This accounting alert circulates notices uploaded by SEC in its website implementing new procedures for submission of reports and other documents during the quarantine period.

Introduction

Pursuant to the imposition of an enhanced community quarantine and stringent distancing measures over Luzon and across provinces in the country to prevent the spread of the 2019 Coronavirus Disease (COVID-19), the Securities and Exchange Commission (SEC) issued three notices on March 17 and 18, 2020 in its website, temporarily changing the rules for the filing of reports, communications and other documents by corporations. A brief summary on each issuance is included below.

For Publicly-listed Companies

All PLCs are directed by the SEC to file their respective structured and current reports by uploading the same through the PSE Edge. All reports filed with the PSE Edge during the effective period shall be considered as having been filed with the SEC. The SEC reserves the right to require the PLCs to submit a copy to the SEC at a later time as may be necessary. The SEC shall also make the proper arrangement with PSE for the latter to furnish the SEC with the reports filed in the PSE Edge. The PSE also posted CN No. 2020-0024 on March 17, 2020 to echo the SEC notice, noting that the filings must follow the relevant PSE rules and procedure on submission.

For other communications, PLCs shall direct them to msrd_covid19@sec.gov.ph.

This notice and the directives therein shall take effect beginning March 17, 2020 and shall be followed until further notice.

For Issuers of Registered Securities (other than PLCs)

All issuers of registered securities (other than PLCs) are mandated to file their respective structured and current reports and direct their other communications to msrd_covid19@sec.gov.ph as direct email messages or attachments.

This notice and the directives therein shall take effect beginning March 17, 2020 and shall be followed until further notice.

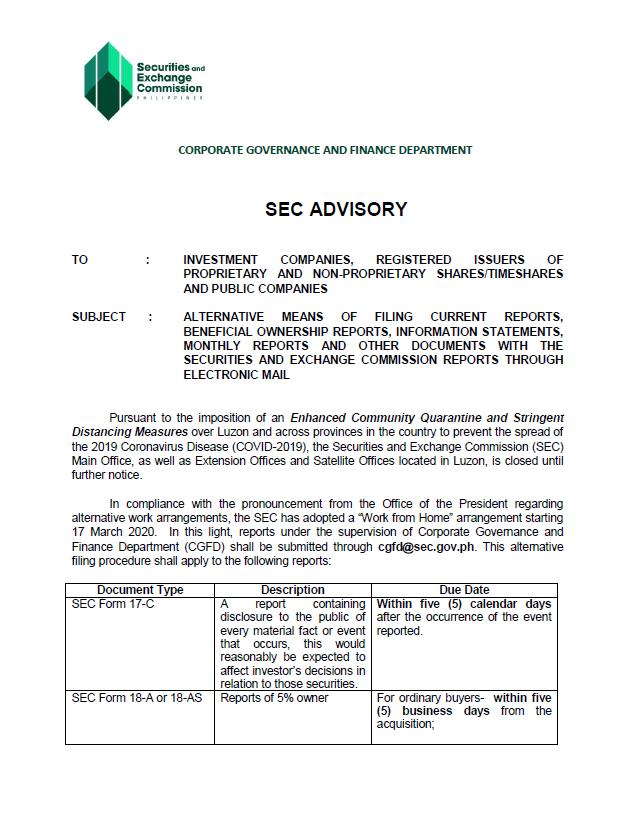

For Investment Companies, Registered Issuers of Proprietary and Non-proprietary Shares/Timeshares and Public Companies

Reports under the supervision of Corporate Governance and Finance Department (CGFD) shall be submitted through cgfd@sec.gov.ph. This alternative filing procedure shall apply to the following reports:

- SEC Form 17-C

- SEC Form 18-A or 18-AS

- SEC Form 23-A or 23-B

- SEC Form 20-IS

- SEC Form 20-ISA

- Monthly Sales and Redemption Report

For ease of monitoring, corporations covered shall submit one report per company, using the following format in the subject head: COMPLETE NAME OF THE COMPANY_SUBJECT REPORT (Example: ABCDEF Corp_SEC Form 17-C).

In addition, every report submitted via email must be accompanied by a certification of the person who prepared the report on behalf of the covered company that the information contained therein are true and correct. This certification must be attached in the same email together with the subject report to be filed. Due to the exigency of the situation and only for the purpose of alternative filing, reports to be submitted via email shall not be required to be notarized even if they normally require notarization for validity.

However, upon implementation by the SEC of regular working hours, all covered companies shall submit hard copies of said reports and/or documents with proper notarization with the CGFD within 10 calendar days from the date that the quarantine order has been lifted or withdrawn. To ensure the integrity of documents, the covered companies must issue a certification that the hard copies submitted refer to one and the same report that they filed via email. Such certification must also indicate the date of their submission through email.

This notice and the directives therein shall take effect beginning March 18, 2020 and shall be followed until further notice.

See attached SEC and PSE Notices for the complete details of this publication.