This Accounting Alert is issued to provide a reminder to companies on their assessment and accounting for debt modifications, impairment, going concern, CREATE Act, and transfer pricing.

Overview

As businesses continue to grapple with the lingering effects of the COVID-19 global pandemic, entities should continuously assess its impact on operations and financial statements, particularly on the following:

- accounting for debt modifications;

- accounting and review of impairment on non-financial assets;

- evaluation of management's assessment of the company’s ability to continue as a going concern;

- accuracy of the company's current and deferred income tax computations due to the changes in tax rates during the year arising from the CREATE Act; and,

- the status of company’s transfer pricing documentation.

Debt Modification

Debt restructuring can take various legal forms including:

- an amendment to the terms of a debt instrument (e.g., the amounts and timing of payments of interest and principal) or

- a notional repayment of existing debt with immediate re-lending of the same or a different amount with the same counterparty. The borrower will usually incur cost in a debt restructuring, and other fees might also be paid or received. The accounting for debt modification depends on whether it considered to be "substantial" or "non-substantial".

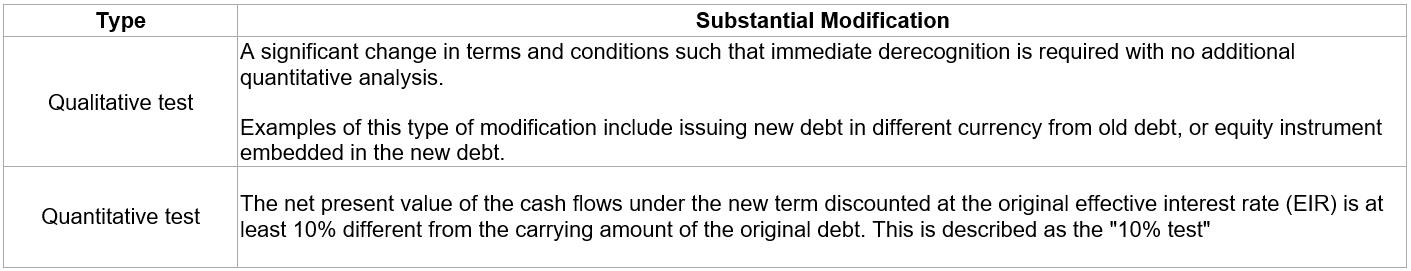

There are two tests to check whether the modification is substantial, and these are as follows:

![]()

PFRS 9, Financial Instruments, contains guidance on non-substantial modification and the accounting in such cases. It states that costs or fees incurred are adjusted against the liability and are amortized over the remaining term. That same guidance is silent on other changes in the cash flows.

