(Revenue Memorandum Circular Nos. 047-2025, 52-2025 and 58-2025, Revenue Memorandum Order No. 13-2025)

This Tax Alert is issued to inform all concerned on the clarifications and updates on the implementation of VAT on digital services pursuant to Republic Act (RA) No. 12023, as implemented by Revenue Regulation (RR) No. 3-2025.

Pursuant to RR No. 03-2025, digital services consumed in the Philippines are subject to 12% VAT effective June 2, 2025. While registration or updating of registration of Non-resident digital service providers (NRDSPs) is extended until July 1, 2025.

Registration Requirement for Non-resident digital service providers (NRDSPs)

i. All NRDSPs with Business-to-Business (B2B) and/or Business-to-Consumer (B2C) transactions are required to register with the BIR.

ii. Registration shall be made through the VAT on Digital Services (VDS) Portal once available. In the meantime, NRDSPs or their appointed resident third-party service providers can register through the Online Registration and Update System (ORUS). Manual registration may likewise be done with the BIR Revenue District Office No. 39 – Quezon City if the NRDSP has its local representative.

iii. The NRDSPs shall register with the BIR on or before July 1, 2025.

iv. The following information shall be provided by the NRDSP during registration via ORUS:

a. Name of business entity, including trade name;

b. Name of the authorized representative, and Taxpayer Identification Number (TIN) in case of local authorized representative, responsible for tax administration, if any;

c. Registered foreign address; and

d. Contact information of the NRDSP (e.g., Contact number, email address).

Any official registration document issued by an authorized government regulatory body (e.g., Securities and Exchange Commission, tax authority) in the country where NRDSP was incorporated or organized (e.g., Articles of Incorporation, Certificate of Tax Residency) that includes the name of the NRDSP shall be sufficient for the registration.

NRDSPs do not need a local representative in the Philippines to register with the BIR. However, an NRDSP may appoint a resident third-party service provider (an individual or entity, such as a law firm or accounting firm) for purposes of registration, filing of tax return and payment of taxes, receiving notices, record keeping, and other reporting obligations. The appointment of a resident third-party service provider shall not classify the NRDSP as a resident foreign corporation doing business in the Philippines.

During registration, the NRDSP shall select VAT as its tax type. A BIR Certificate of Registration (COR)/BIR Form No. 2303 containing the assigned TIN and other registration details shall be issued to the NRDSP, which shall be used in the filing of VAT returns, and remittance of VAT, if any, to the BIR.

An NRDSP which fails to register for VAT shall be imposed with applicable penalties under Section 13 of RR No. 3-2025, and suspension of its business operations under Section 12 of the same Regulations, if warranted.

Invoicing, Remittance of VAT and Filing of VAT Returns

The following are the VAT Treatment and compliance requirements for the following transactions:

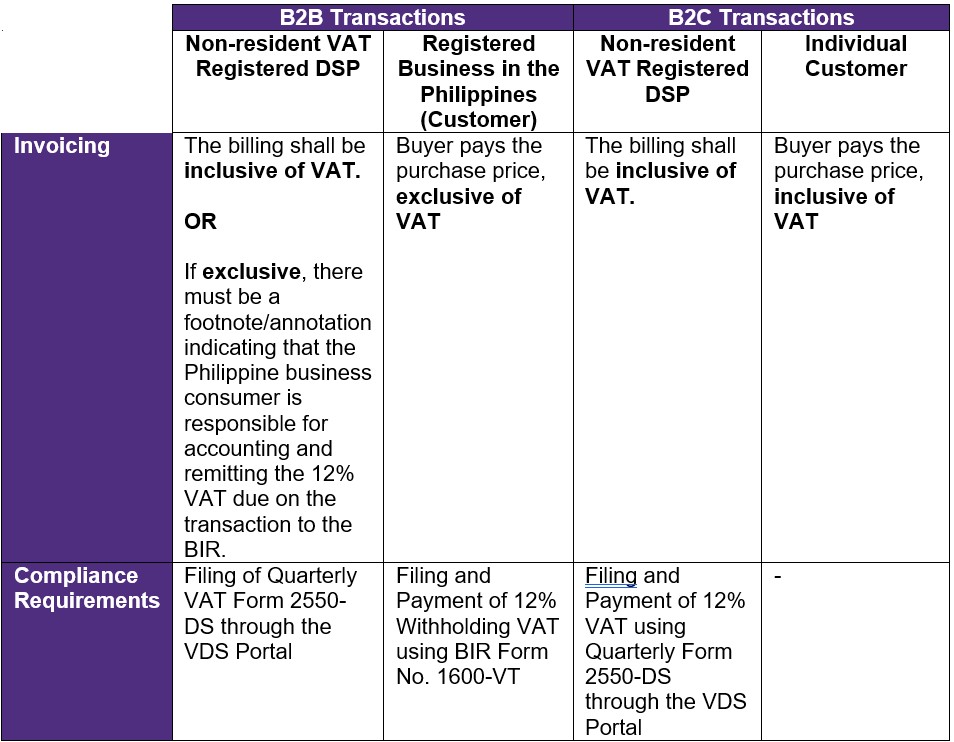

A. B2B and B2C transactions of Non-resident VAT Registered DSP

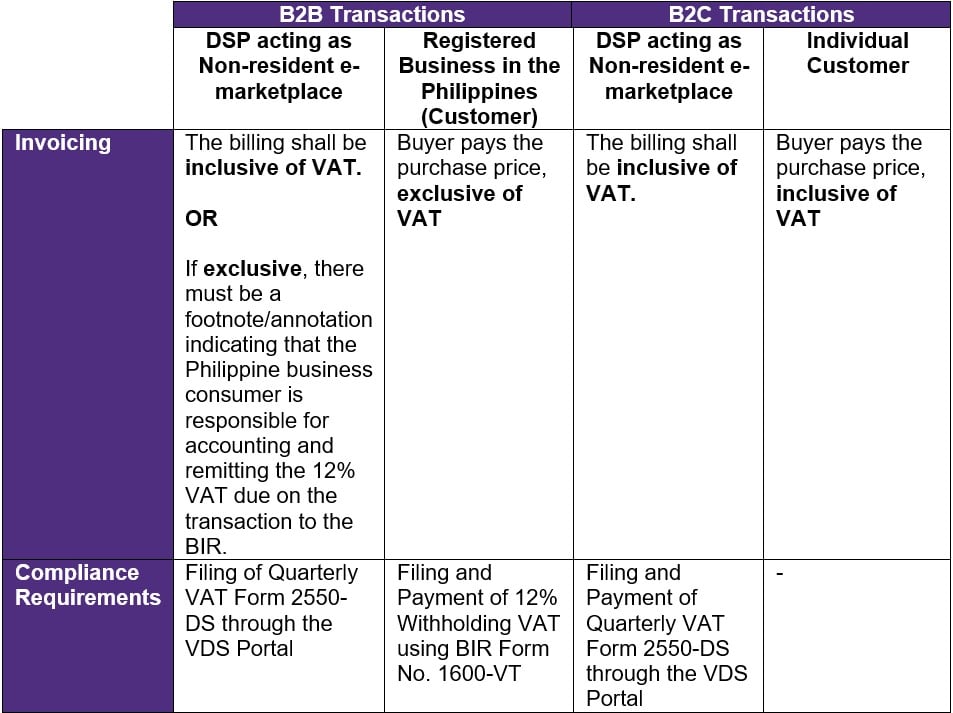

The following mechanisms in the remittance of VAT on digital services shall be observed by DSPs acting as an online marketplace or e-marketplace of resident and non-resident sellers. A DSP can be considered an e-marketplace if it controls the key aspects of the supply and performs any of the following:

- It sets directly or indirectly any of the terms and conditions under which the supply of digital services is made; or

- It is involved in the ordering or delivery of digital services whether directly or indirectly

