The Rate of Return on Assets, often referred to as Return on Assets (ROA), is a widely accepted Profit Level Indicator (PLI) when applying the Transactional Net Margin Method (TNMM). It is especially suitable for asset intensive businesses, where profitability is most accurately assessed by measuring how efficiently a company utilises its operating assets to generate returns.

When is ROA most appropriate?

ROA is most relevant when operating assets are the primary value drivers, such as in:

- Full-fledged or contract manufacturing operations;

- Contract or toll manufacturers with significant production equipment;

- Leasing businesses;

- Logistics providers with substantial fleets; and,

- Other capital-intensive service industries.

Benchmark comparables typically also depend heavily on asset utilisation. However, ROA becomes less reliable when a business’s main value drivers are unique intangibles rather than tangible operating assets, or when differences in asset valuation between the tested party and comparables cannot be reliably adjusted. In such cases, the OECD indicates that sales-based PLIs (e.g., operating margin) or cost-based PLIs (e.g., markup on total costs) may serve as more reliable indicators.

How to compute ROA?

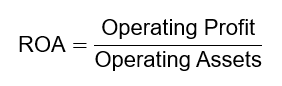

ROA is computed as

where:

- Operating profit refers to earnings before interest and taxes (EBIT), excluding non-operating and extraordinary items to align how comparables report operating performance. Excluded items typically include:

- Interest-related items: interest expense on borrowings and amortisation of debt discounts or premiums;

- Asset disposals and write-offs: gains or losses on disposal of fixed assets and investments, and impairment losses on fixed assets, inventory and intangibles;

- Investment-related income: dividend income and interest income on investments; and,

- Natural disaster-related losses: losses from earthquakes, floods, and fires.

- Operating assets are assets that contribute directly to the generation of operating profit, typically including:

- Tangible fixed assets: land, buildings and machinery;

- Operating intangibles: technology, patents, and production-related know‑how; and,

- Working capital: inventories and trade receivables net of trade payables.

- Investments, financial assets, and excess cash must be excluded, unless the tested party operates in the financial sector.

- To better reflect the asset base over the period, average operating assets (e.g., beginning and ending balances) should be used.

(Chapter II: Documentation, OECD Transfer Pricing Guidelines, January 2022, Revenue Regulations No. 2-2013, and Revenue Audit Memorandum Order No. 1-2019)

ROA is a practical and defensible PLI for asset intensive operations, as it aligns profitability with the economic contribution of operating assets under both OECD and Philippine transfer pricing rules. Taxpayers with capital-heavy business models should assess whether ROA is the most appropriate PLI and ensure that computations and benchmarking are thoroughly documented in preparing transfer pricing documentation.