Overview

The Securities and Exchange Commission (SEC) issued Memorandum Circular No. 16, Series of 2025, titled “Adoption of Philippines Financial Reporting Standards (PFRS) on Sustainability Disclosures and Issuance of Reporting Guidelines for Publicly Listed Entities and Largely Non-listed Entities". SEC approved the adoption of PFRS S1 and S2 during its Commission En Banc meeting on 04 December 2025. PFRS S1 sets out the general requirements for the disclosure of sustainability‑related financial information, while PFRS S2 focuses on climate‑related disclosures.

In support of this adoption, the SEC issued the Sustainability Reporting Guidelines, together with a PFRS Adoption Roadmap, to guide covered companies in phased implementation. These standards are aligned with IFRS S1 and S2 issued by the International Sustainability Standards Board and were approved for local application through the Philippine standard‑setting process. The Guidelines aim to enhance transparency, comparability, and decision‑usefulness of sustainability disclosures, support long‑term value creation, and attract ESG‑focused investment. The issuance is grounded in the SEC’s mandate to promote good corporate governance, investor protection, and internationally aligned reporting in the Philippine capital market.

Section 1. Sustainability Reporting Format and Frameworks to be Used

- Publicly listed companies (PLCs) and large non‑listed entities (LNLs) that are reporting entities under Section 17.2 of the Revised Securities Regulation Code shall submit their Sustainability Report as an attachment to the annual report.

- Large non‑listed entities (LNLs) not covered under Item 1 shall submit their Sustainability Report together with their audited financial statements.

- All PLCs and LNLs shall ensure that their Sustainability Reports are reviewed and approved by the board of directors prior to issuance.

- From the effectivity of this Memorandum Circular until the fiscal year immediately preceding the mandatory adoption of PFRS S1 and PFRS S2, PLCs shall continue to comply with the Sustainability Reporting Guidelines under SEC Memorandum Circular No. 4, Series of 2019. During this transition period, PLCs are encouraged to begin aligning and transitioning their disclosures to PFRS S1 and PFRS S2 in preparation for mandatory adoption.

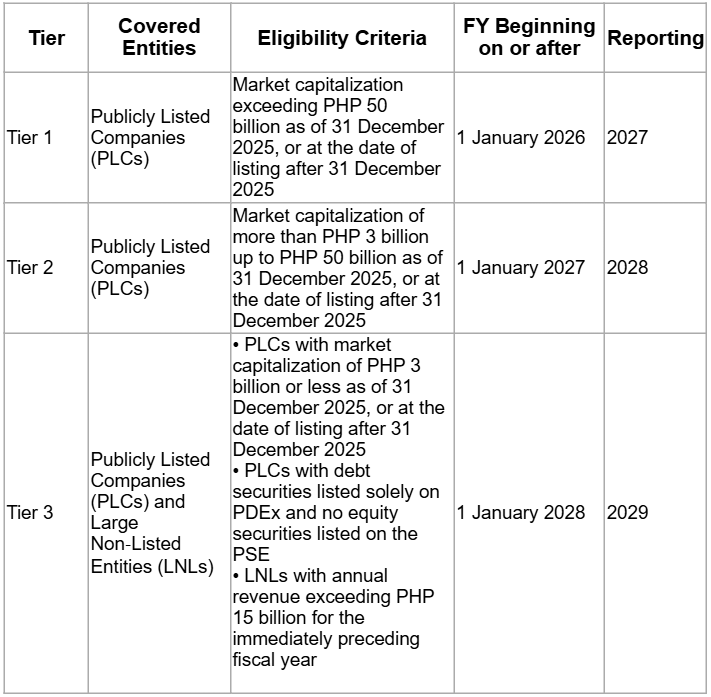

Beginning FY 2026, covered companies shall start adopting PFRS S1 and PFRS S2 with limited extensions of transition standard reliefs, under a tiered approach:

Market capitalization of a PLC is determined using the closing or last traded share price as of 31 December 2025, or the price at the date of listing for companies listed thereafter. LNL qualification is based on annual revenue for the fiscal year ending on or after 31 December 2027, with continued annual assessment until the revenue threshold is met; foreign‑currency revenues are converted using the closing exchange rate. Tier classification is fixed as of the relevant measurement date and requires ongoing annual sustainability reporting, solely to determine the timing of initial adoption of PFRS S1 and PFRS S2. Other international sustainability frameworks may be included in the same report in addition to PFRS S1 and S2, provided they do not conflict with the standards, do not obscure material information, and are clearly disclosed.

