Executive Summary

The Securities and Exchange Commission (SEC) issued Memorandum Circular (MC) No. 10, Series of 2026, providing comprehensive guidelines on the reportorial requirements, monitoring procedures, and updated scale of fines and penalties applicable to One Person Corporations (OPCs). The circular consolidates and updates compliance obligations covering officer appointments, financial statement submissions, related‑party disclosures, bonding requirements for self‑appointed treasurers, and transitory provisions.

Purpose of the Circular

The Circular aims to establish clear and uniform monitoring guidelines for One Person Corporations (OPCs) in accordance with Sections 115 and 129 of the Revised Corporation Code, recognizing the need to standardize the assessment of fines and penalties for this relatively new corporate structure. It consolidates and operationalizes existing regulatory provisions governing OPCs, including those under SEC MC No. 7 (2019), by outlining updated procedures for reportorial submissions, compliance monitoring, and enforcement actions.

Who Is Affected

Covered Entities

- All One Person Corporations (OPCs) registered with the SEC.

- OPCs with single stockholders acting as treasurers (bonding requirements).

- Existing OPCs subject to monitoring, penalty assessments, or transitory compliance.

Not Covered

- Non‑OPC stock or non‑stock corporations.

- Partnerships, regular corporations, and OPCs dissolved or under liquidation.

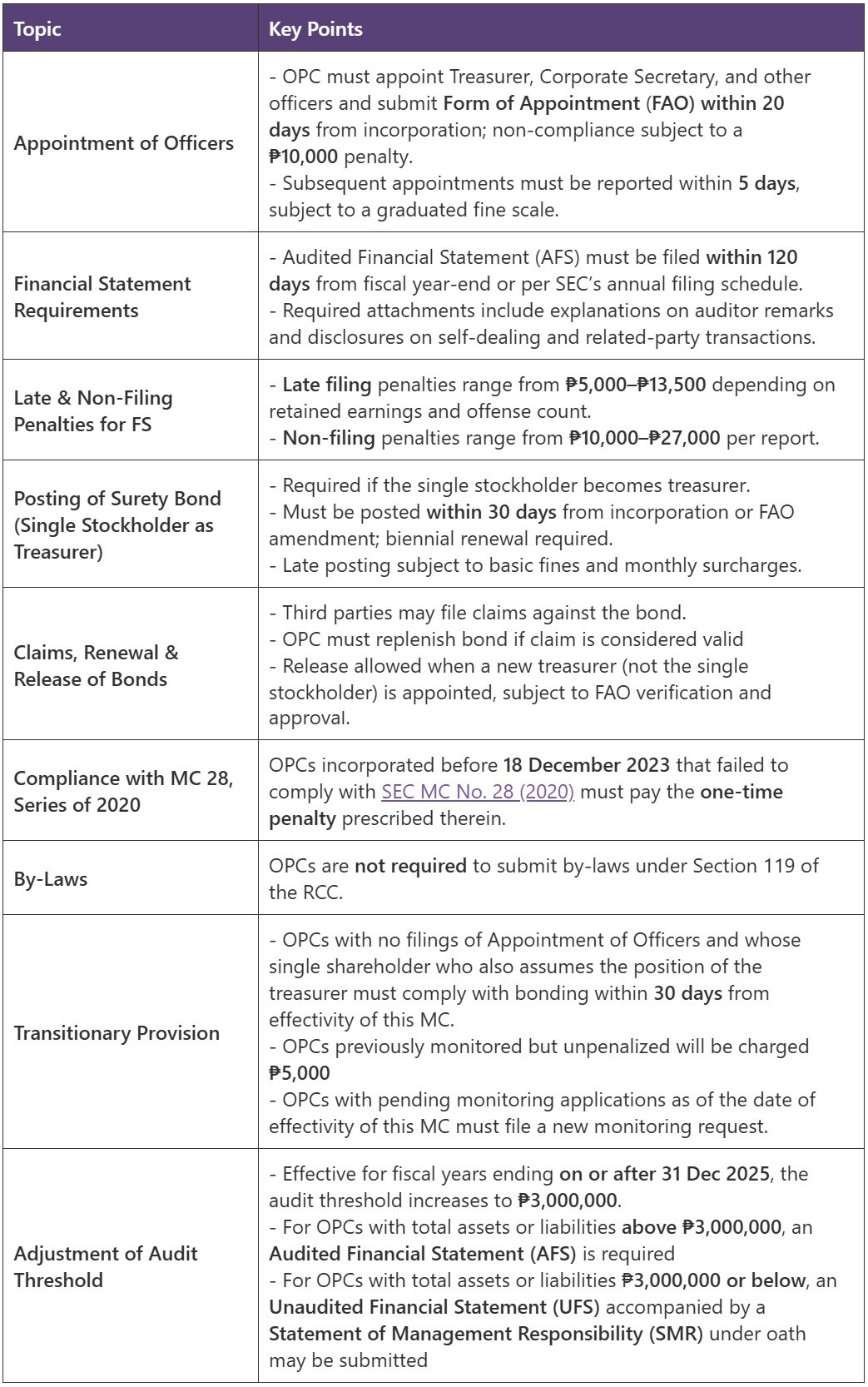

Highlights of SEC MC No. 10, Series of 2026

Annexes to SEC MC No. 10, Series of 2026

The Circular includes standard forms that OPCs must use when complying with specific requirements. These annexes provide the official templates to ensure uniform and complete submissions to the SEC:

- Annex A - Form for Appointment for One Person Corporation (FAO) - contains the prescribed form for reporting both initial and subsequent officer appointments. It captures the OPC’s corporate profile, nominee and alternate nominee information, officer details, and required notarization. A second page collects confidential residential and identification details that are not uploaded to the SEC’s publicly accessible database. OPCs must use this form whenever submitting or updating officer appointments.

- Annex B - Application for Release of Surety Bond for OPC - provides the required form for OPCs seeking the release of a previously posted surety bond. It documents the original bond certificate, confirms the appointment of a new treasurer, and includes a declaration that no creditors or third parties will be adversely affected. It also contains the notarization section and the SEC’s internal routing and approval fields. OPCs should refer to this form when changing from a single‑stockholder treasurer to a newly appointed treasurer.

Through these guidelines, the SEC seeks to ensure consistency, transparency, and proper oversight in the implementation of requirements related to officer appointments, financial reporting, and other statutory obligations that apply uniquely to OPCs.

Please refer to the PDF file below for further guidance.

To explore additional SEC Memorandum Circulars referenced in this alert or to access related regulatory issuances, you may also visit www.sec.gov.ph for more comprehensive guidance.