B. B2B and B2C transactions of DSP acting as Non-resident e-marketplace For Resident/Non-resident Suppliers

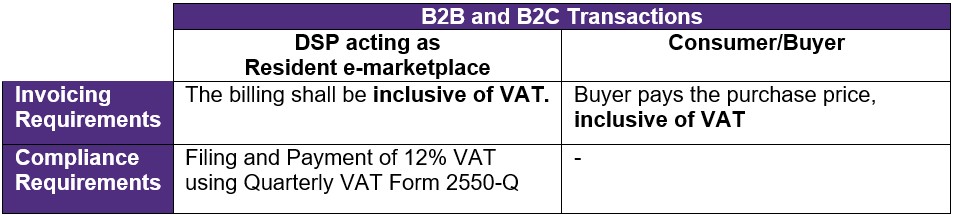

C. B2B and B2C transactions of DSP acting as Resident e-marketplace for Non-resident Supplier

For sale of NDRSP generated through e-marketplace but paid directly to the NRDSP, the e-marketplace is not liable to remit the VAT on the sale. However, the service fee for availing the online platform/marketplace shall be subject to VAT.

NRDSP may verify if the buyer is engaged in business in the Philippines for VAT purposes through the following means:

1. Obtaining the buyer’s TIN;

2. Providing a questionnaire or tick box in their website/platforms; and/or

3. Request for other business registration documents (e.g. BIR COR).

The Philippine business customers/buyers may use the filed and paid BIR Form 1600-VT as proof of input VAT claim from purchases of digital services from NRDSPs.

Tax Return for VAT on Digital Services

Copy of the Value-Added Tax (VAT) Return For Nonresident Digital Service Provider (BIR Form 2550-DS) is available in the BIR website (2550-DS Jan 2025 version_Folio.pdf). Pursuant to RMC 52-2025, A separate revenue issuance shall be issued on the manner and guidelines for the filing and payment of VAT on Digital Services as implemented by RR No. 3-2025.

Invoicing Requirements

There is no prescribed form for the invoice to be issued by NRDSPs as long as the following mandatory information are present:

1. Date of the transaction

2. Transaction Reference Number

3. Identification of the consumer (including the TIN for B2B)

4. Brief description of the transaction

5. The total amount with the indication that such amount includes VAT

For B2B transactions, the VAT amount must be clearly stated on the invoice issued by the NRDSP. If in case such amount cannot be clearly stated, a footnote or annotation must be included indicating that the Philippine consumer/buyer is responsible for accounting and remitting the 12% VAT due on the transaction to the BIR.

Erroneous Remittance of VAT by NRDSP

In case the NRDSP paid the corresponding VAT to the BIR, but the Philippine Consumer has already paid the withholding VAT, the NRDSP cannot file for a refund but may amend the filed BIR Form 2550-DS showing the overpayment which may be carried-over to the succeeding quarter/s.

VAT Exempt Transactions

a. For educational institutions with subscription-based services, it shall only present to the DSP the accreditation/recognition from DepED, CHED, and TESDA in order to avail the VAT exemption. There is no need to secure the Certificate of Tax Exemption from BIR.

b. Purchases of digital services which are directly attributable to registered activity or export activity of qualified Registered Business Enterprises (RBEs) and Export Oriented Enterprises (EOEs) with Certification issued by the Investment Promotion Agencies (IPAs) or DTI shall not be subject to 12% VAT.

Shared Cost Charged to Philippine Subsidiary

In cases where the contracting party of the NRDSP is outside the Philippines (e.g., in the US) and the US entity shares costs with different markets (including subsidiaries in the Philippines), the Philippine subsidiary shall be responsible in withholding and remitting to the BIR the VAT due on the shared cost for digital services consumed in the Philippines as a B2B transaction.

Transitory Provision

Digital services rendered effective June 2, 2025 shall be subject to VAT by the NRDSP even if the buyer already paid the full contract price in advance without including the 12% VAT. NDRSP shall remit the VAT to the BIR since the buyer no longer has control over the payment.