This Accounting Alert is issued to circulate Securities and Exchange Commission (SEC or the Commission) Memorandum Circular No 02 (MC/the Circular) series of 2022 dated January 19, 2021.

The SEC has set the deadlines for the filing and submission of the 2021 audited financial statements (AFS) and general information sheet (GIS) of corporations through the Electronic Filing and Submission Tool (eFAST) [formerly known as Online Submission Tool (OST)].

I. Annual Financial Statements (AFS)

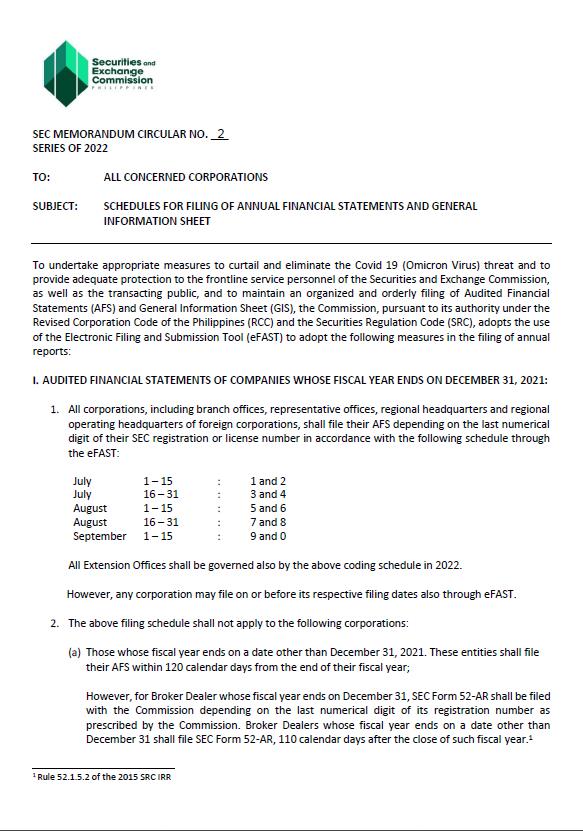

All corporations, including branch offices, representative offices, regional headquarters and regional operating headquarters of foreign corporations whose fiscal year ends on December 31, 2021 shall file their AFS based on the last digit of the SEC registration or license number in accordance with the following schedule:

1 and 2 : July 1 to 15

3 and 4 : July 16 to 31

5 and 6 : August 1 to 15

7 and 8 : August 16 to 31

9 and 0 : September 1 to 15

The SEC extension offices will likewise implement the coding schedule. Corporations may submit their reports on or before their respective filing dates.

Corporations whose securities are listed on the Philippine Stock Exchange and are covered under Section 17.2 of Republic Act No. 8799, or the Securities Regulation Code (SRC), are encouraged to observe the due date of filing for their AFS, which is within 105 calendar days after the end of their fiscal year, as an attachment to their annual reports. However, such entities will also be given an extension of until May 15, 2022 to file their annual reports due to current circumstances.

SEC will accept late filings starting September 16, 2022. Corporations, which submitted their reports late, will be subject to the prescribed penalties computed from the last date of the aforementioned filing schedule.

Corporation whose fiscal year ends on a date other than December 31, 2021 should file its AFS within 120 calendar days from the end of its fiscal year.

II. General Information Sheet (GIS)

All corporations shall file their GIS within 30 calendar days from:

a. Stock Corporations – date of actual annual stockholders’ meeting

b. Non-Stock Corporations – date of actual annual members meeting

c. Foreign Corporations – anniversary date of the issuance of the SEC License.

III. Other Reports

Reports other than the AFS and GIS that are not available in the eFAST may be submitted by sending through email at ictdsubmission@sec.gov.ph.

Online Submission

All corporations are required to submit their annual reportorial requirements online through eFAST at https://cifss-ost.sec.gov.ph. Hard copies of reports submitted through eFAST will no longer be required.

Corporations and their authorized filers must enroll in the eFAST before they can submit reports to the system. They have until March 31, 2022 to complete their enrollment, which involves the submission of a board resolution authorizing its representative to file reports on behalf of the corporation, as well as a copy of their accomplished GIS form version 2020 or their submission in compliance with SEC Memorandum Circular No. 28, Series of 2020 (MC 28).

Submission of reports Over-the-Counter and/or through mail/courier via SENS shall no longer be accepted.

All reports submitted through eFAST should be scanned or digital copies of the manually signed or digitally signed reports. The responsibility to ensure the integrity and authenticity of the e-signature rests upon the signatory or authorized signatory of the filer. All electronic transactions referred to in this memorandum shall be governed by the existing and prevailing laws and regulations, as applicable.

See attached Memorandum Circular for further details.