This Accounting Alert is issued to provide an overview of Philippine Accounting Standards (PAS) 36, Impairment of Assets, to assist preparers of financial statements and those charged with governance of reporting entities in understanding the requirements of PAS 36, and to revisit some areas where confusion has been seen in practice.

Overview

Usually, non-current assets are measured in the financial statements at either cost or revalued amount. However, PAS 36, Impairment of Assets, requires assets to be carried at no more than their revalued amount and any difference to be recorded as an impairment. However, its requirements of when and if to undertake an impairment review are sometimes challenging to apply in practice.

This Accounting Alert explains if and when a detailed impairment test as set out in PAS 36 is required. The guidance prescribes different requirements for goodwill and indefinite life intangible assets (including those not ready for use) when compared to all other assets. As such, this article will cover Step 3 in the impairment review which is to determine if and when to test for impairment is needed.

If and When an Entity Should Test for Impairment

PAS 36 requires an entity to perform a quantified impairment test (i.e., to estimate the recoverable amount):

- if at the end of each reporting period, there is any indication of impairment for the individual asset or cash generating unit (CGU) (indicator-based impairment); and,

- annually for the following types of assets, irrespective of whether there is an indication of impairment:

- intangible assets with an indefinite useful life;

- intangible assets not yet available for use; and,

- goodwill acquired in a business combination.

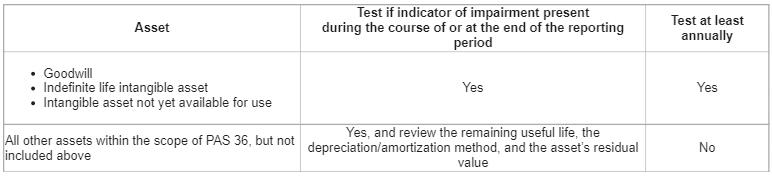

Timing requirements for impairment testing by asset type are as follows:

![]()

Indicator-based Impairment Testing

PAS 36 requires an entity to assess at the end of each reporting period whether there is any indication that an asset or CGU may be impaired. This requirement also applies to goodwill, indefinite life intangible assets, and intangible assets not yet ready for use (although, in practice, an indicator review is necessary only at period ends that do not coincide with the annual test). If any such indication exists, the entity should estimate the recoverable amount of the asset or CGU.

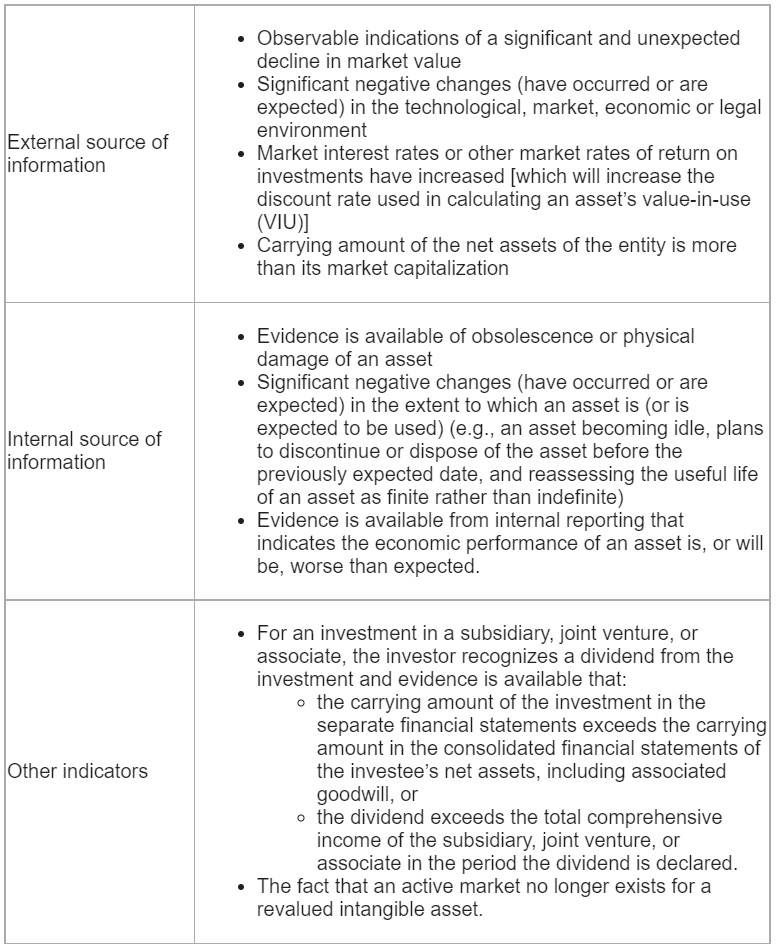

PAS 36 provides a non-exhaustive list of external, internal and other indicators that an entity should consider, as follows:

![]()

The Accounting Alert also provides discussions about the relation of impairment indicators and the need to review the useful life, depreciation/amortization method and residual value of non-financial assets, annual impairment testing, and insights on the timing of annual impairment test.

See attached Accounting Alert for further details.