THE Bureau of Internal Revenue (BIR) has issued Revenue Regulations (RR) No. 6-2019 to provide guidelines for processing estate tax amnesty applications.

Who can avail?

The estate tax amnesty shall cover the estate of a decedent who died on or before Dec. 31, 2017, with or without assessments duly issued thereof, whose estate taxes have remained unpaid or have accrued as of Dec. 31, 2017.

The estate tax amnesty shall exclude the following:

A. Delinquent estate tax liabilities that have become final and executory and those covered by Tax Amnesty on Delinquencies; and

B. Properties involved in cases pending in appropriate courts:

1. Falling under the jurisdiction of the Presidential Commission of Good Government;

2. Involving unexplained or unlawfully acquired wealth under Republic Act (RA) 3019, otherwise known as the Anti-Graft and Corrupt Practices Act, and RA 7080 or an Act Defining and Penalizing the Crime of Plunder;

3. Involving violations of RA 9160, otherwise known as the Anti-Money Laundering Act, as amended;

4. Involving tax evasion and other criminal offenses under Chapter II of Title X of the National Internal Revenue Code of 1997, as amended; and

5. Involving felonies of frauds, illegal exactions and transactions, and malversation of public funds and property under Chapters III and IV of Title VII of the Revised Penal Code.

When do we avail?

The application for estate tax amnesty shall be filed within two years from June 15, 2019 or until June 15, 2021.

How much will it cost?

A rate of six percent shall be imposed on each decedent’s total net taxable estate at the time of death without penalties, at every stage of transfer of property. The minimum estate amnesty tax for the transfer of the estate of each decedent shall be P5,000.

What is the composition and valuation of the gross estate?

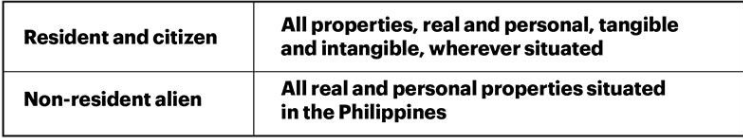

The gross estate of a decedent shall be comprised of the properties and interest therein at the time of their death, and such lifetime transfers included in the in the gross estate, as follows:

The gross estate shall be valued based on the fair market value as of the time of death of the decedent. Cash in bank in local or foreign currency shall be based on the peso value of the balance at the date of death, while proprietary shares in any association, recreation or amusement club shall be valued using the bid price on the date of death or nearest the date of death.

What are the deductions allowable to the gross estate?

The gross estate may be reduced by the deductions allowed by the estate tax law applicable at the time of death of the decedent. For a complete list of allowable deductions, please refer to Annex A of RR No. 6-2019.

Who can file?

The estate tax return shall be filed by the executor or administrator, legal heirs, transferees, or beneficiaries of the decedent.

How and where do we file?

The applicant needs to submit the following documentary requirements:

1. Estate Tax Amnesty Return (ETAR);

2. Duly validated Acceptance Payment Form (APF) with the proof of payment; and

3. Other related documentary requirements enumerated in the ETAR.

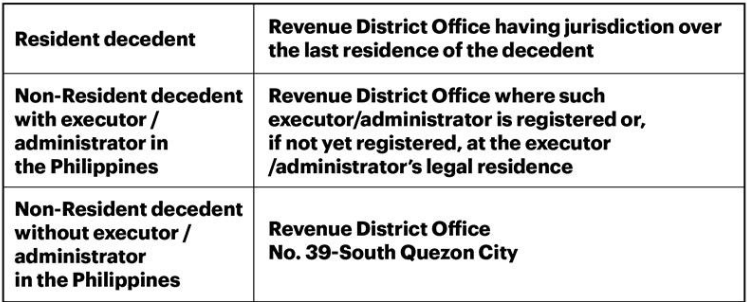

Depending on the classification of the decedent, the application must be filed with the following offices:

The Certificate of Availment of the Estate Tax Amnesty shall be issued by the concerned RDO within 15 calendar days from the receipt of the application for estate tax amnesty, together with duly validated APF and complete documentary requirements.

What are the benefits?

Upon full compliance with all conditions, the estate tax liability shall be considered settled and the taxpayer shall be immune from the payment of all estate taxes, as well as any increments and additions thereto, arising from the failure to pay any and all estate taxes for taxable year 2017 and prior years, and from all appurtenant civil, criminal, and administrative cases and penalties under the 1997 Tax Code, as amended.

Please be guided accordingly.

SOURCE: P&A GRANT THORNTON

Certified Public Accountants

As published in SunStar Cebu, dated 20 June 2019