(Revenue Memorandum Circular No. 87-2024, August 7, 2024)

This Tax Alert is issued to inform all concerned on the filing of tax returns and payment of taxes pursuant to Section 3 of RR No. 4-2024, implementing the provision of Republic Act No. 11976, otherwise known as EOPT Act.

Filing of Tax Return

Taxpayers who are already enrolled in the Electronic Filing and Payment System (eFPS), shall continue using it. If there is an advisory of unavailability, taxpayer shall be allowed to use eBIRForms.

Taxpayers mandated to use eFPS but not enrolled in eFPS and in any eFPS-Authorized Agent Bank (AAB) shall use eBIRForms for e-filing and pay the corresponding taxes electronically.

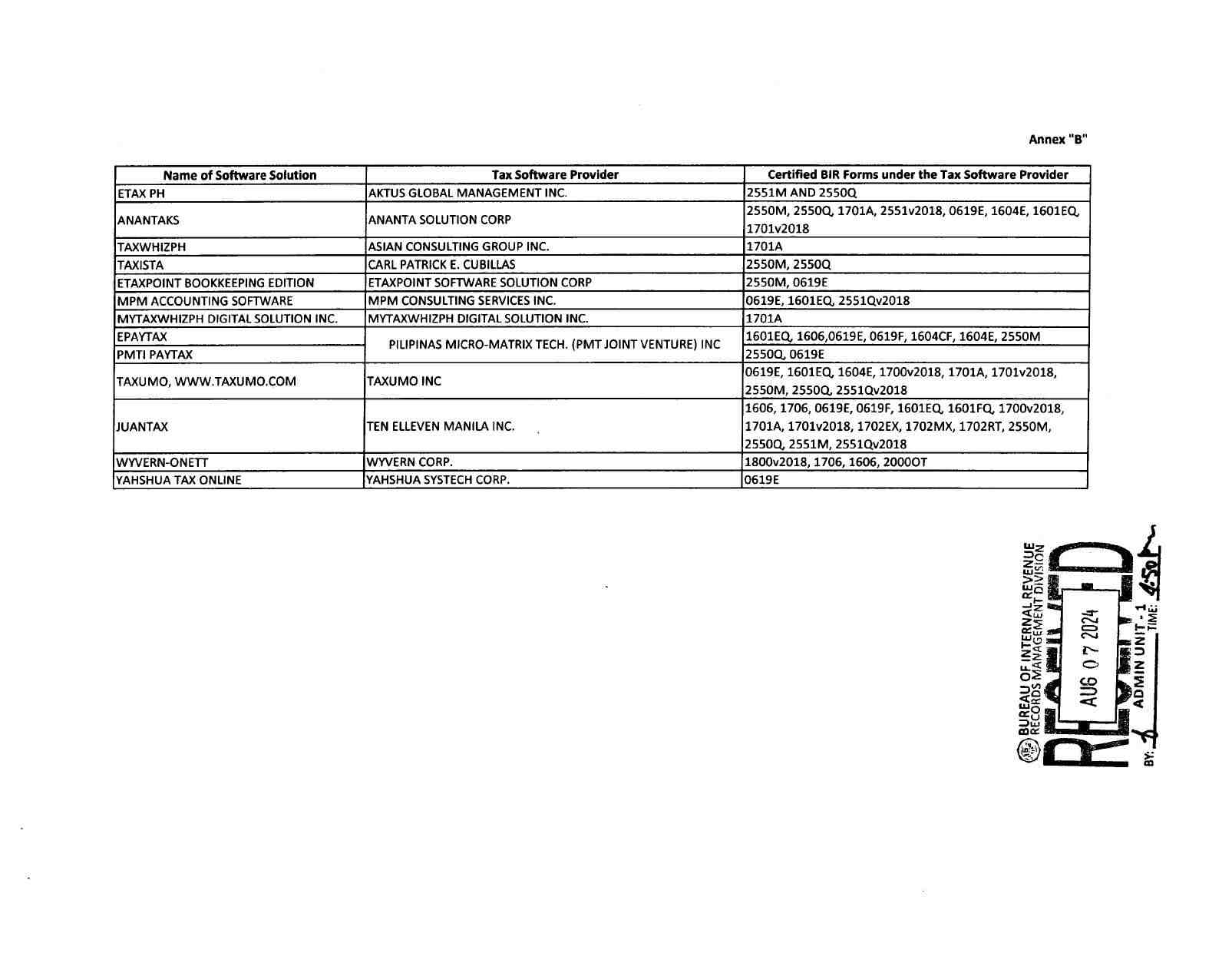

If the electronic platforms such as eFPS, eBIRForms, and Tax Software Providers (TSPs) of the Bureau of Internal Revenue (BIR) are not available, manual filing shall be allowed.

