Executive Summary

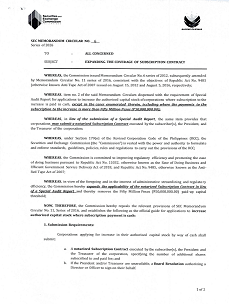

The SEC has simplified capital increase filings by allowing a notarized Subscription Contract to replace the Special Audit Report (SAR) for cash-paid subscriptions, regardless of amount. This change, introduced under SEC Memorandum Circular No. 6, Series of 2026, removes the long-standing ₱50-million threshold that previously triggered additional audit requirements. The Circular aims to streamline regulatory requirements, enhance ease of doing business, and improve administrative efficiency, consistent with the Revised Corporation Code, the Anti‑Red Tape Act, and the Ease of Doing Business Act.

Key Points

The Circular removes the ₱50 million paid‑up capital threshold previously required for allowing a notarized Subscription Contract in place of a SAR. Corporations increasing their authorized capital stock through cash subscription may now submit:

- A notarized Subscription Contract, executed by the subscriber(s), President, and Treasurer, specifying the number of shares subscribed and paid for; and

- A Board Resolution authorizing another director or officer to sign, if the President and/or Treasurer are unavailable.

SAR remains mandatory for the following entities:

- Listed companies

- Public companies under the Securities Regulation Code

- Companies offering or selling securities to the public

- Companies with SEC‑regulated secondary licenses

The SEC retains the authority to require a SAR in other cases when necessary to prevent fraud.

Effectivity and Repealing Clause

This Circular takes effect immediately upon completion of its publication in a newspaper of general circulation. Upon its effectivity, the Circular repeals, amends, or modifies all laws, rules, and regulations inconsistent with its provisions, specifically repealing the relevant provisions of SEC Memorandum Circular No. 11, Series of 2016.