Executive Summary

The Securities and Exchange Commission (SEC) issued SEC MC No. 8, Series of 2026, adopting the 2026 Rules of Procedure of the Securities and Exchange Commission to modernize, streamline, and clarify procedural rules governing all administrative and adjudicative actions handled by the Commission. These updated rules replace the 2016 SEC Rules of Procedure. The 2026 Rules explicitly state that the 2016 Rules of Procedure are repealed.

Purpose of the New Rules

The 2026 Rules were introduced to:

- Reflect recent statutory developments, including the Revised Corporation Code (RCC), the Securities Regulation Code (SRC), and the Financial Products and Services Consumer Protection Act (FCPA)

- Align with current jurisprudence

- Promote prompt, efficient, and inexpensive resolution of cases before the SEC

- Enhance enforcement powers across the Commission’s departments and hearing panels

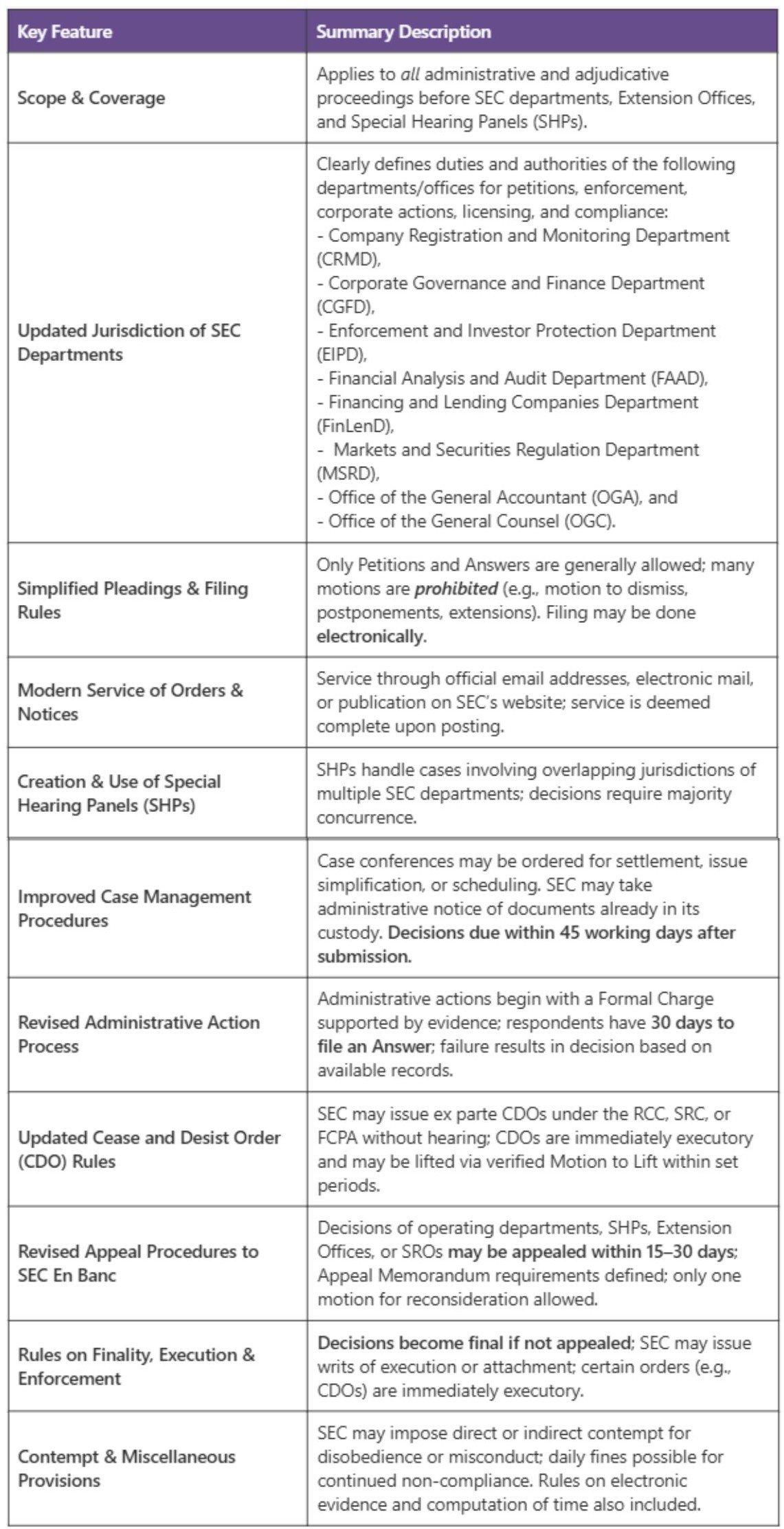

Key Features of SEC MC No. 8 (2026 Rules of Procedure)

Who Is Affected

The updated Rules have broad impact across the SEC-regulated community, particularly:

1. Corporations, Partnerships, and Associations

All juridical entities subject to SEC jurisdiction — including domestic corporations, foreign corporations doing business in the Philippines, and associations — must adhere to the updated procedures for petitions, filings, administrative actions, appeals, and compliance processes.

2. Regulated Entities under Various Special Laws

This includes entities governed by the:

- Revised Corporation Code

- Securities Regulation Code

- Lending Company Regulation Act

- Financing Company Act

- Investment Company Act

- Financial Products and Services Consumer Protection Act (FCPA)

— all of which fall under matters listed in the jurisdiction of multiple SEC Operating Departments.

3. Capital Market Participants and Self‑Regulatory Organizations (SROs)

The 2026 Rules expressly apply to proceedings involving exchanges, clearing agencies, broker‑dealers, investment houses, fund managers, transfer agents, and other market institutions under the Markets and Securities Regulation Department (MSRD).

4. Individuals and Officers Involved in Corporate Matters

Officers, directors, trustees, compliance officers, resident agents, and other responsible individuals are directly affected due to procedural rules on:

- service of processes,

- filing requirements,

- administrative sanctions, and

- possible contempt actions for non‑compliance.

These updated Rules streamline and modernize the SEC’s internal processes placing strong emphasis on electronic service, uniform department jurisdiction, structured case handling, and enhanced enforcement mechanisms.