This Accounting Alert is issued to circulate Securities and Exchange Commission (SEC or the Commission) Memorandum Circular No 03 (MC/the Circular) series of 2021 dated March 9, 2021.

To maintain an organized and orderly filing of Audited Financial Statements (AFS), General Information Sheet (GIS) and other annual reports, the Commission, pursuant to its authority under the Revised Corporation Code (RCC) and the Securities Regulation Code (SRC) adopt the following measures in the filing of annual reports:

Mode of Submission of Reports

Submission of annual reports to the Commission shall be done online using the Commission's Online Submission Tool (OST).

Except as otherwise provided in the MC and other issuances, the Commission shall no longer accept hard copies of reports. No submission through email, mail, courier and chutebox shall also be allowed and/or accepted.

The submission of GFFS and SFFS in diskette or compact disc as mandated in SEC MC No. 6-2006 is no longer required.

Reports Accepted Through the OST

For the initial implementation of the OST, the following reports shall be accepted:

- AFS

- Duly stamped received by the Bureau of Internal Revenue (BIR) or proof of filing with the BIR should be attached to their AFS.

- Duly signed by the auditor and all required signatories.

- Statement of Management's Responsibility (SMR) duly signed by authorized representatives.

- Compliant with all the AFS requirements as stated in the checklist available on the SEC website and in accordance with the Revised SRC Rule 68, if applicable

- Sworn Statement for Foundation (SSF)

- General Form for Financial Statements (GFFS)

- Industry-specific Special Form for Financial Statements (SFFS)

- GIS

- Affidavit of Non-Operation (ANO), to be filed together with the GIS/FS. Filer may submit a GIS/FS without any movement/change.

- Affidavit of Non-Holding of Annual Meeting (ANHAM), to be filed together with the GIS. The filer may also submit a GIS, without any movement/change (No Meeting Held).

The optional filing of ANO and ANHAM, when warranted, is subject to existing applicable SEC Memorandum Circulars, rules and regulations, including but not limited to, SEC Memorandum Circular No. 3, Series of 2007, as superseded by Section 25 of the RCC. The ANO and ANHAM are deemed not filed if not attached to the FS and GIS respectively.

Mandatory Enrollment to the OST

All corporations and partnerships registered with SEC must enroll in the OST to access and submit reports, except as otherwise provided in this Circular and other issuances of the SEC.

The enrollment process of all registered corporations and partnerships, detailed under Section 5 of the MC, will start on March 15, 2021.

All corporations that will file their reports through the OST but whose applications for enrollment are still for validation by the SEC Company Registration and Monitoring Department, shall receive a notification during their registration and through their registered email on how to proceed with their application.

Required Format of Submission

The OST will prompt the filer whether the report to be filed should be in Portable Document Format (PDF), Microsoft Excel and/or other formats.

The responsibility for ensuring the accuracy and completeness of the reports lies with the filers or the authorized signatories.

The SEC will provide on the OST website and in the official SEC website step-by-step guides on the conversion of documents to be filed in the OST.

Review and Acceptance of the Reports

Filers will receive an automatic reply for the initial acceptance of the reports for review by the SEC-Electronic Records Management Division (SEC-ERMD) about the quality of the image. Once the reports have passed the quality assurance, a Quick Response (QR) Code will be issued to filers online. In the case of filers who complied with prescribed format but failed to indicate the prescribed content required in the report, the SEC department requiring such report will address the issue during the monitoring process through proper review and assess penalties, if applicable, subject to the existing laws, rules and regulations and memorandum circulars issued by the Commission.

Other Requirements for AFS

1. The AFS, other than the consolidated financial statements, shall be stamped “received” by the BIR or its authorized banks, unless the BIR allows an alternative proof of submission for its authorized banks.

2. The basic components of the AFS as prescribed under the Revised SRC Rule 68, shall be submitted by the filers.

3. The general financial reporting requirements listed in the Revised SRC Rule 68, states the threshold for an AFS as follows:

a. Stock corporation with total assets or total liabilities of P600,000 or more as prescribed under the RCC and any of its subsequent revisions or such amount as may be subsequently prescribed;

b. Non-stock corporations with total assets or total liabilities of P600,000 or more as prescribed under the RCC and any of its subsequent revisions or such amount as may be subsequently prescribed;

c. Branch offices/representative offices of stock foreign corporations with assigned capital in the equivalent amount of P1,000,000 or more;

d.Branch offices/representative offices of non-stock foreign corporation with total assets in the equivalent amount of P1,000,000 or more;

e. Regional operating headquarters of foreign corporations with total revenues in the equivalent amount of P1,000,000 or more; and,

f. Financial statements of branch offices of foreign corporations licensed to do business in the Philippines by the SEC shall comply with the requirements of this Rule unless otherwise determined by the SEC as not applicable.

