This Accounting Alert is issued to circulate Philippine Interpretations Committee (PIC) Questions and Answers (Q&A) 2020-06 dated December 7, 2020 on accounting for payments between and among lessors and lessees in accordance with PFRS 16, Leases.

Issue

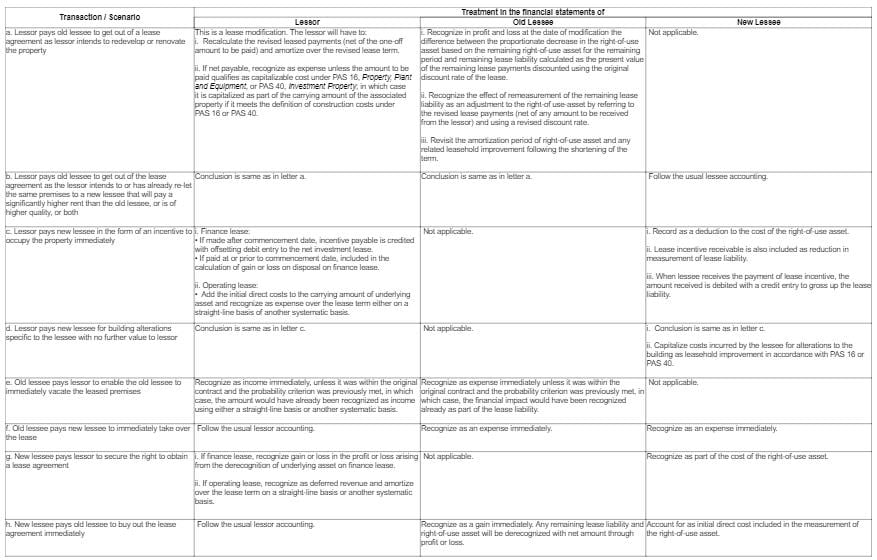

What is the accounting treatment, from both the lessor’s and the lessee’s perspectives, in respect of payments made between and among lessors and lessees (both old lessees and new lessees) under several scenarios below?

a. Lessor pays old lessee to get out of a lease agreement as lessor intends to redevelop or renovate the property;

b. Lessor pays old lessee to get out of the lease agreement as the lessor intends to or has already re-let the same premises to a new lessee that will pay a significantly higher rent than the old lessee, or is of higher quality, or both;

c. Lessor pays new lessee in the form of an incentive to occupy the property immediately;

d. Lessor pays new lessee for building alterations specific to the lessee with no further value to lessor;

e. Old lessee pays lessor to enable the old lessee to immediately vacate the leased premises;

f. Old lessee pays new lessee to immediately take over the lease;

g. New lessee pays lessor to secure the right to obtain a lease agreement; and,

h. New lessee pays old lessee to buy out the lease agreement immediately.

Consensus

Presented below are the accounting treatment of payments made between lessors and lessees (both old lessees and new lessees) depending on the scenario:

![]()

Status and Effectivity

The effective date of the consensus in this Q&A will be upon approval by the Financial Reporting Standards Council, which is December 9, 2020.

See attached PIC Q&A 2020-06 for further details.