trading rights, prepaid rent, insurance and other expenses, goodwill, organization expenses; and,

ii. All unsecured advances and loans, deficits in customers' and non- customers' unsecured and partly secured notes, deficits in special omnibus accounts or similar accounts carried on behalf of another Broker Dealer, after application of calls for margin, marks to the market or other required deposits that are outstanding two (2) business days or less, deficits in customers' and non- customers’ unsecured and partly secured accounts after application of calls for margin, marks to the market or other required deposits that are outstanding two (2) business days or less, except deficits in cash accounts for which not more than one extension respecting a specified securities transaction has been requested and granted, the market value of stock loaned in excess of the value of any collateral received therefore, and any collateral deficiencies in secured demand notes in conformity with SRC Rule 49.1.2.

Section 2. SRC Rule 50 is hereby amended as follow:

Purchases by a customer in a cash account shall be paid in full within two (2) business days after the trade date.

Section 3. SRC Rule 52 is hereby amended as follows:

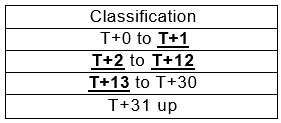

a. Monthly Aging of Customers' Receivables

The aging schedule shall indicate the monetary and securities collateral values of the customers' receivable as of end of month, broken down as follows:

![]()

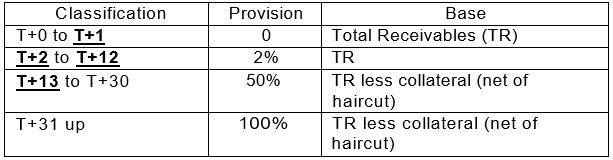

b. Every Broker Dealer shall appropriate Allowance for Doubtful Accounts (ADA) using and in accordance with the following schedule:

![]()

The ADA is computed by getting, for each doubtful account, an amount equivalent to the provision (see table (b) above) of the amount outstanding, net of collateral (net of haircut). The basis for the computation would be the individual accounts.

II. SEC MEMORANDUM CIRCULAR NO. 16 SERIES OF 2004

The following sections were also amended under SEC MC 2023-11. Please refer to the attached circular for the details and respective discussion of each section.

Section 4. Subsection III Computation of NLC

Section 5. Schedule for Part 4 Schedule for Specific and General Provisioning for Overdue Accounts

Section 6. Schedule B.2 Counterparty Risk Requirement Counterparty Risk Factors for Unsettled Agency Trades, SRC Rule 49 (H), Subsection VI

Section 7. Schedule B.3 Counterparty Risk Requirement Counterparty Risk Factors for Unsettled Principal Trades, SRC Rule 49 (H), Subsection VI

Section 8. Schedule B.4 Counterparty Risk Factors for Debts/Loans, Contra Loss, And Other Debts Due, SRC Rule 49 (H), Subsection

See attached Memorandum Circular for further details.