Issue of refund of taxes in G.R. No. 271261

Adding to the wealth of jurisprudence in interpreting the two-year prescriptive period, the Supreme Court (or the “Court”) revisited the interpretation of the two-year prescriptive period for tax refund claims under Section 229 of the National Internal Revenue Code, as amended (or “Tax Code”) in its decision in G.R. No. 271261. The central issue in this case was the proper reckoning point for the two-year prescriptive period and what constitutes “payment of taxes”.

In this case, the Petitioner is a domestic corporation engaged in developing and operating tourist facilities such as casino entertainment complexes with hotels, retail, and amusement areas. It has a valid and existing gaming licence issued by the Philippine Amusement and Gaming Corporation (“PAGCOR”). The Petitioner paid taxes to the BIR, claiming that they had “erroneously or illegally collected and passed-on input VAT on purchases attributable to gaming revenues”. Thereafter, the Petitioner filed an application for a refund with the BIR, which was then denied.

In summary of the proceedings, the claim of refund under Sec. 112 of the Tax Code of the Petitioner failed in the Court of Tax Appeals (“CTA”) as well as with the Supreme Court. The Supreme Court agrees that while the Petitioner is a VAT-exempt entity under exemption from special laws, its transactions with its suppliers are not considered zero-rated or effectively zero-rated sales under the Tax Code. In the case, the CTA En Banc concluded that since the Petitioner seeks its “erroneous payment of passed-on input VAT on purchases” attributable to gaming revenues for the 1st quarter of taxable year 2016 applicable provision is Sec. 229 of the Tax Code for recovery of taxes erroneously paid.

In relation to the above, one of the primordial issues raised in the said case before the Supreme Court is the interpretation of the phrase “payment of taxes” under Sec. 229 of the Tax Code. Petitioner argued that this should be interpreted “as the time the passed-on taxes” are determined to be erroneous, which is the date of the filing of the quarterly VAT return declaring the input VAT subject to the claim for refund. In contrast, the CTA En Banc held that the two-year period should be counted from the actual date of payment to the BIR of the VAT passed on to the Petitioner by its suppliers and that the operative act under Sec. 229 of the Tax Code is the “actual remittance by the supplier.”

In resolving the dispute, the Court reaffirmed its established jurisprudence on the matter. It emphasised that the phrase “payment of taxes” under Sec. 229 of the Tax Code is to be interpreted in two ways: (1) the actual payment of tax or penalty sought to be refunded, regardless of the existence of any supervening cause after payment, as well as (2) the date of filing of the adjusted final tax return. The Court did not require “actual remittance by the suppliers” as the reckoning point. By applying the principle of “substantial justice, equity, and fair play” the Court ruled that the actual date of filing of the quarterly VAT return of Petitioner should be the reckoning point.

The Court clarified that for income tax refunds, the two-year period begins from the filing of the Final Adjustment Return and not when the quarterly income tax was paid. The Court established that only on the Final Adjustment Return is when the taxpayer’s actual tax liability or overpayment can be determined. Likewise, the Court ruled that the prescriptive period starts from the filing of the adjusted final tax return, which reflects the audited and finalised figures of the taxpayer’s operations. Lastly, the Court maintained that it has not required “actual remittance by the suppliers” as the reckoning point; rather, it has consistently reckoned the two-year prescriptive period from the actual payment of tax or penalty sought to be refunded as well as on the date of filing of the adjusted final tax return.

