This Accounting Alert is issued to circulate the recent memorandum issued by the Bangko Sentral ng Pilipinas (BSP) relative to the submission of Annual Report (AR) and Audited Financial Statements (AFS) of banks by electronic means.

As stated in BSP Memorandum No. M-2020-055 issued on July 11, 2020 and in line with the digitalization initiatives of the BSP, banks shall observe the following submission guidelines beginning with the 2019 AR and AFS:

Submission Guidelines

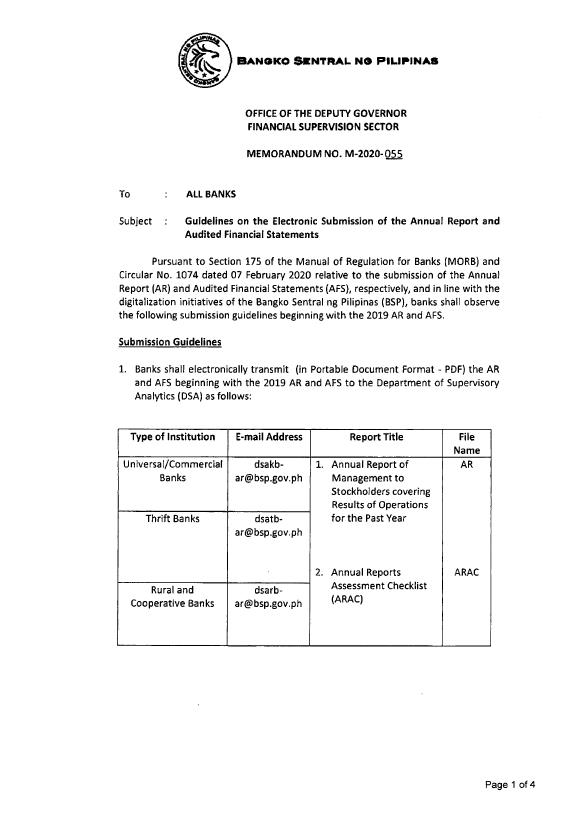

- Banks shall electronically submit the following documents in portable document format (PDF) to the Department of Supervisory Analytics (DSA). The specific email addresses of the recipients per type of bank and the corresponding file name for each document are listed in the attached memorandum.

- Annual Report Set

- Annual Report of Management to Stockholders covering Results of Operations for the Past Year

- Annual Reports Assessment Checklist

- Audited Financial Statements Set

- Audited Financial Statements

- Certification of the External Auditor

- Reconciliation Statement including adjusting entries, if any

- Letter of Comments (LOC) or Certification by the External Auditor that there are no issues noted in the course of audit to warrant the submission of LOC

- Copy of the Board Resolutions (or Country head Report, in case of foreign banks with branches in the Philippines) on action(s) taken by the covered institutions on AFS and LOC, if any

- Certification by the External Auditor of none to report on matters adversely affecting the condition or soundness of the bank

- Audited Financial Statements of the FCDU/EFCDU (AFS-FXT)

- Banks shall apply the following prescribed format for the subject:

AR<space><Bank Name>,<space><Reference period in dd month yyyy>

AFS<space><Bank Name>,<space><Reference period in dd month yyyy>

- Pursuant to BSP Memorandum No. M-2017-028, banks shall only use email addresses officially registered with the DSA in electronically submitting reports. The same registered email addresses shall be used by the DSA in electronically acknowledging the submitted reports.

- Banks that are unable to electronically transmit the AR and AFS may use any portable storage device (e.g., USB flash drive) and submit the same through messengerial or postal services within the prescribed deadline to the DSA office, the address of which is provided in the attached memorandum.

Important Reminders

- For AFS submission, banks shall submit the six required files above, and the seventh file, if the bank is engaged in foreign exchange transactions.

- The following may result in a failed submission, among others:

- Failure to use prescribed filenames;

- Failure to use the correct file format;

- Failure to use the prescribed subject line or reporting date;

- Failure to use an officially registered email address;

- Transmitting to the wrong email address; and,

- Attachments do not contain the exact number of files.

- Report submissions that do not conform with the prescribed guidelines will not be accepted and will be considered non-compliant with the BSP reporting requirements as provided under Section 171 of the Manual of Regulation for Banks.

See attached Memorandum for further details.