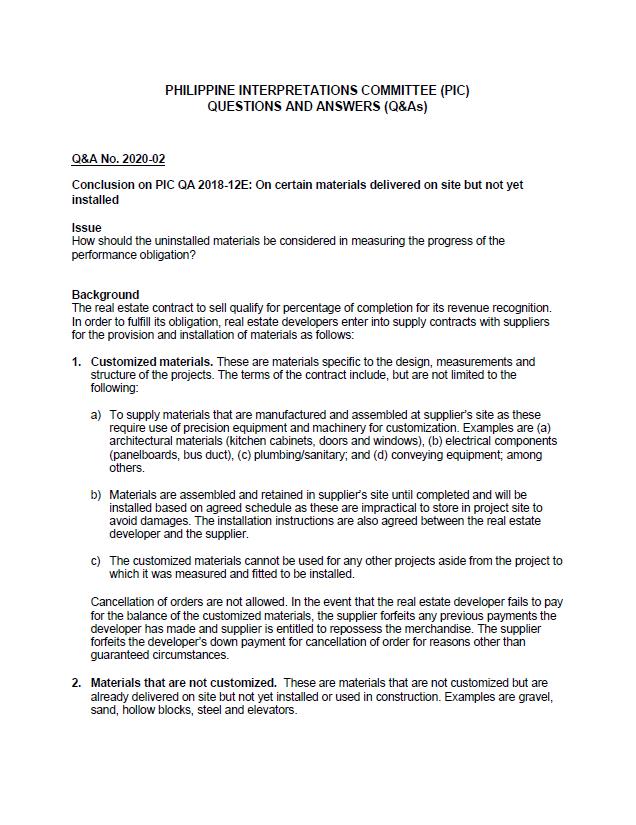

Conclusion on the Treatment of Materials Delivered on Site but not yet Installed in Measuring the Progress of the Performance Obligation

This Accounting Alert is issued to circulate Philippine Interpretations Committee (PIC) Questions and Answers (Q&A) 2020-02 dated October 29, 2020 on the treatment of materials delivered on site but not yet installed in measuring performance obligation in accordance with PFRS 15 - Revenue from Contracts with Customers in the real estate industry.

What is the Issue?

A real estate contract to sell qualify for percentage of completion for its revenue recognition. In order to fulfill its obligation, real estate developers enter into supply contracts with suppliers for the provision and installation of materials. How should the materials delivered on site but not yet installed be considered in measuring the progress of the performance obligation?

Background

Paragraph 39 of PFRS 15 requires that for each performance obligation satisfied over time, an entity shall recognize revenue by measuring the progress towards complete satisfaction of that performance obligation. The objective when measuring progress is to depict an entity’s performance in transferring control of goods or services promised to a customer (i.e. the satisfaction of an entity’s performance obligation). As indicated in paragraph B18 of PFRS 15, under the input method, revenue is recognized on the basis of the entity’s effort or inputs to the satisfaction of a performance obligation.

Further, PIC Q&A 2018-12E states that in reference to paragraph B19(b)(ii) of PFRS 15, there is no transfer of control to the customer upon delivery of materials to the construction site. Control is transferred to the customer only upon installation of use in construction. However, real estate developers often enter into supply contracts with suppliers for the provision and installation of materials which may be customized (e.g., architectural materials, electrical components, conveying equipment, etc.) or not customized (e.g., sand, gravel, hollow block, steel, and elevators).

Consensus

In recognizing revenue using a cost-based input method, the cost incurred for customized materials not yet installed are to be included in the measurement of progress to properly capture the efforts expended by the real estate developer in completing its performance obligation. In this case, a real estate developer is not just providing a simple procurement service to the customer as it is significantly involved in the design and details of the manufacture of the materials. The customization and manufacture of the materials, which is done at the project site, is the more significant portion of the work compared to the installation portion at the project site. Moreover, the customized materials have no alternate use to a real estate developer as these cannot be used in any other project.

In the case of uninstalled materials that are not customized, since the real estate developer is not involved in their design and manufacture, revenue should only be recognized upon installation or use in construction.

Status and Effectivity

This Q&A is still subject for approval of the Board of Accountancy as of January 6, 2021. The effective date of the consensus in this Q&A follow that of PIC Q&A 2018-12, upon approval by the Financial Reporting Standards Council which is November 6, 2020.

See attached PIC Q&A 2020-02 for further details.