This Accounting Alert is issued to provide an overview of Philippine Accounting Standards (PAS) 36, Impairment of Assets, to assist preparers of financial statements and those charged with governance of reporting entities in understanding the requirements of PAS 36, and to revisit some areas where confusion has been seen in practice.

Overview

The accounting requirements regarding impairment of tangible and intangible assets are governed by PAS 36, Impairment of Assets. The requirements are not new, however, remain challenging as the guidance is detailed and complex in some areas.

Identifying cash-generating units (CGUs) is a critical step in the impairment review and can have a significant impact on its results. That said, the identification of CGUs requires judgement. The identified CGUs may also change due to changes in an entity’s operations and the way it conducts them.

This Accounting Alert discusses how to allocate goodwill to CGUs, which follows an article on how to identify CGUs and how to allocate assets to CGUs.

Allocation Basis for Goodwill

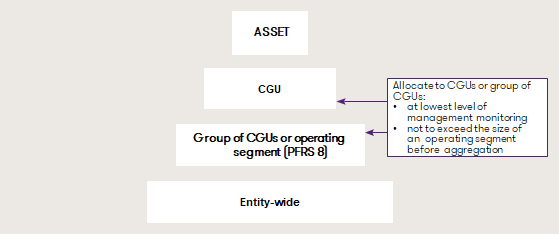

The below diagram summarizes the different allocation bases for goodwill:

![]()

It is not possible to determine the recoverable amount of goodwill independently from other assets because goodwill does not generate cash flows of its own; rather it contributes to the cash flows of individual CGUs or multiple CGUs.

As such, goodwill must be allocated to individual CGUs (or groups of CGUs) for the purpose of impairment testing. The guidance in PAS 36 requires the goodwill acquired in a business combination to be allocated to each of the acquirer’s CGUs or groups of CGUs that are expected to benefit from the synergies of the combination. Further, the level to which the goodwill is allocated must:

- represent the lowest level within the entity at which the goodwill is monitored for internal management purposes, and

- not be larger than an operating segment before aggregation as defined by PFRS 8 ‘Operating Segments’.

Allocating Goodwill to Group of CGUs

PAS 36 acknowledges that sometimes goodwill cannot be allocated to individual CGUs on a non-arbitrary basis. It therefore allows or requires allocation to groups or clusters of CGUs, subject to the limits noted above.

If management has a monitoring process for goodwill, PAS 36 seems to require goodwill to be allocated to the lowest level at which it is monitored but limits this to the size of the operating segment before any aggregation. Allocation at such a level means goodwill can be monitored using existing reporting systems consistent with the way management monitors its operations.

If there is no separate monitoring process for goodwill, PAS 36 allows a choice of allocation to:

- individual CGUs;

- groups of CGUs forming part of an operating segment before aggregation; or,

- groups of CGUs forming an entire operating segment before aggregation.

The Accounting Alert also provides brief definition of an operating segment in accordance to PFRS 8, and examples and practical insights of allocating acquired goodwill in a business combination, changes in the initial allocation of goodwill, provisional allocation of goodwill, and reallocation of goodwill.

See attached Accounting Alert for further details.