This Accounting Alert is issued to give insights on how to identify the acquirer within the Scope of PFRS 3, Business Combination.

The acquisition method set out in PFRS 3 is applied from the point of view of the acquirer – the entity that obtains control over an acquiree that meets the definition of a business. An acquirer must therefore be identified whenever there is a business combination. This accounting alert explains how to identify the acquirer.

Identifying the acquirer

PFRS 3 initially directs an entity to PFRS 10, Consolidated Financial Statements, to identify the acquirer, and to consider which entity controls the other (i.e. the acquiree). In most business combinations identifying the acquirer is straightforward and is consistent with the transfer of legal ownership. However, the identification can be more complex for business combinations when:

- businesses are brought together by contract alone such that neither entity has legal ownership of the other

- a combination is affected by legal merger of two or more entities or through acquisition by a newly created parent entity

- there is no consideration transferred (combination by contract), or

- a smaller entity arranges to be acquired by a larger one.

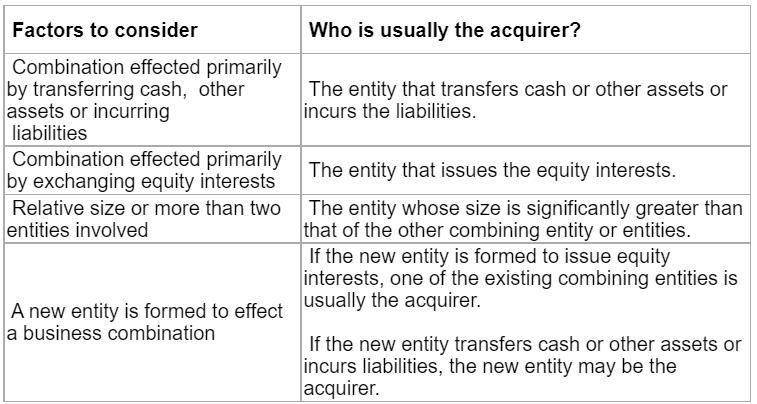

This means if, when applying the control guidance in PFRS 10, it is not clear which of the entities being combined is the acquirer, entities should revert back to PFRS 3 which provides the following additional indicators to consider:

![]()

The Accounting Alert also provides in-depth analysis in identifying the acquirer when considering the factors mentioned above.

See attached Accounting Alert for further details.