This Accounting Alert summarizes the amendments to IFRS 17 and IFRS 4 issued by the IASB to help companies implement the Standard.

Executive Summary

The International Accounting Standards Board (IASB) has published amendments to IFRS 17, Insurance Contracts, which aim to respond to feedback from stockholders and help entities to easily transition and implement the Standard. The IASB also issued IFRS 4 (Amendments), Insurance Contracts - Extension of the Temporary Exemption from Applying IFRS 9 so that eligible ensurers can still apply IFRS 9, Financial Instruments alongside IFRS 17.

The series of amendments:

- ease transition by deferring the effective date of the Standard and by providing additional relief to reduce the effort required when applying IFRS 17 for the first time;

- make financial performance easier to explain; and

- further reduce costs by simplifying some of the requirements of the Standard.

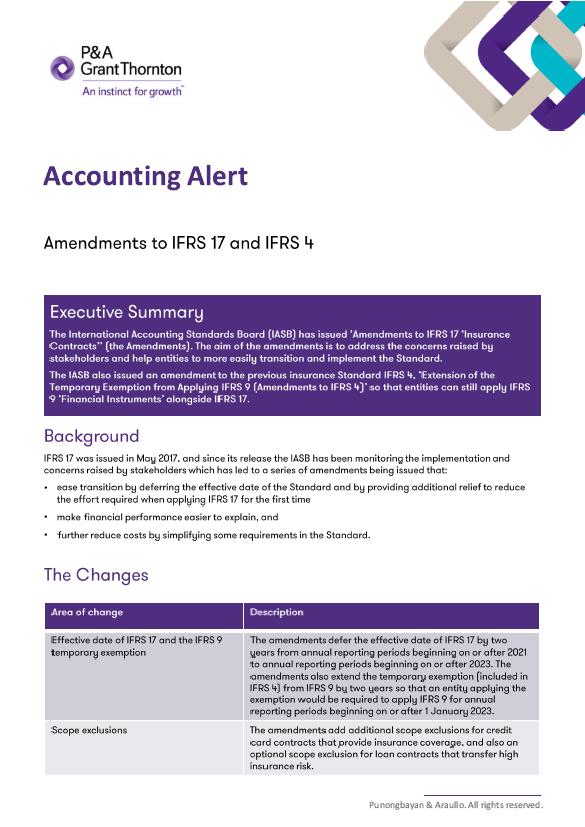

The Changes

The fundamental principles introduced when the IASB first issued IFRS 17 remain unaffected. The following are the main areas of change:

- Effective date of IFRS 17 and the IFRS 9 temporary exemption

- Scope exclusions

- Expected recovery of insurance acquisition flows

- Contractual service margin attributable to investment-return service and investment-related service

- Applicability of the risk mitigation option

- Interim financial statements

- Reinsurance contracts held - recovery of losses on underlying insurance contracts

- Presentation in the statement of financial position

- Transitional modifications and reliefs

- Other minor amendments

See attached Accounting Alert for the complete details and summary of each area of change.