This Accounting Alert is issued to circulate Bangko Sentral ng Pilipinas (BSP) Circular 1151 (the Circular) dated August 24, 2022.

The Monetary Board, in its resolution No. 1145 dated 4 August 2022, approved the amendments to the relevant provisions of the Manual of Regulations for Banks (MORB) aimed at increasing the minimum capital requirements for rural banks. The new minimum capitalization requirement is part of the initiatives under the Rural Bank Strengthening Program (RBSP). The RBSP was developed to enhance the operations, capacity, and competitiveness of rural banks. lt is anchored on the principle that a safe and sound bank is well-capitalized. A strong capital base enables rural banks to enhance their risk management systems, upgrade resources and manage operational costs, meet prudential standards, and accelerate digitaI transformation.

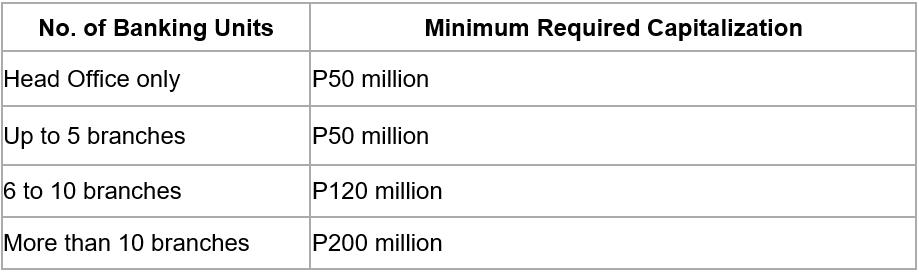

Revised Minimum Capital and Tiering

The minimum capitalization of rural banks shall be as follows:

![]()

Implementation

- Rural banks which comply with the new capital levels shall submit to the BSP a certificate of compliance, signed by the president of officer of equivalent rank, within ten (10) banking days from the date of effectivity of the Circular.

- Non-compliant rural banks are given five (5) years to comply with the new minimum capital requirements. They may refer to available options such as merger, consolidation, acquisition, third party investment, voluntary surrender of banking license, and capital build-up program (CBUP).

See attached BSP Circular 1151 for further details.