This Accounting Alert is issued to provide an overview of Philippine Accounting Standards (PAS) 36, Impairment of Assets, to assist preparers of financial statements and those charged with governance of reporting entities in understanding the requirements of PAS 36, and to revisit some areas where confusion has been seen in practice.

Overview

PAS 36, Impairment of Assets, provides the core principles when assessing if an asset should be impaired. However, due to the complex nature of the guidance, the requirements of PAS 36 can be challenging to apply in practice.

This Accounting Alert looks at the scope of the impairment review (i.e., the types of assets that are included) and how it is structured (i.e., the level at which assets are reviewed). Assets must be reviewed for impairment at the lowest level possible – sometimes this is at the individual asset level but more often assets are allocated to a cash generating unit (CGU) for impairment review purposes. Further, goodwill and corporate assets will need to be allocated to a CGU or groups of CGUs.

Identifying the Assets within the Scope of PAS 36

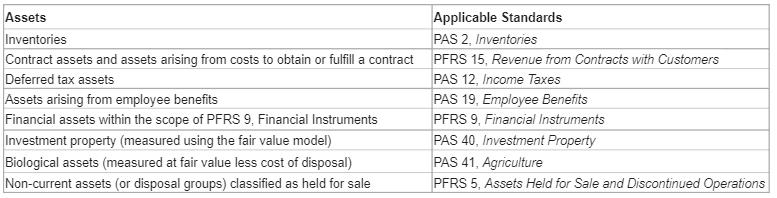

PAS 36 must be applied in accounting for the impairment of all assets unless they are specifically excluded from its scope. The scope exceptions cover assets for which the requirements of other PFRS render a PAS 36-based impairment review irrelevant or unnecessary (e.g., PAS 2, Inventories, requires that inventory be written down to its net realizable value if lower than cost, so inventory is explicitly excluded from the scope of PAS 36).

The following assets are outside the scope of PAS 36:

![]()

Determining the Structure of the Impairment Review

Once an entity has confirmed the assets in question are within the scope of PAS 36, the next step is to determine whether the asset will be reviewed for impairment individually or as part of a larger group of assets or CGUs (in other words, the structure of the impairment review for purposes of applying PAS 36).

When possible, PAS 36 should be applied at the individual asset level. This will be possible only when:

- the asset generates cash inflows that are largely independent of those from other assets or groups of assets) or

- the asset’s value in use (VIU) can be estimated to be close to fair value less costs of disposal (FVLCOD) and FVLCOD can be measured.

The Accounting Alert also provides a flowchart that describes the assessment to determine the structure of the impairment review.

See attached Accounting Alert for further details.