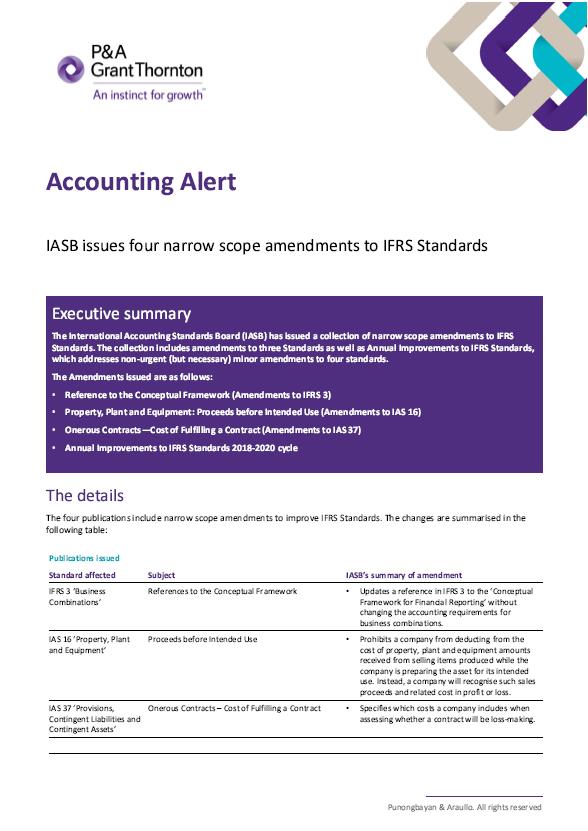

This Accounting Alert is issued to circulate and summarize the collection of narrow scope amendments to IFRS Standards issued by the International Accounting Standards Board (IASB).

Background

The IASB has issued on May 14, 2020 several small amendments to the IFRS Standards. The package of amendments includes narrow-scope amendments to three Standards as well as the IASB's Annual Improvements, which are changes that clarify the wording or correct minor consequences, oversights or conflicts between requirements in the Standards.

Summary

The Amendments issued are summarized below.

- Amendments to IFRS 3, Business Combinations - References to the Conceptual Framework update a reference in IFRS 3 to the Conceptual Framework for Financial Reporting without changing the accounting requirements for business combinations.

- Amendments to IAS 16, Property, Plant and Equipment - Proceeds before Intended Use prohibit a company from deducting from the cost of property, plant and equipment amounts received from selling items produced while the company is preparing the asset for its intended use. Instead, a company will recognize such sales proceeds and related cost in profit or loss.

- Amendments to IAS 37, Provisions, Contingent Liabilities and Contingent Assets - Onerous Contracts specify which costs a company includes when assessing whether a contract will be loss-making.

- Annual Improvements make minor amendments to:

- IFRS 1, First-time Adoption of International Financial Reporting Standards - Subsidiary as a First Time Adopter which simplify the application of IFRS 1 by a subsidiary that becomes a first-time adopter after its parent in relation to the measurement of cumulative translation differences;

- IFRS 9, Financial Instruments - Fees in the '10 per cent' Test for Derecognition of Financial Liabilities which clarify the fees a company includes when assessing whether the terms of a new or modified financial liability are substantially different from the terms of the original financial liability;

- Illustrative Examples accompanying IFRS 16, Leases - Lease Incentives which remove potential for confusion regarding lease incentives; and,

- IAS 41, Agriculture - Previously Held Interests in a Joint Operation which remove a requirement to exclude cash flows from taxation when measuring fair value thereby aligning the fair value measurement requirements in IAS 41 with those in other IFRS Standards.

Effective Date

All amendments are effective for annual reporting periods beginning on or after January 1, 2022, with early application permitted.

See attached Accounting Alert for further details.