Conclusion on the Accounting Treatment for the Difference when the Percentage of Completion is Ahead of the Buyer’s Payment

This Accounting Alert is issued to circulate Philippine Interpretations Committee (PIC) Questions and Answer (Q&A) 2020-03 dated September 30, 2020 on the accounting treatment for the difference when the percentage of completion of a performance obligation is ahead of the buyer’s payment, in accordance with PFRS 15, Revenue from Contracts with Customers.

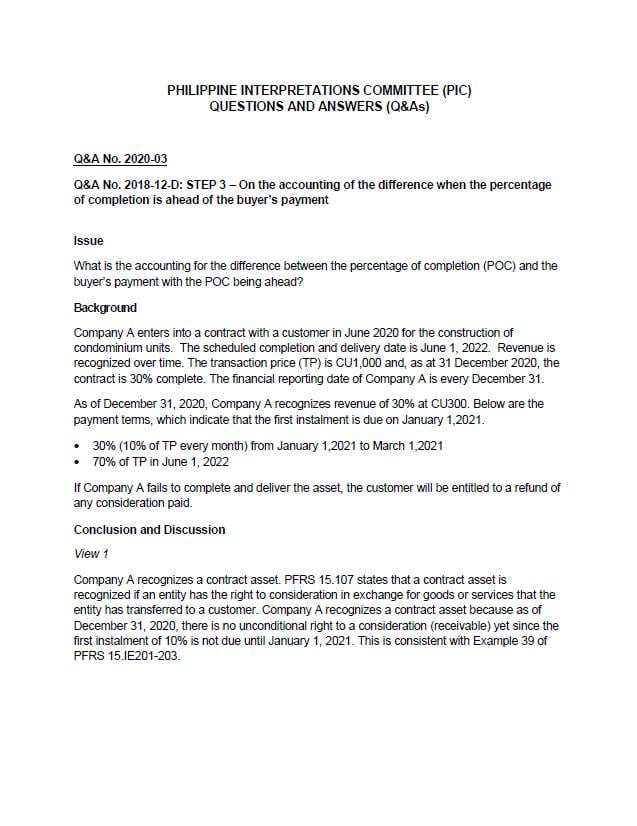

What is the Issue?

What is the accounting treatment when an entity recognizes revenue by measuring the percentage of completion of the performance obligation and there is difference between the percentage of completion and the buyer’s payment, with the percentage of completion being ahead?

Consensus

There are two views on how entities can account for the difference when the percentage of completion is ahead of the buyer's payment.

View 1- The entity recognizes a contract asset

Paragraph 107 of PFRS 15 states that a contract asset is recognized if an entity has the right to consideration in exchange for goods or services that the entity has transferred to a customer. The company recognizes a contract asset because as of the end of the reporting period, there is no unconditional right to a consideration (receivable) as the payment is not yet due. This is consistent with Example 39 of PFRS 15.IE201-203.

View 2- The entity recognizes a receivable

Paragraph 108 of PFRS 15 states that a receivable is an entity’s right to consideration that is unconditional. A right to consideration is unconditional if only the passage of time is required before payment of that consideration is due. If the required payment subsequent to the end of the reporting period arises from a contractually agreed payment term and only the passage of time is required before an entity has a right to consideration, the entity may recognize a receivable.

The PIC has concluded that both views are acceptable as long as this is consistently applied in transactions of the same nature. In either case, the disclosures under PFRS 15 should be complied with.

Status and Effectivity

This Q&A is still subject for approval of the Board of Accountancy as of January 6, 2021. The effective date of the consensus in this Q&A follow that of PIC Q&A 2018-12, upon approval by the Financial Reporting Standards Council which is October 14, 2020.

See attached PIC Q&A 2020-03 for further details.