(Revenue Memorandum Circular No. 075-2025 issued on July 23, 2025)

This Tax Alert is issued to inform all concerned of the extension of statutory deadlines for the filing and payment of tax returns, including the submission of required reports and other documents, by taxpayers registered under the Revenue District Offices (RDOs) adversely affected by the Southwest Monsoon and Typhoons Crising, Dante, and Emong.

Pursuant to Revenue Memorandum Circular (RMC) No. 075-2025, the Bureau of Internal Revenue (BIR) has extended the deadlines for the filing of tax returns and corresponding attachments, payment of taxes due thereon, and other mandatory submissions to the BIR originally due on July 21 and 25, until July 31, 2025. This relief measure is intended to provide sufficient time for taxpayers, BIR personnel, and affected Authorized Agent Banks (AABs) within the covered RDOs to comply with their statutory obligations.

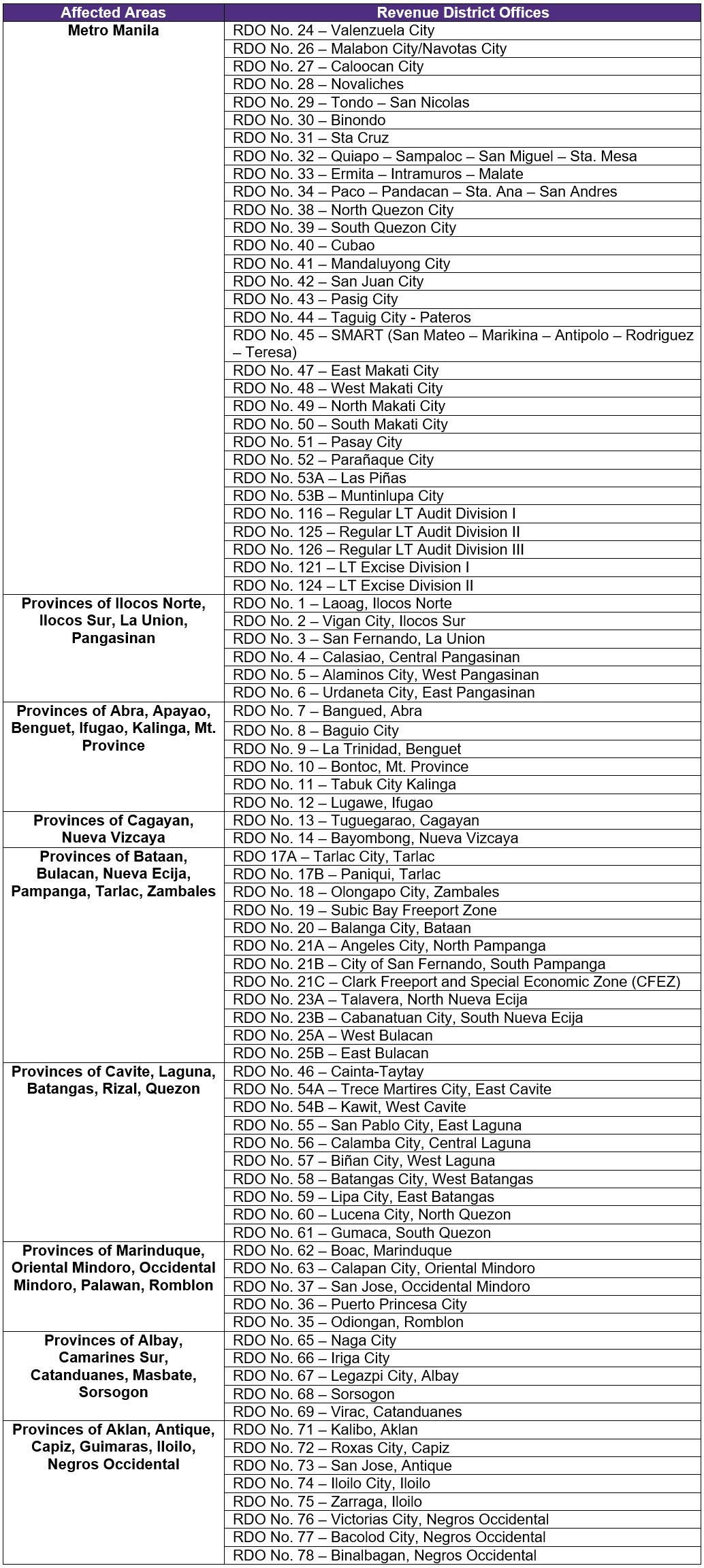

A. Covered RDOs

The extension applies to taxpayers registered in the following RDOs located in Metro Manila and various provinces across Luzon, Visayas, and Mindanao.