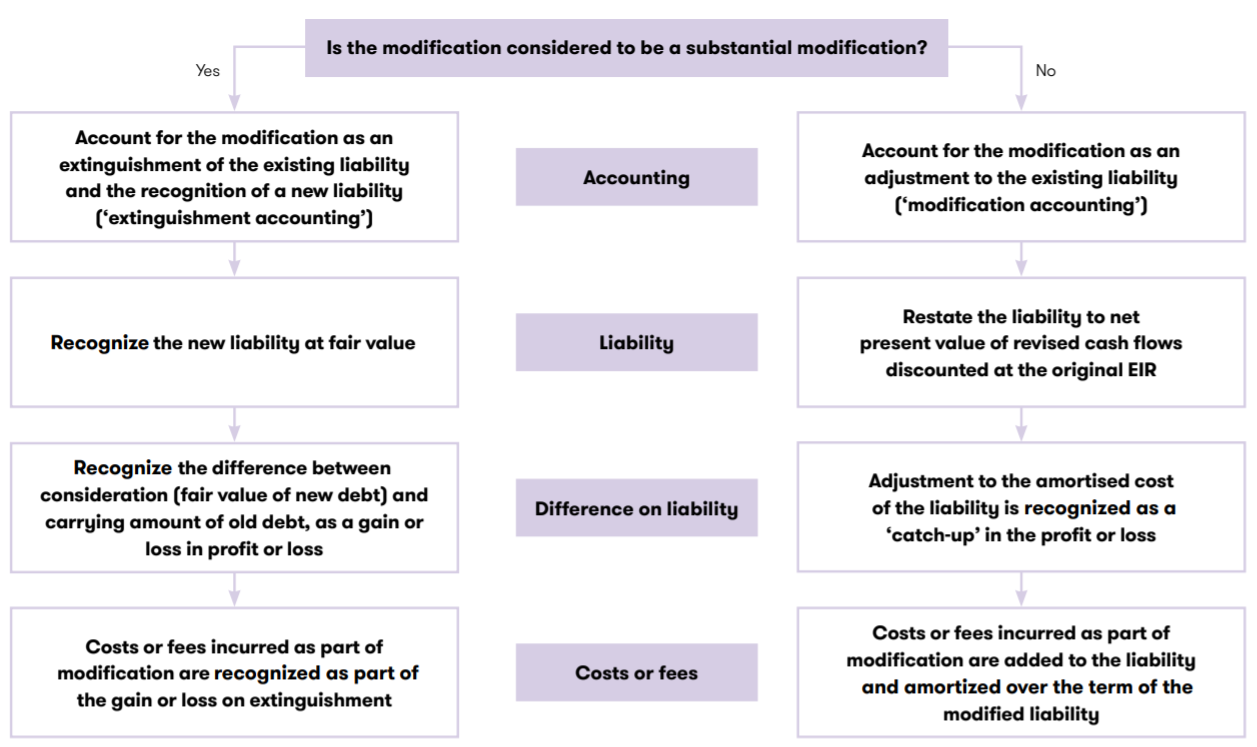

In determining whether the entity’s existing debt would qualify as modified, the management should consider and assess whether there were changes to the terms of the existing loan agreements, such as, but not limited to, changes on interest rates, maturity dates and principal payment schedules, or granted payment holidays or deferrals on principal and interest. The following flowchart sets out the accounting impact when the debt modification is substantial or not substantial:

![]()

Furthermore, the adverse effects of the pandemic to various industries may cause entities to fail to meet certain debt covenants stated in its loan agreements. Loan agreements often include covenants that, if breached by the borrower, permit the lender to demand repayment before the loan’s normal maturity date. In response to a borrower’s request, creditors may decide to voluntarily waive some or all of the rights they acquire as a result of a breach. Management must ensure that a waiver from the creditors, if necessary, will be obtained prior to the end of the reporting period. While all breaches of covenant requirements cause concern, when a breach remains unremedied and the creditor has obtained a right to demand accelerated repayment of the related loan, this may also indicate a material uncertainty as to the entity’s ability to continue as a going concern.

Impairment

Generally, non-current assets are measured in the financial statements at either cost or revalued amount. PAS 36, Impairment of Assets, requires assets to be carried at no more than their revalued amount and any difference between the carrying value and recoverable amount to be recorded as an impairment.

PAS 36 requires an entity to perform a quantified impairment test (i.e., to estimate the recoverable amount):

- if at the end of each reporting period, there is any indication of impairment for the individual asset or cash generating unit (CGU) (indicator-based impairment); and,

- annually for the following types of assets, irrespective of whether there is an indication of impairment:

- intangible assets with an indefinite useful life;

- intangible assets not yet available for use; and,

- goodwill acquired in a business combination.

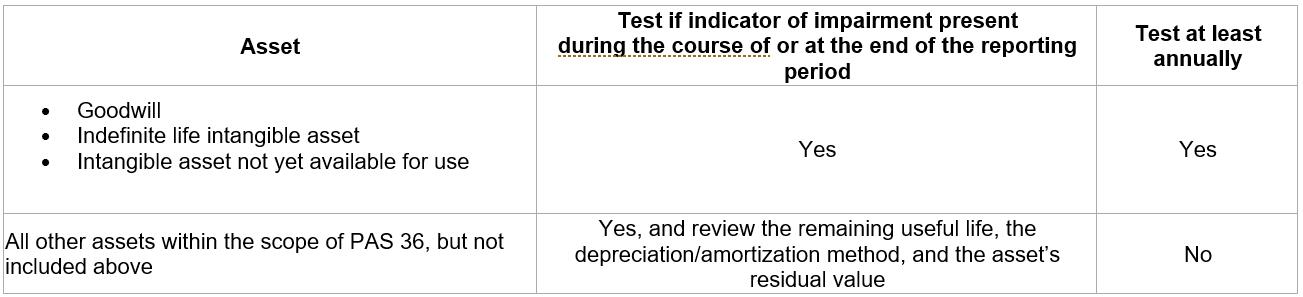

Timing requirements for impairment testing by asset type are as follows:

![]()

Management should consider how the repeating lockdowns and case surges in 2021 may have affected the recoverability of its non-financial assets, such as property and equipment, investment properties and other non-financial assets. Any reduction in the use of these assets, or potential declines in their recoverable amounts may indicate impairment. For goodwill and indefinite life intangible assets, management should ensure that cash flow projections used in the annual impairment test are updated to consider the continuing effects of the pandemic to the entity’s operations.

