This Accounting Alert is issued to circulate Insurance Commission (IC/Commission) Circular Letter (CL) No. 2021-65 dated November 5, 2021 applicable to IC-accredited insurance and/or reinsurance brokers and its external auditors.

Overview

The IC circular letter No 2021-65, revised on-site examination and off-site verification, covers the revised rules and procedures on the determination of net worth, fiduciary ratio, on-site and off-site examination of insurance and/or reinsurance brokers with valid Certificate of Authority from the lC.

This CL also covers the reports required to be filed by the insurance and/or reinsurance brokers with the lC, and additional disclosures required to be made in the Audited Financial Statements (AFS), as specified in Annex A as attached herewith.

The CL was issued with the following objectives:

- To complement the enforcement of Section 3 of CL No. 2018-52, "Guidelines on the Licensing Requirements of the lnsurance and/or Reinsurance Brokers";

- To exercise the authority and power of the lC to refuse renewal, suspend or revoke the license of any insurance and/or reinsurance brokers in accordance with the Section 314 of the Amended lnsurance Code; and,

- To provide guidance on the preparer and lC-accredited external auditor on the assets or liabilities to be recognized for the purpose of prudential reporting to the IC.

Prudential Financial Requirements

All insurance and/or reinsurance brokers with valid Certificate of Authority from the lC shall, at all times, comply with the following:

1. Net Worth Requirement

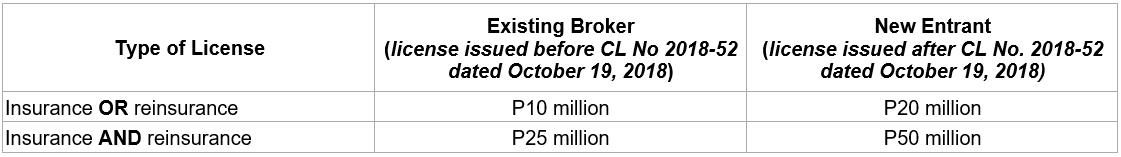

As provided under Section 3 of CL No. 2018-52, licensed insurance and/or reinsurance brokers are required to maintain the following net worth requirements:

![]()

The balances as reported in the AFS, as audited by an lC-accredited external auditor, shall be the basis for the net worth computation, provided that, the other prudential requirements and disclosures are complied with (i.e., clients' money/fiduciary accounts).

2. Surety Bond and Errors and Omissions Policy

The requirements on the submission of surety bond and errors and omission policy shall be in accordance with the provisions of Sections 6 and 7 of lC CL No. 2018-52 and/or equivalent future issuances.

3. Keeping Separate Clients' Money Account

Section 315 of the Amended lnsurance Code requires every license insurance and/or reinsurance broker to ensure faithful performance of its fiduciary responsibilities on behalf of its clients and partner insurance and/or reinsurance companies. Thus, an insurance and/or reinsurance broker is required to keep client monies in a client account separate from its own monies. lt is not allowed to use client monies for any purpose other than for the purposes of the client.

4. Fiduciary Ratio Requirement

ln addition to the net worth requirement above, an insurance and/or reinsurance broker with a credit aqreement with an insurance/reinsurance company or broker shall comply with the Fiduciary Ratio Requirement set by the lC.

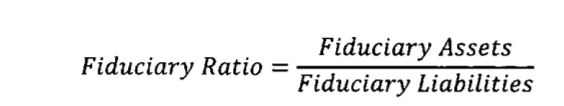

Fiduciary ratio is computed by dividing the total fiduciary assets, either cash or receivables being held by an insurance and/or reinsurance broker, over the total fiduciary liabilities. The formula is as follows:

![]()

The fiduciary ratio to be maintained shall be 1:1. Amounts to be used is gross of the commissions, allowances for impairment, taxes, fees and other charges.

5. Keeping Proper Books of Accounts.

All licensed insurance and/or Insurance brokers should strictly adhere to the requirements of CL No. 2018-17 or any equivalent future issuance in preparation of their statutory and prudential submission to the lC.

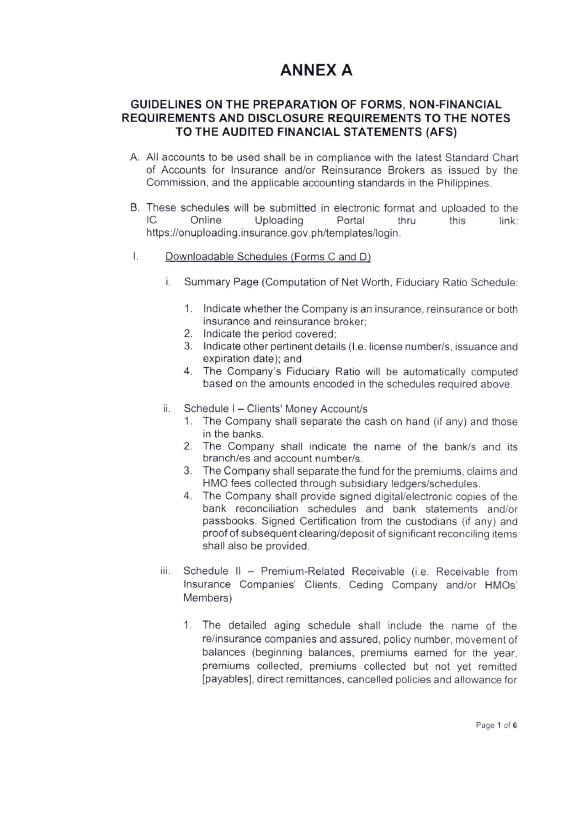

Submission of Annual AFS and Reports by the Auditor in Compliance with the Requirements Above

At a minimum, all licensed insurance and/or reinsurance brokers shall submit the following on or before May 31 after the close of the calendar year:

- AFS;

- Schedule of Clients' Money Accounts;

- Schedule of Premium-related Accounts and its reconciliation;

- Schedule of Fiduciary Computation; and,

- Other requirements deemed necessary by the lC.

Guidelines in the preparation of the schedule and complete set of requirements are found in Annex "A" as attached herewith.

On-site Examination/Off-site Verification

- The lC shall conduct regular off-site verification or monitoring. On-site examination, on the other hand, shall be conducted at least once every five (5) years and as deemed necessary, based on the previous risk ranking of the company. On-site examination and off-site verification include supervisory reporting, review, and analysis of conduct of business (such as but not limited to complaints, arrangements with (re)insurance companies and brokers and disclosure of information). The lC may specify information to be provided for onsite examination and off-site verification purposes, including information to be reported routinely or on an ad hoc basis. Supervisory reporting requirements may include but are not limited to the abovementioned reports and those enumerated in Annex A.

- The lC examiners may coordinate with other lC divisions whether information provided is sufficient to cover all areas of the supervisory reporting and review.

- The insurance and/or reinsurance broker shall supply any document or information that is requested by the lC.

- The lC may provide an exception to certain requirements upon the lnsurance Commissioner's approval of the insurance and/or reinsurance broker's formal written request.

Transitory Provisions

All lnsurance and/or Reinsurance Brokers with valid Certificate of Authority are required to adopt the requirements of this CL in the preparation of their 2022 financial statements and submissions to the lC on May 31, 2023.

The CL also discussed provisions on Broker's classification, regulatory and supervisory enforcement, and review provision.

See attached Circular Letter and Annex A for further details.