Executive Summary

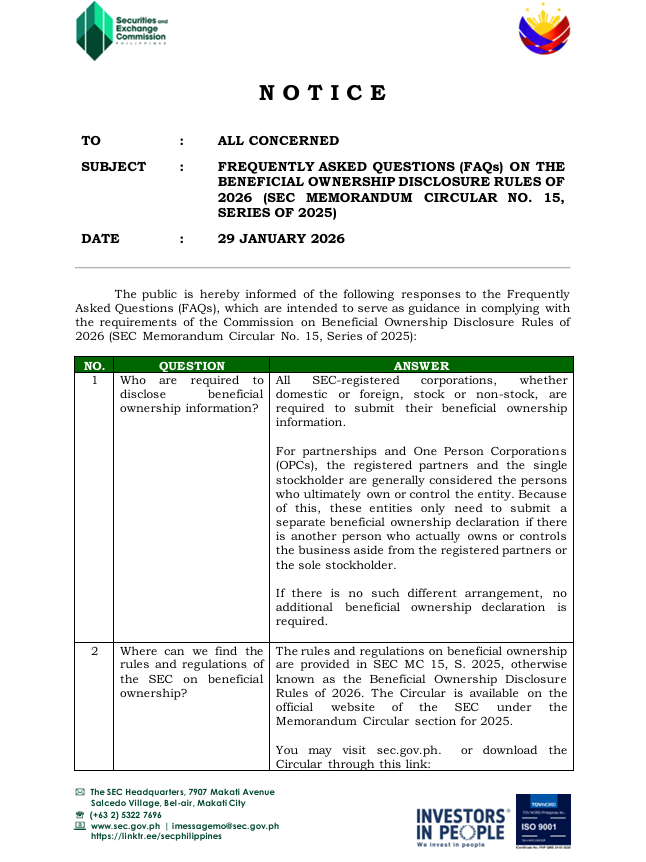

On January 29, 2026, the Securities and Exchange Commission (SEC) has released a comprehensive set of Frequently Asked Questions (FAQs) to guide entities in complying with the Beneficial Ownership Disclosure Rules of 2026, implemented through Hierarchical and Applicable Relations and Beneficial Ownership Registry (HARBOR).

What Is “Beneficial Ownership”?

A beneficial owner is the natural person who ultimately owns, controls, or exercises effective influence over a corporation—even if not listed as the legal owner. Corporations cannot be beneficial owners. Information required includes full name, address, date of birth, nationality, contact information, tax identification number (TIN) or passport, civil status, Politically Exposed Person (PEP) status, nature of control, ownership percentage, and date of acquisition. Further details on the identification and verification of beneficial ownership are available in the P&A Accounting Alerts on SEC MC No. 15‑2025.

Purpose of Disclosure

a. Ensure corporations operate for lawful purposes

b. Prevent money laundering, terrorism financing, and other illicit activities

c. Uphold international Anti-Money Laundering, Combating the Financing of Terrorism, and Countering Proliferation Financing (AML/CFT/CPF) standards.

d. Protect the Philippines from being used for unlawful financial schemes

Who must disclose?

- All SEC‑registered corporations (domestic/foreign, stock/non‑stock).

- Partnerships and One Person Corporations (OPCs) only need to file if someone other than the registered partners or sole stockholder actually owns or controls the entity.

Filing Platform

Starting 30 January 2026, all beneficial ownership declarations must be submitted through HARBOR, integrated with eFAST for General Information Sheet (GIS) filing.

Reporting Timeline

- New corporations: At registration

- Existing corporations: With the next GIS filing starting 30 January 2026

- Changes in beneficial ownership must be reported within 7 days. Amendments to previously submitted Beneficial Ownership Declarations (BODs) may be filed through HARBOR; the system automatically categorizes them as amendments.

Additional Information

For other Frequently Asked Questions (FAQs) not covered in the summary above, please refer to the attached document or in the linked circular below. This document is intended to serve as guidance in complying with the requirements of the Commission on Beneficial Ownership Disclosure Rules of 2026 (SEC Memorandum Circular No. 15, Series of 2025).