4. Stock and non-stock corporations which do not meet the P600,000 total assets or total liabilities threshold, may-submit their AFS accompanied by a duly notarized Treasurer’s Certification only (rather than an Auditor's Report).

5. One Person Corporations shall submit AFS audited by an independent certified public accountant. However, if the total assets or total liabilities of the corporation are less than P600,000, the financial statements shall be certified under oath by the corporation’s Treasurer and President.

6. Regulated entities must comply with all the required documents on AFS submission, including but not limited to, other documents to be filed together with the AFS, schedules and other requirements, pursuant to the Revised SRC Rule 68.

Other Options for the Submission of Reports:

- OST Kiosks

Filers who successfully created an account in the OST shall submit their reports online. In case filers cannot enroll and submit reports through the OST, kiosks shall be provided in SEC offices and other areas, as may be designated by the SEC for technical assistance on the use of the OST.

The OST Kiosks will be available for nine months, from March 15, 2021 to December 15, 2021, which can be extended as needed subject to existing rules and regulations. Subsequent submissions shall be done remotely.

- Over-the-Counter Submission

The SEC Main Office, all SEC Extension Offices (EOs) and Satellite Offices may accept reports over the counter provided that filers present the Notice from OST that problems have been encountered during the process of enrollment and/or submission. All EOs shall follow the existing procedures in the filing of reports over the counter, including transmittal to the Head Office after encoding.

- Reports to be Submitted Through Email

Scanned copies of the printed or hard copies of the Reports with wet signature and proper notarization other than AFS, GIS, SSF, GFFS, SFFS shall be filed in PDF through email at: ictdsubmission@sec.gov.ph . For those reports that require the payment of filing fees, these still need to be filed and sent via email with the SEC’s respective operating departments.

Deadlines for Submission of Reports

- For the initial implementation of the OST, all stock corporations are required to enroll with the system starting March 15, 2021 to December 15, 2021. Non-stock corporations are given the option whether they will enroll and submit their reports through OST or proceed to the SEC Kiosk for assistance in the enrollment process or submit their reports over the counter.

- All corporations shall submit their GIS thirty (30) days after their Annual Meeting counted from their date of Annual Meeting or Actual Meeting.

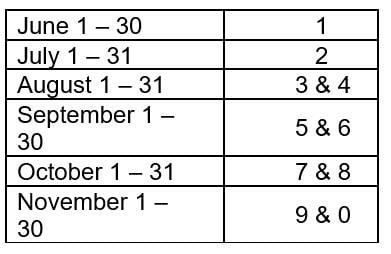

- All stock corporations with fiscal year ending December 31, including branch offices, representative offices, regional headquarters, and regional operating headquarters of foreign corporations, shall enroll and file their AFS through the OST depending on the last numerical digit of their SEC registration or license number in accordance with the following schedule:

![]()

- All stock corporations may enroll and submit their reports through OST even prior to their respective coding schedule.

- GFFS and industry-specific SFFS must be filed within 30 days from the deadline of AFS submission.

The above filing schedule shall not apply to the following corporations:

- Those corporations whose fiscal year ends on a date other than December 31. These entities shall file their AFS within 120 calendar days from the end of their fiscal year.

- Those whose securities are listed in the Philippine Stock Exchange (PSE) and whose securities are registered but not listed in PSE (except those companies which filed SEC Form 17 EX) and Public Companies covered under Section 17.2 of the SRC. These entities shall continue to observe the due date of filing of their AFS (within 105 calendar days after the end of the fiscal year), as an attachment to their Annual Reports (SEC Form 17-A).

- Corporations whose AFS are being audited by the Commission on Audit (COA); Provided, that the following documents are attached to their AFS:

a. An Affidavit signed by the President and Treasurer (or Chief Finance Officer, where applicable), attesting to the fact that the company has timely provided COA with the financial statements and supporting documents and that the audit of COA has just been concluded; and,

b. A letter from COA confirming the information provided in the above Affidavit.

Date of the Receipt of the Reports

The reckoning date of receipt of reports is the date the report was initially submitted to the OST, if the filed report is compliant with the existing requirements. A report which was reverted or rejected is considered not filed or not received. A notification will be sent to the filer, stating the reason of the report’s rejection in the remarks box.

Submissions made outside of the OST’s operating hours shall be considered filed on the next working day.

Fees and Charges

For the initial implementation (3 months) of the OST and the OSP, the SEC will not charge fees and charges for public access.

Modification and Amendments

All other circulars, memoranda, notices and implementing rules and regulations that may be inconsistent with the foregoing provisions shall be deemed modified or amended accordingly.

Effectivity

This Circular shall take effect immediately after its publication in two newspapers of general circulation.

See attached Memorandum Circular for further details.