Executive Summary

The Securities and Exchange Commission (SEC), empowered under various provisions of the Revised Corporation Code of the Philippines, is issuing a Memorandum Circular to strengthen the independence and effectiveness of Independent Directors through rules aligned with international best practices. These provisions authorize the SEC to prescribe qualifications, disqualifications, voting requirements, board membership limits, and other governance standards, while also promoting broader opportunities for qualified individuals to serve as Independent Directors. After public exposure of the draft circular and consideration of stakeholder feedback, the SEC is formally issuing rules that apply to companies with equity securities listed on an Exchange, as defined under the Securities Regulation Code.

Term Limit

Independent Directors (ID) may serve one‑year terms and are limited to a maximum cumulative service of nine years in the same company. Those who served prior to the Circular’s effectivity are still subject to the same nine‑year limit, counted from 2012.

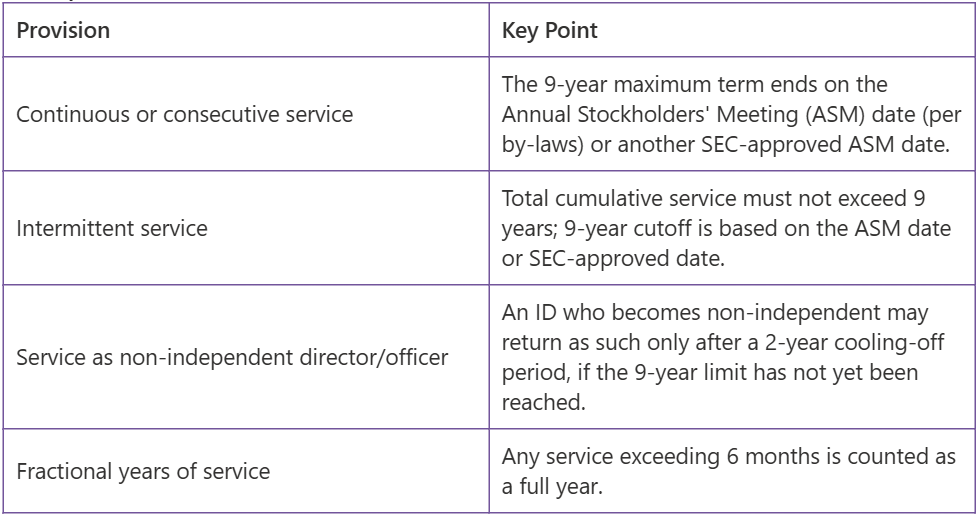

Computation of Nine-Year Term Limit

An Independent Director who has completed the maximum nine‑year cumulative term may no longer be re‑elected as an ID of the same company but may still serve in a non‑independent capacity without any cooling‑off period. Companies must ensure that their IDs continuously meet all qualification and none of the disqualification requirements under applicable SEC rules. Serving as an ID in a subsidiary or affiliate is not, by itself, a basis for disqualification. In cases where other regulatory agencies impose different term‑limit rules, the shorter maximum term shall prevail.

Penalties

Companies that allow an Independent Director to exceed the maximum cumulative term limit will incur a penalty of ₱1,000,000 per violation each year, plus an additional ₱30,000 for every month the director continues to hold the position. Repeated violations, specifically a third or subsequent offense—may result in the suspension or revocation of the company’s primary or secondary license.

Exception

IDs of government-owned-or-controlled corporations (GOCCs) shall be governed by the terms and limitations provided in their respective charters.

Repealing and Separability Clauses

The Circular repeals or modifies any previous SEC circulars, orders, or guidelines—including SEC MC No. 9 (2009), relevant portions of SEC MC No. 19 (2016), and other inconsistent provisions, to ensure alignment with the rules established in the Circular. If any part of the Circular is declared invalid, the remaining proviions will continue to remain effective and enforceable.

Transitionary Provision

Incumbent Independent Directors who have already reached the maximum term limit when the Circular takes effect may continue serving as Independent Directors only until their company’s 2026 Annual Stockholders’ Meeting or another ASM date approved by the SEC.

Effectivity

The Circular becomes effective on 01 February 2026 after publication in two (2) newspapers of general and national circulation.