Submission of Attachment

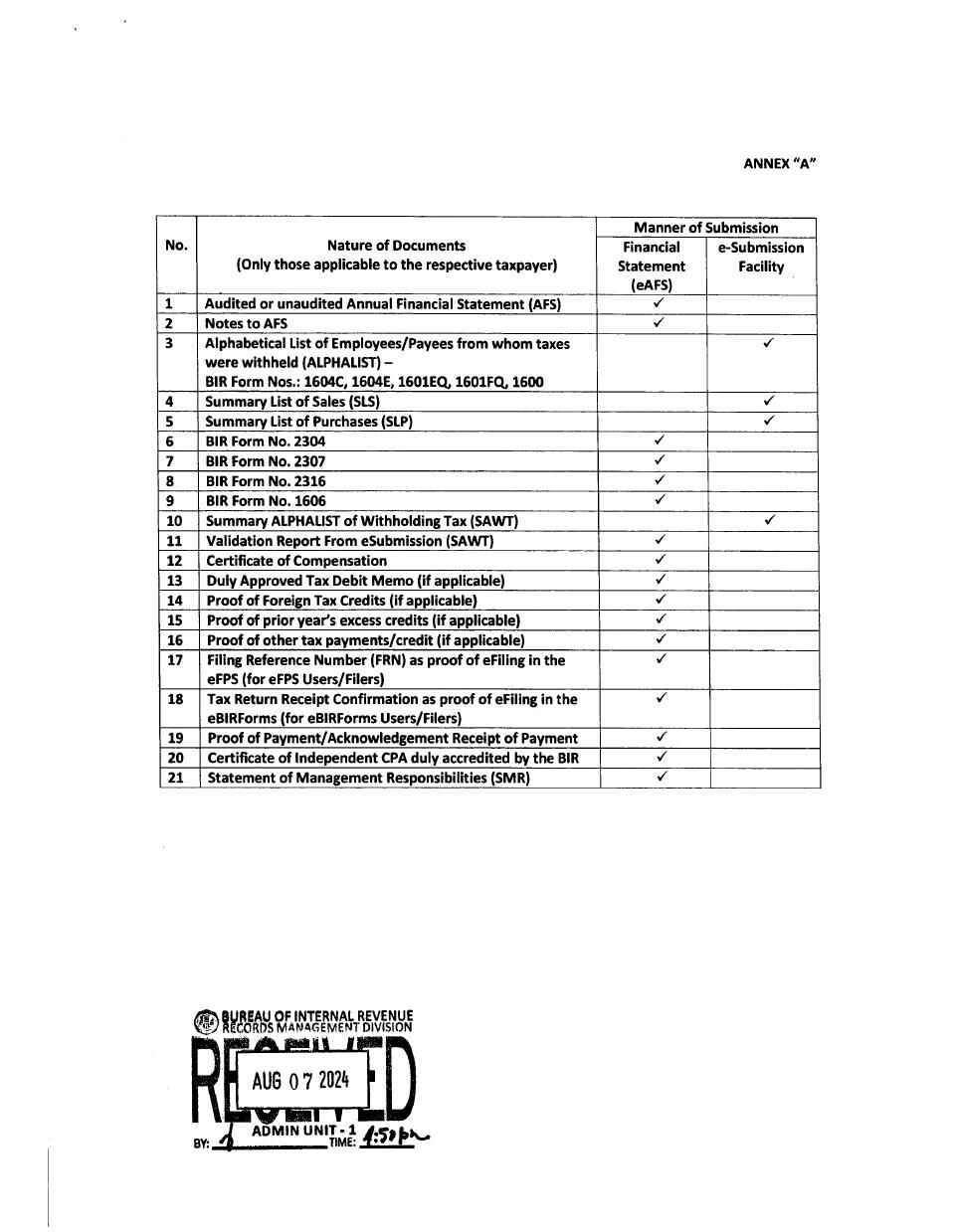

The attachments to the tax returns shall be submitted electronically using the Electronic Audited Financial Statements (eAFS)/eSubmission Facility, whichever is applicable. In case of unavailability, the attachments can be submitted manually to the BIR district office that has jurisdiction over the taxpayer.

RMC No. 87-2024 Annex A.pdf (bir.gov.ph) lists the documents that shall be submitted through eAFS and eSubmission Facility.

