(Revenue Memorandum Circular No. 004-2026 issued on January 15, 2026)

This Tax Alert is issued to inform all concerned on the existing policies on the registration of Permanently Bound Loose-leaf Books of Accounts and Computerized Books of Accounts and the grant of extension on the registration of books of accounts and accounting records for Taxable Year 2025 due to intermittent log-in issues in Online Registration and Update System (ORUS).

I. Mandatory Registration through ORUS

All taxpayers using permanently bound loose‑leaf or computerized books of accounts must register their books of accounts online strictly via ORUS.

Once registration is successful, ORUS generates a QR Code which can be validated online.

The QR Code shall (1) be affixed to the first page of permanently bound loose‑leaf books, or (2) be printed and kept for computerized books for record purposes.

Manual registration (for stamping) at the RDO where the head office or branch is registered, is allowed only when there is:

1. An official advisory on ORUS downtime; or

2. A screenshot of the error message encountered during online registration process is presented.

II. Records Not Covered by ORUS Registration

Registration of loose-leaf invoices, receipts, and other accounting records is not yet available in ORUS; therefore, these documents must continue to be processed manually at the concerned RDO.

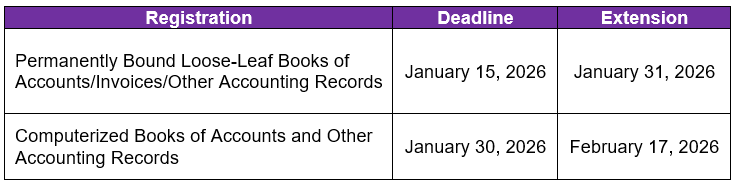

III. Extension of Registration Deadlines

Taxpayers must comply with the foregoing registration requirements within the extended deadlines to avoid the imposition of penalties under existing revenue laws, rules and regulations.