Executive Summary

The Securities and Exchange Commission (SEC) issued Memorandum Circular No. 15, Series of 2025, titled “Revised Beneficial Ownership Disclosure Rules”, effective January 1, 2026. This Circular establishes a comprehensive framework for identifying, declaring, and reporting beneficial ownership information to enhance transparency, prevent misuse of corporate vehicles for illicit activities, and align with international standards on anti-money laundering (AML) and combating the financing of terrorism (CFT).

Scope

The Rules shall apply to all persons, natural and juridical, under the jurisdiction of the Commission, including but not limited to:

a. All domestic stock and non-stock corporations;

b. Partnerships;

c. Foreign corporations (e.g. Regional Operating Headquarters, Regional Headquarters of Multinational Companies, Representative Offices, Branch Offices);

d. One-Persons Corporation;

e. Incorporators, directors, trustees, officers, shareholders or members, and beneficial owners;

f. Person filing application for incorporation or registration of corporations with the Commission; and

g. All other corporations and legal entities or arrangements subject to the regulation of the Commission

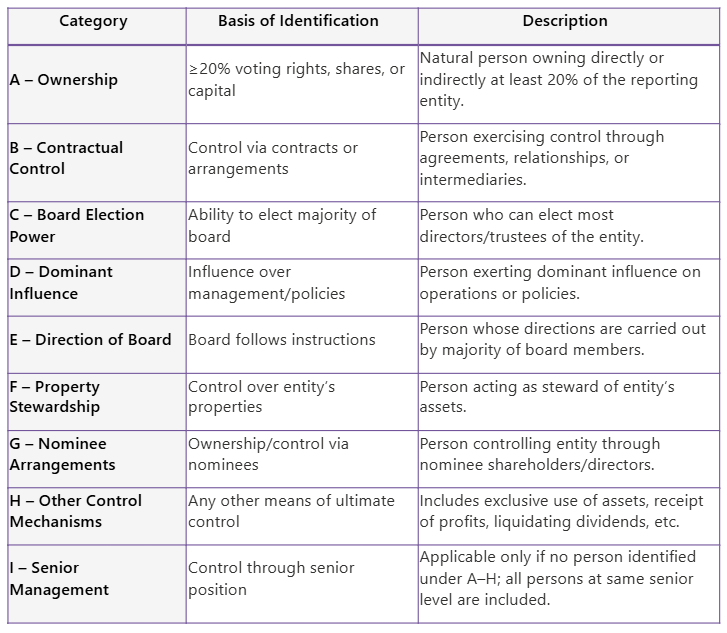

Beneficial Ownership Identification and Verification

Only natural persons shall be recognized as beneficial owners. All beneficial owners falling under any of the following categories shall be disclosed and all applicable categories shall be reported. An individual shall be considered a beneficial owner from the time they qualify under any of the following categories below:

The Circular also specifies the persons that do not qualify as beneficial owners and special cases governing One-Person Corporation, Partnerships, Corporation with Tiered Structures and Cross-Border Ownership Structures. Please refer to the attachment link below for further details.

Rules on Bearer Shares

Bearer Shares shall refer to equity securities owned by the person that holds the physical certificate which enables the transfer of ownership of shares of stock by mere delivery of such certificate. It shall likewise refer to instruments that accord ownership in a legal entity to the person who possesses or is the holder of the bearer share certificate and any other similar instruments without traceability.

The Circular prohibits the issuance, sale, or public offering of bearer shares and bearer share warrants to prevent untraceable ownership. It mandates that all transfers of shares be disclosed and recorded in the Stock and Transfer Book within thirty (30) days, as unrecorded transfers are not binding on the corporation. The rule also requires full disclosure of nominee arrangements, including the identity and details of nominators, whether individuals, corporations, or trusts, and applies to both new and existing corporations. Dividend payments are restricted to recorded owners, except for publicly listed companies using authorized depositories. Certain covered institutions under the Anti-Money Laundering Act (AMLA) may be exempt if already subject to customer identification and record-keeping requirements. All disclosures under this rule must be submitted online through the SEC’s designated platform to ensure transparency and compliance.

Information and Filing Requirements

The Circular establishes the information and filing requirements for beneficial ownership which includes detailed personal information and ownership control as enumerated in the attachment link below.

The Commission may request additional documents and explanations regarding beneficial ownership declarations, and corporations must comply within the specified timeframe. Responsibility for accurate and timely disclosure rests with designated parties such as the Corporate Secretary for domestic corporations, the Resident Agent for foreign corporations, and the single stockholder, trustee, or executor for One-Person Corporations. Filing timelines require initial disclosure at incorporation or registration for new entities, submission with the next General Information Sheet for existing entities, and reporting of any changes within seven (7) calendar days. All beneficial ownership information must be submitted through the SEC’s designated Beneficial Ownership Registry, with alternative filing methods allowed only under exceptional circumstances.

Authority of the Commission

The Securities and Exchange Commission is granted broad authority to enforce compliance with beneficial ownership disclosure requirements. It can verify the accuracy and completeness of submitted information by examining corporate records, requesting additional documentation, conducting audits, and performing targeted reviews based on risk assessments. The Commission may also collaborate with other government agencies, private entities, and foreign jurisdictions to validate disclosures. Additionally, mechanisms can be established for reporting discrepancies, and controlled access to beneficial ownership information may be provided to law enforcement agencies, competent authorities, and other authorized entities, while ensuring compliance with data privacy laws.

Penalties

Corporations that fail to disclose beneficial ownership information without lawful cause may face escalating fines based on their retained earnings or fund balance, starting from ₱50,000 and reaching up to ₱500,000 for repeated violations, with multipliers for larger corporations. Additional fines of ₱1,000 per day apply for delays, capped at ₱2,000,000. False declarations can result in penalties of up to ₱2,000,000 and possible corporate dissolution. Directors, trustees, and officers who fail to exercise due diligence may be fined up to ₱1,000,000 and disqualified from holding positions for five years. The SEC may also impose suspension or revocation of incorporation certificates for willful violations. Enforcement includes compliance orders, remedial measures, settlement options (except for repeated or deliberate violations), and publication of non-compliant entities. Whistleblower protections and incentives are provided to encourage reporting of violations, reinforcing transparency and accountability.