This Accounting Alert is issued to circulate Philippine Interpretations Committee (PIC) Questions and Answers (Q&A) 2020-07 dated January 29, 2021 on accounting for the proposed changes in income tax rates under the CREATE Bill.

Background

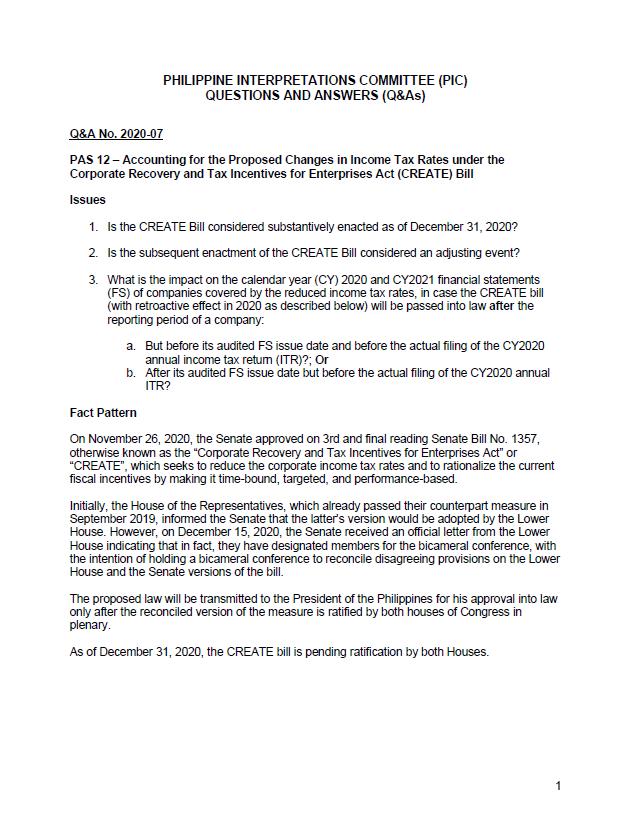

On November 26, 2020, the Senate approved on third and final reading Senate Bill No. 1357, otherwise known as the CREATE Bill, which seeks to reduce the corporate income tax rate and to rationalize the current fiscal incentives by making it time-bound, targeted, and performance-based.

Initially, the House of the Representatives, which already passed their counterpart measure in September 2019, informed the Senate that the latter’s version would be adopted by the Lower House. However, on December 15, 2020, the Senate received an official letter from the Lower House indicating that in fact, they have designated members for the bicameral conference, with the intention of holding a bicameral conference to reconcile disagreeing provisions on the Lower House and the Senate versions of the bill.

The proposed law will be transmitted to the President of the Philippines for his approval into law only after the reconciled version of the measure is ratified by both houses of Congress in plenary.

As of December 31, 2020, the CREATE bill is pending ratification by both Houses. Since the CREATE Bill will still have to go through a Bicameral Committee Hearing and has to be submitted to the President for approval, the same may not be passed into law until the first quarter of 2021, at the earliest.

Issue

1. Is the CREATE Bill considered substantively enacted as of December 31, 2020?

2. Is the subsequent enactment of the CREATE Bill considered an adjusting event?

3. What is the impact on the calendar year (CY) 2020 and CY 2021 financial statements of companies covered by the reduced income tax rates, in case the CREATE bill (with retroactive effect in 2020 as described below) will be passed into law after the reporting period of a company:

- But before its audited financial statements issue date and before the actual filing of the CY 2020 annual income tax return (ITR)?; Or,

- After its audited financial statements issue date but before the actual filing of the CY 2020 annual ITR?

Consensus

1. The CREATE Bill is not considered substantively enacted as of reporting date, December 31, 2020, given the following circumstances as of said date:

- Congress as the legislative body and the President representing the executive body of the government are separate and independent from each other;

- The bill is still pending with the bicameral committee of Congress, and consequently not yet submitted to the President of the Philippines;

- Upon submission to the President of the Philippines, he may either approve it or exercise his veto power to stop the enactment of the subject bill; and,

- In case the bill is vetoed by the President, Congress may not be able to garner the required two-thirds vote to overturn the presidential veto.

2. Under paragraph 22h of PAS 10, Events after the Reporting Period, if the bill is passed into law after the balance sheet date but before the issuance of the audited financial statements, it is treated as a non-adjusting event. Disclosure of the nature of changes and impact to the financial statements is required if the impact is expected to be significant.

On the other hand, if the bill is passed into law after the issue date of the CY 2020 audited financial statements but prior to the actual filing of the CY 2020 annual ITR, there is no subsequent event that requires related financial statements disclosure. However, companies may consider disclosing the general key features of the proposed bill and expected financial impact.

Impact to the Financial Statements

Based on the foregoing consensus, below are the impact to the CY 2020 and CY 2021 financial statements:

1. CY 2020 Financial Statements

- Current and deferred taxes for financial statements reporting purposes will still be measured using the applicable income tax rates as of December 31, 2020 since the CREATE bill was not yet enacted / substantively enacted as of such date (there will be difference between the provision for current income tax per CY 2020 financial statements and the amount of income tax due per CY 2020 ITR).

- If the CREATE bill is enacted prior to CY 2020 audited financial statements issue date and before the actual filing of the CY 2020 ITR, this is a non-adjusting event but significant effects of changes in tax rates on current and deferred tax assets and liabilities should be disclosed. Companies in this case will have to compute for current and deferred taxes based on adjusted tax rates to determine the impact of the change in the tax rate.

- If the CREATE bill is enacted after the CY 2020 audited financial statements issue date but before the actual filing of the CY 2020 ITR, this is no longer a subsequent event, but companies may consider disclosing the general key features of the proposed bill and the expected impact in its audited financial statements.

2. CY 2021 Financial Statements

- PAS 12, Income Taxes, provides that components of tax expense (income) may include “any adjustments recognized in the period for current tax of prior periods” and “the amount of deferred tax expense (income) relating to changes in tax rates or the imposition of new taxes”.

- An explanation of changes in the applicable tax rate(s) compared to the previous accounting period is also required to be disclosed.

- Hence, the provision for current income tax for CY2021 will include the difference between income tax per CY 2020 financial statements and CY 2020 ITR (since the latter will not be taken up in the CY 2020 financial statements and thus be taken up in the CY 2021 financial statements).

- Deferred tax assets and liabilities as of December 31, 2021 will be remeasured using the new tax rates. The impact of remeasurement is recognized in profit or loss (i.e., provision for/benefit from deferred income tax), unless it can be recognized in other comprehensive income or another equity account.

- Any movement in deferred taxes arising from the change in tax rates that will form part of the provision for/benefit from deferred taxes will be included as well in the effective tax rate reconciliation.

Status and Effectivity

The effective date of the consensus in this Q&A will be upon approval by the Financial Reporting Standards Council which is January 29, 2021.

See attached PIC Q&A 2020-07 for further details.