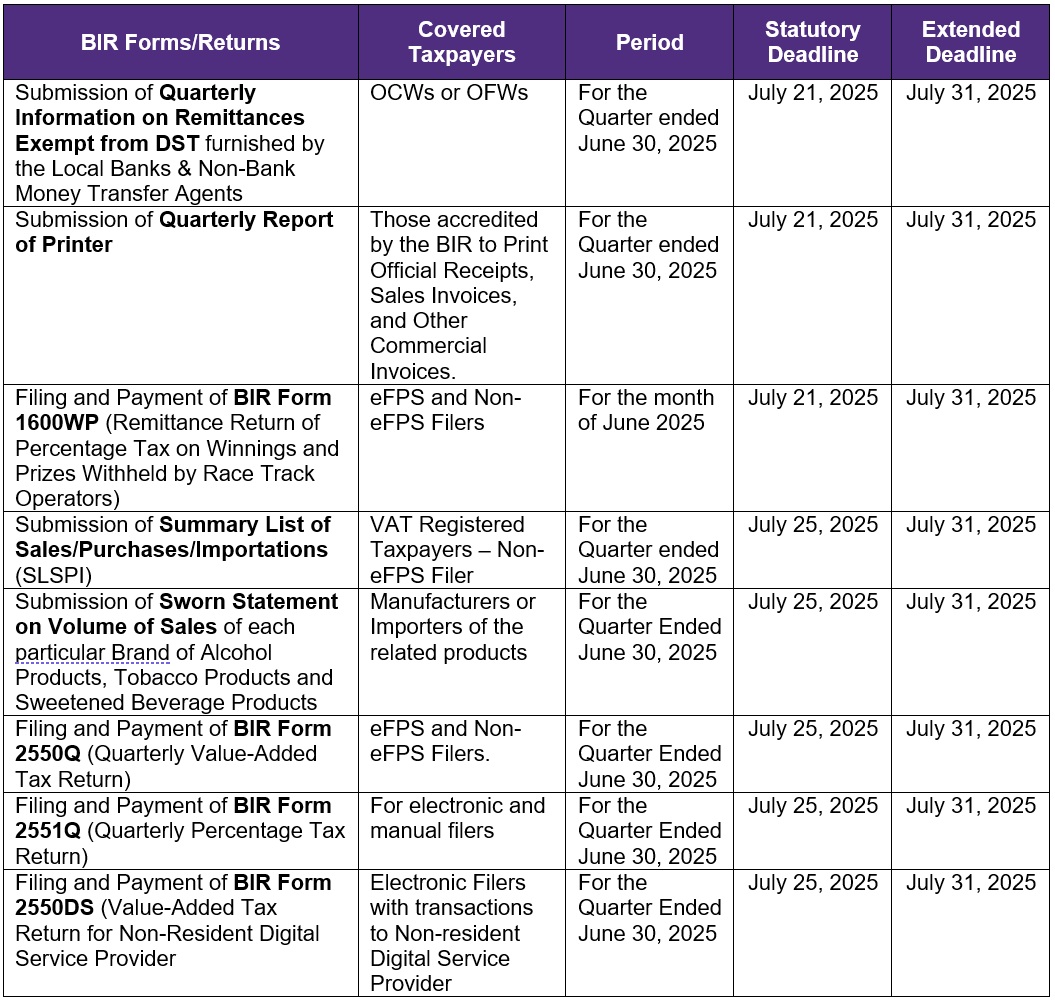

B. Covered Returns, Attachments, and Other Reports

C. Effectivity

This Circular takes immediate effect.