BUSINESS LEADERS’ optimism in the Philippine economy slumped to its lowest level since the first quarter of 2016, according to the Grant Thornton International Business Report (IBR) released by P&A Grant Thornton on Tuesday.

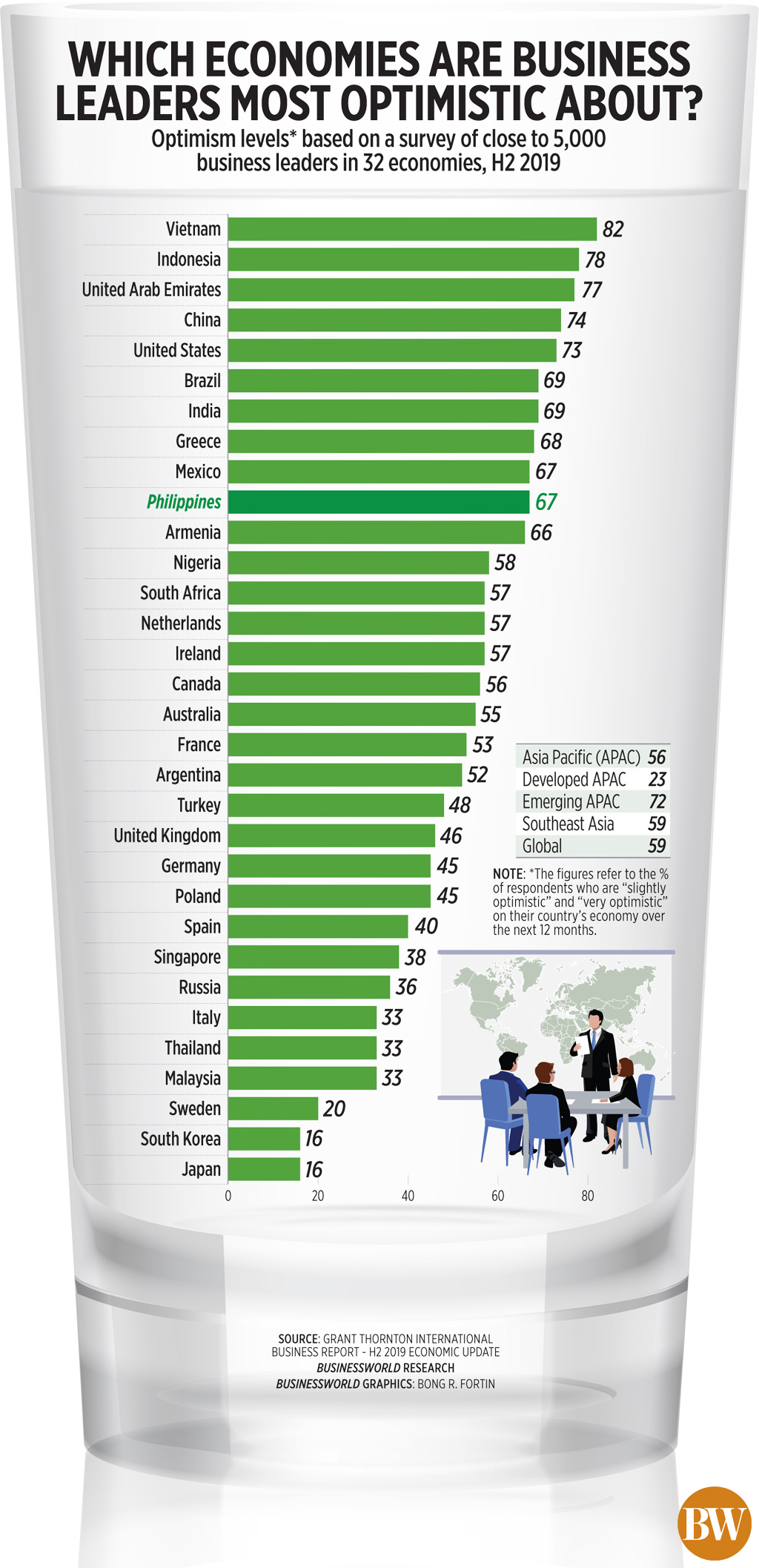

Data from the Grant Thornton IBR covering the second half of 2019 showed 67% of Filipino respondents are optimistic about the outlook of the Philippine economy in the next 12 months, lower than the 84% who were optimistic in the first half.

“Two-thirds of firms retain an optimistic or very optimistic economic outlook for the Philippines, but this is 17 percentage points down since (first half of 2019) and is a series record low (since first quarter of 2016). Nevertheless, the mid-market remains hopeful that its revenues and profitability will remain high,” P&A Grant Thornton said in a statement.

The Grant Thornton IBR surveyed 4,812 respondents from mid-market companies in 32 economies. Data for the Philippines came from interviews conducted between October and November 2019 with 105 Filipino chief executive officers, managing directors, chairperson or other senior executives from all industry sectors.

Despite the drop, the Philippines remained to be one of the ten most optimistic economies surveyed. Business leaders in Vietnam had the most optimistic outlook on their economy with 82%, followed by Indonesia (78%), United Arab Emirates (77%), China (74%) and United States (73%). Each country has a different sample size.

Philippine business optimism is still eight percentage points above ASEAN business optimism (59%) as a whole.

The IBR data also showed Philippine companies’ expectations of revenue and profit growth declined, although this was described as still “strongly positive.” Revenue growth expectation slid to 68% in the second semester of 2019, from 84% in the first semester while profit expectation fell to 71% in the second half, from 80% in the first half.

“44 percent of mid-market companies in the Philippines expect their exports to increase, even if expectations have actually decreased from 59 percent in H1 2019 to 44 percent H2 2019. Export intentions declined by 15 percentage points to 44 percent — although it remains almost double the 2015 to 2018 average. However, this is below the ASEAN average and moving in the opposite direction to the emerging trend in Asia Pacific,” P&A Grant Thornton said.

Data from the IBR also showed Philippine companies’ investment intentions are mostly down from the previous semester. Data showed 68% of the firms surveyed plan to invest in research & development, an increase from 66% in the first half of 2019. Companies with plans to invest in staff was flat at 68%, while 63% of those surveyed said they will invest in technology (from 75%), 59% in plant & machinery (from 68%), and 53% in new buildings (from 59%).

“The latest figures are beginning to reveal the global slowdown in economic growth. On a positive note, mid-sized firms in the Philippines remain very much optimistic about their expansion,” Ma. Victoria Españo, chairperson and CEO of P&A Grant Thornton, said in the statement.

When asked about constraints to businesses, those surveyed cited a shortage of orders and the lack of skilled workers, with 40% of Filipino mid-sized firms citing reduced demand for products and services and a third citing the availability of skilled workers and labor costs as business constraints.

“27 percent of Filipino medium-sized companies surveyed said that financial constraints were a barrier to expanding their business internationally, while others also cited rule of law and corruption (26 percent) and tax codes and compliance (25 percent) as barriers,” P&A Grant Thornton said.

GLOBAL PULSE

Meanwhile, global leadership community for chief executives YPO released its 2020 global pulse survey.

Among 2,960 respondents from 115 countries, 96% of chief executives said that rate building and maintaining trust with stakeholders are high priorities.

Majority of business leaders in Asia said that taking action on societal issues positively impacts employee trust, with 67% of Asian business leaders agreeing to the statement compared to 54% of the rest of the world. Similarly, 68% of Asian business leaders said it builds public trust, compared to 55% globally. — J.P.Ibañez

As published in BusinessWorld, dated 15 January 2020