Payment of Taxes

a. Electronic Payment

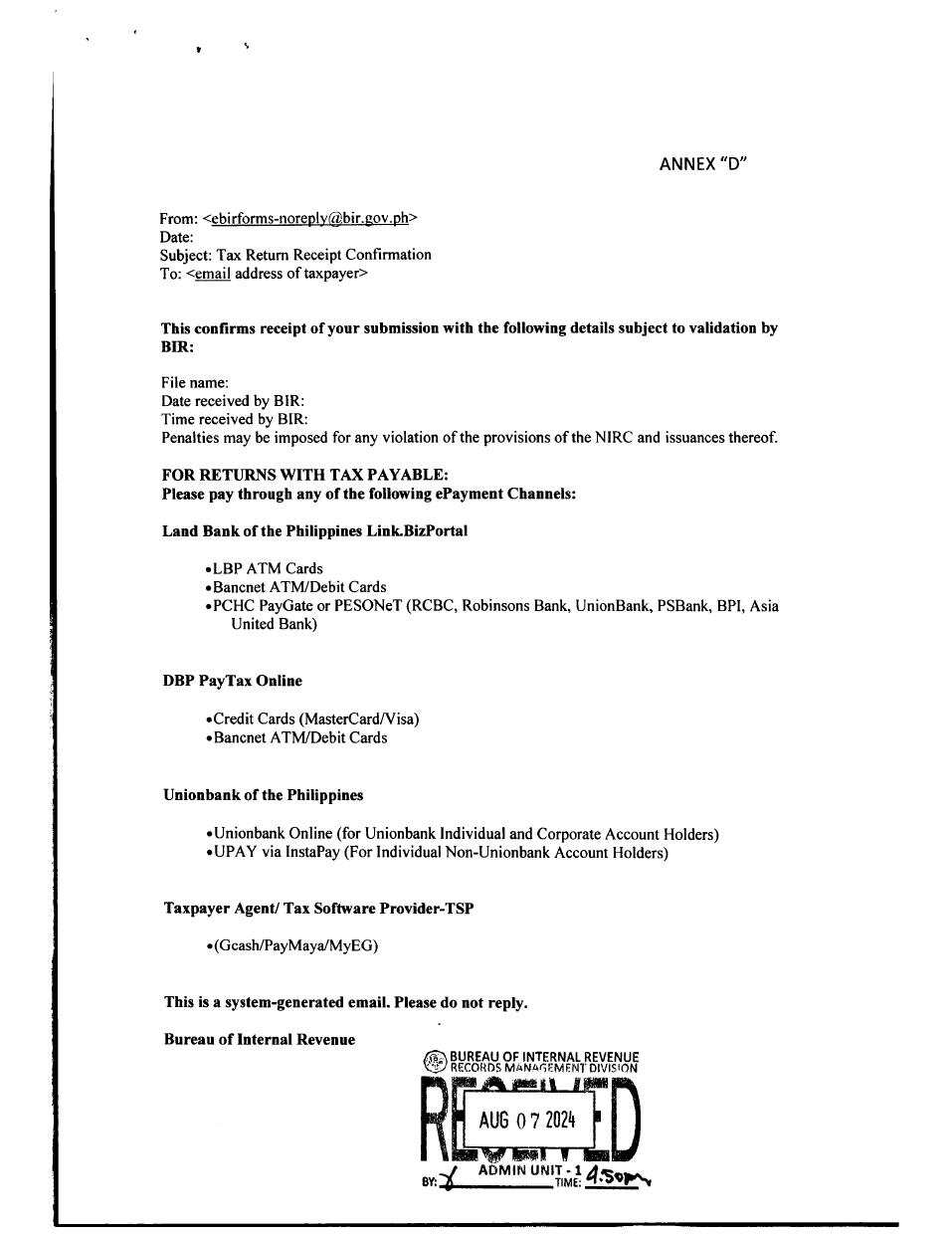

i. ePay gateways that taxpayers can use in the payment of their taxes aside from the eFPS. Listed below are the ePay gateways for tax payment. You can also refer to the BIR website from time to time for the updated list:

- Land Bank of the Philippines (LBP) Link.Biz Portal - for taxpayers who have ATM account with LBP and/or holders of BancNet ATM/Debit/Prepaid Card or taxpayer utilizing PESONet facility for depositors of AUB, BPI, PSBank, RCBC, Robinsons Bank, and Union Bank;

- Development Bank of the Philippines (DBP) Pay Tax Online - for holders of Visa/MasterCard Credit Card and/or BancNet ATM/Debit Card;

- Union Bank of the Philippines (UBP) Online/The Portal Payment Facilities - for taxpayers who have an account with UBP or InstaPay using UPAY facility (for individual Non-Account holder of UnionBank); or

- Tax Software Provider:

MyEG – using credit cards or electronic wallets (e-wallets) such as GCash, Maya, GrabPay, or ShopeePay

MAYA – (Mobile Application)

Taxpayers who shall avail of the ePay may access the abovementioned ePay facilities by accessing the BIR website. Upon clicking the "ePay" icon, users shall be directed to the available ePay gateways. Taxpayers may also directly access the following AAB/TSP links:

LBP: www.lbp-eservices.com/egps/portal/index.jsp

DBP: www.dbppaytax.com

Union Bank: online.unionbankph.com

MyEG: http://myeg.ph/services/bir

Taxpayers who will avail of the services of Maya shall download and install the Maya mobile application from the Google Play Store, Apple App Store, or Huawei AppGallery. Taxpayers shall bear any convenience fee that may be charged by TSP and/or mobile companies for using their electronic filing/payment facilities.