Section 2. External Assurance

Mandatory external limited assurance on Scope 1 and Scope 2 greenhouse gas (GHG) emissions shall be required two (2) years after an entity’s initial implementation of PFRS S1 and S2, on a per‑tier basis. The assurance engagement shall be conducted by an independent assurance practitioner, who may be either a Certified Public Accountant or a qualified non‑accountant. Over time, the assurance requirement will progress toward reasonable assurance, and companies are encouraged to voluntarily obtain reasonable assurance over their full sustainability report.

All external sustainability assurance engagements shall be performed in accordance with International Standard on Sustainability Assurance (ISSA) 5000, subject to compliance with its quality management and ethical requirements. Additional rules and guidance on external assurance will be issued by the Commission.

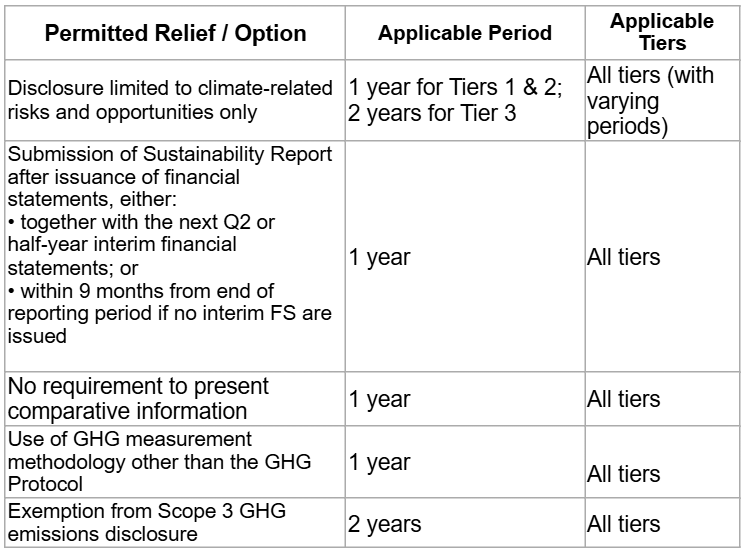

Section 3. Transition Reliefs

To address implementation challenges identified during public consultations, limited extensions to the transition reliefs provided under the Standards have been granted. No additional reliefs beyond those specified are provided, as companies are permitted to apply reasonable and supportable information available at the reporting date without undue cost or effort for certain disclosure requirements.

Section 4. Exemptions from Mandatory Reporting

An LNL may be exempted from submitting a separate Sustainability Report, provided that all of the following criteria are satisfied:

- The LNL’s immediate, intermediate, or ultimate parent, as defined under the applicable PFRS Accounting Standards, prepares and files a Sustainability Report in accordance with a recognized sustainability reporting framework required in the jurisdiction where the parent submits its corporate reports. This may include PFRS S1 and S2, European Sustainability Reporting Standards (ESRS), or other IFRS‑aligned sustainability disclosure standards.

- The LNL’s sustainability‑related disclosures are included in the parent company’s Sustainability Report, which is publicly available.

- The LNL submits a duly accomplished Certificate of Exemption from Mandatory Sustainability Reporting (Annex A) as an attachment to its annual financial statements.

The Commission may recognize other cases as valid exemptions from the mandatory submission of Sustainability Reports, subject to evaluation and approval.

Section 5. Compliance with the Attachment of Sustainability Report

For PLCs, failure to submit or attach the Sustainability Report or to comply with PFRS S1 and S2 shall be subject to penalties for an incomplete Annual Report, with separately scaled fines for non‑ or late submission. Such violations shall be treated as first offenses under this Circular. Penalties for LNLs shall be determined through subsequent issuances of the Commission.

Section 6. Repealing Clause

This Circular repeals SEC Memorandum Circular No. 4, Series of 2019, and all other circulars, rules, regulations, or parts thereof that are inconsistent with the provisions of this Circular.

For further guidance, please refer to the attached circular.