This Accounting Alert is issued to summarize recent circular letters (CLs) issued by the Insurance Commission (IC) from May 14 to May 18, 2020.

CL No. 2020-58: Regulatory Relief on the Admittance of Premiums Receivable due to the COVID-19 Pandemic

Covered entities: All non-life insurance and professional reinsurance companies

Effectivity: Applied to annual and quarterly financial reports for the year 2020, unless extended or changed as deemed necessary by the IC.

The IC issued CL No. 2020-58 on May 14, 2020 to relax the admittance rule over premium receivables in view of the delays in collection of premiums from policyholders due to the COVID-19 pandemic. The basis for admitting Premium Receivable account (direct agents, general agents and insurance brokers) for all non-life insurance and professional reinsurance companies shall be adjusted from 90 days to 180 days from the date of issuance of the policies.

CL No. 2020-59: Online Submission of Annual Statements (AS), Audited Financial Statements (AFS) and Attachments

Covered entities: All insurance and professional reinsurance companies, mutual benefit associations, pre-need companies, health maintenance organizations and insurance and/or reinsurance brokers

Effectivity: Shall take effect immediately

The IC issued CL No. 2020-59 on May 14, 2020 requiring all regulated companies to submit their AS, AFS and attachments for the reporting periods starting 2019 onwards through electronic means. These companies are also advised to send the said documents in a compressed and password-protected file. Notwithstanding this new requirement, the IC may also require a company to submit and likewise, examine the original hard copy of the electronically submitted documents. The IC has released updated checklists together with the CL for guidance of each of the regulated entities.

CL No. 2020-60: Regulatory Relief on Networth Requirements and Guidelines on the Implementation of Amended Risk-based Capital (RBC2) Framework for Calendar Year 2020

Covered entities: All insurance and professional reinsurance companies

Effectivity: Shall take effect immediately

The IC, through CL No. 2020-60 issued on May 15, 2020, promulgated the following guidelines:

1. All insurance companies already compliant with the networth requirements as of December 31, 2019 under Section 194 of the Amended Insurance Code before the declaration of ECQ and adversely affected by the crisis are:

a. relieved from the quarterly compliance of the networth requirements of P900,000,000; and,

b. required to comply with the CL 2016-68 (Amended Risk-based Capital Framework) and revised regulatory intervention (RBC ratio)

2. All insurance companies which are not compliant before the declaration of the ECQ are required to make fulfill their respective commitments to the IC to put up additional funds to cover the networth deficiency before availing the relief as discussed in (1) above.

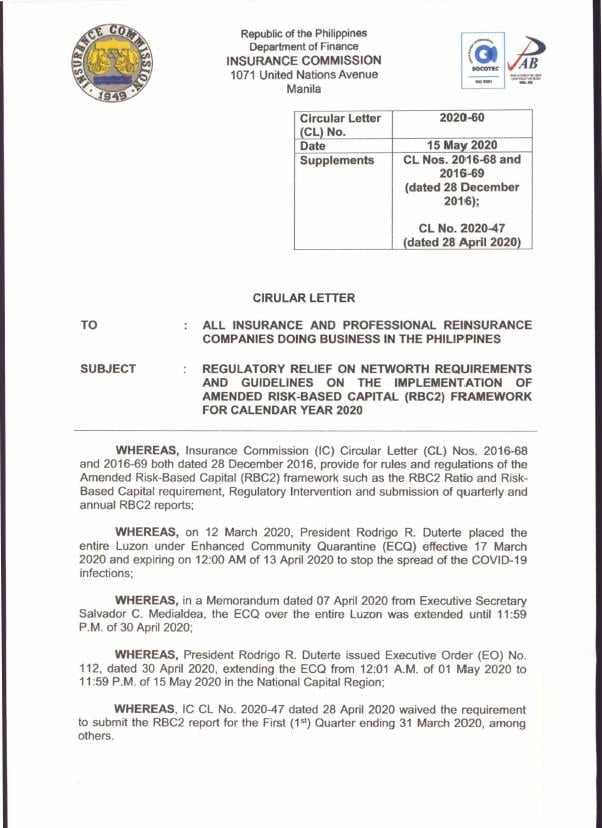

3. Submission of 2020 RBC2 reports for the following periods shall be required.

![]()

CL No. 2020-62: Deferral of IFRS 17 Implementation

Covered entities: All insurance and professional reinsurance companies

Effectivity: Shall take effect immediately

On March 17, 2020, the International Accounting Standards Board (IASB) has decided to further defer the effective date of IFRS 17, Insurance Contracts to annual reporting periods beginning on or after January 1, 2023. In view of this, the IC, through CL No. 2020-62 issued on May 18, 2020, amended provisions under Section 1 of CL No. 2018-69, Deferral of Implementation of IFRS 17 - Insurance Contracts and deferred the implementation of IFRS 17 for life and non-life insurance industries by two (2) years after its effective date as decided by the IASB.

See attached Circular Letters for further details.