For further guidance on impairment of assets, please refer to previous Accounting Alerts issued on PAS 36.

Going Concern

When the going concern assumption is a fundamental principle in the preparation of the financial statements, management is responsible for assessing the entity’s ability to continue as a going concern. It is important to pay particular attention to situations which may cast significant doubt to the entity’s ability to continue as a going concern.

The following may assist the management in the assessment of going concern assumption:

- How has the entity been impacted by COVID-19 to date, and how might it be impacted in the future?

- Does the nature or industry of the entity give rise to additional risks?

- Will the business be able to access government or non-government financing or support?

- What timelines for restrictions are factored into financial forecasts?

- How liquid is the entity and what future finance does it have access to?

CREATE Act

Republic Act No. 11524, Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, has been signed by the President, with veto on certain provisions, on March 26, 2021. CREATE Act aims to improve the structure of taxation in the Philippines as well as attract investors to procure economic growth, in an effort to recover from the COVID-19 crisis. The following major changes brought about by the CREATE Act should be reviewed by the management:

- regular corporate income tax rate (RCIT) is decreased from 30% to 25% starting July 1, 2020;

- minimum corporate income tax rate (MCIT) is decreased from 2% to 1% starting July 1, 2020 until June 30, 2023;

- the imposition of 10% tax on improperly accumulated retained earnings is repealed; and,

- the allowable deduction for interest expense is reduced to 20% (from 33%) of the interest income subjected to final tax.

The management should review the application of the lower RCIT/MCIT rate in the prior year's current tax expense and income tax payable which resulted in a lower amount of recognized tax in the company's annual income tax return (AITR) compared to the amount per financial statements. The difference should be charged to the current year's profit or loss. In 2021, the recognized net deferred tax assets as of December 31, 2020 should be remeasured to 25% or 20%, as applicable. The resulting change in the deferred tax asset or liability should also be charged to the current year's profit or loss, or in other comprehensive income, if applicable.

Transfer Pricing

Revenue Regulation (RR) No. 34-2020 issued on December 21, 2020 prescribes the guidelines and procedures on the submission of BIR Form No. 1709 [Related Party Transactions (RPT Form)], Transfer Pricing Documentation (TPD) and other supporting documents. The BIR clarified that taxpayers required to submit BIR Form 1709 are those taxpayers required to file an AITR and has transactions with a domestic or foreign related party during the concerned taxable period. In addition, they should also fall under any of the conditions enumerated and clarified below:

(a) Large Taxpayers;

(b) Taxpayers enjoying tax incentives, i.e. Board of Investments (BOI)-registered and economic zone enterprises, those enjoying Income Tax Holiday (ITH) or subject to preferential Income Tax rate;

(c) Taxpayers reporting net operating losses for the current taxable year and the immediately preceding two (2) consecutive taxable years; and,

(d) A related party, as defined under Section 3 of RR No. 19-2020, which has transactions with (a), (b) or (c). For this purpose, key management personnel (KMP), as defined under Section 3(7) of RR No. 19-2020, shall no longer be required to file and submit the RPT Form, nor shall there be any requirement to report any transaction between KMP and the reporting entity/parent company of the latter in the RPT Form.

Under RR 34-2020, taxpayers who are not covered under Section 2 of RR 34-2020 are required to disclose in the Notes to the Financial Statements that they are not covered by such requirements and procedures for related party transactions provided under the RR. If the reporting entity is covered by the requirements of RR 34-2020, this disclosure is not applicable.

Management should continue monitoring its significant related party transactions entered into 2021 and assess whether these were not covered by the transfer pricing documentation (TPD) previously prepared. This would include assessing whether or not the existing TPD have been updated or recalibrated to include any changes noted during the year. If not updated, or if the entity still does not have TPD available despite being required based on the requirements of TPD regulations of the BIR, management should also assess whether the risk of future tax exposure is material to the financial statements to warrant recognition of provision for future tax delinquencies.