ii. BIR Form No. 0605 with previous tax computations – this can be filed and paid electronically through the electronic platforms and ePay gateways.

b. Issuance of Check

i. Check to be tendered to AAB

Provide the following data after the phrase of “PAY TO THE ORDER OF”

- Bank where the payment is coursed

- For the Account of (FAO) Bureau of Internal Revenue as payee

ii. In case of Manager’s Check or Cashier’s Check

Provide the following data after the phrase of “PAY TO THE ORDER OF”

- Bank where the payment is coursed

- For the Account of (FAO) Bureau of Internal Revenue as payee

- Under the Account Name, indicate the taxpayer’s name and TIN

iii. Check shall be paid through RCO

Indicate after the phrase of “PAY TO THE ORDER OF” the Bureau of Internal Revenue

Taxpayers are reminded that RCOs may only accept cash payments not exceeding P20,000. However, there shall be no limit on tax payments made thru checks.

In case the receiving AAB’s is offline or unavailable, the taxpayers may transfer to another AAB branch, provided that the branch is the same AAB. The taxpayer should write at the back of the check the following:

- Name of the receiving branch;

- Taxpayer’s name; and

- TIN

The 25% surcharge shall not be imposed on a taxpayer who has manually paid the tax due to an AAB outside the jurisdiction of its registered revenue district office (RDO).

Late filing and payment of taxes

In cases of late filing and payment of taxes, taxpayers shall proceed to the RDO for computation of penalties and pay their taxes due to any AAB.