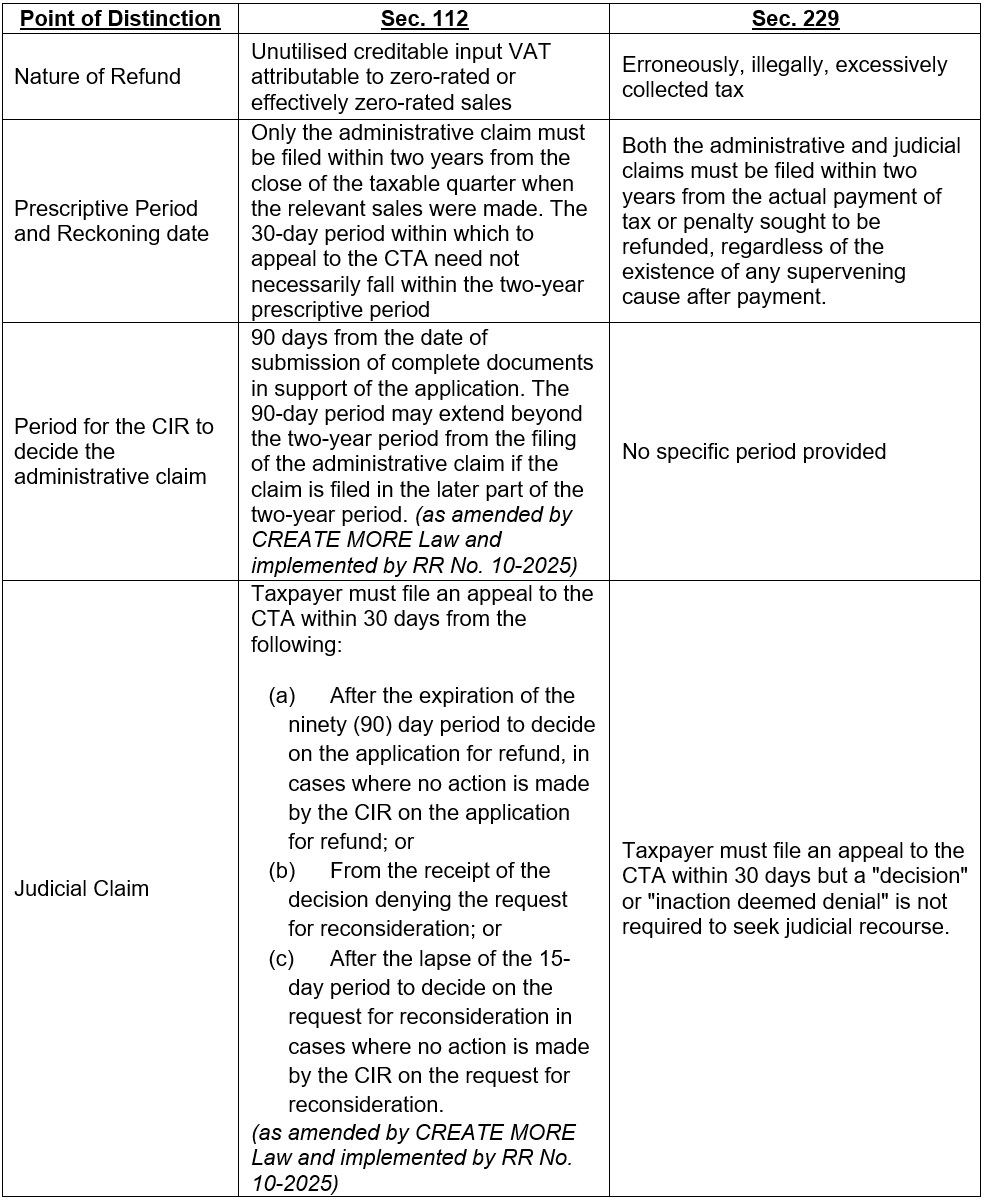

If Sec. 112 was not applicable and Sec. 229 was deemed applicable by the Court, in this case, what then is the difference between the two?

It must be noted that the Petitioner, in the above case, applied for relief with the Court for the application of both Sec. 112 and Sec. 229 of the Tax Code. Sec. 112 pertains to the refund of unutilised creditable input VAT attributable to zero-rated or effectively zero-rated sales. While Sec. 229 pertains to refund of taxes alleged to have been erroneously or illegally assessed or collected, or claimed to have been collected without authority. After all, the amount being refunded herein pertains to “collected and passed-on input VAT on purchases attributable to gaming revenues”. Eventually, the Court ultimately decided that it is Sec. 229 (for erroneously, illegally, excessively paid and collected taxes) as the applicable legal basis in this case and disagreed that Sec. 112 (for refund of unutilised input VAT) is applicable.

To summarise the difference, as presented in the case above, here are the distinctions between Sec. 112 and Sec. 229:

In summary

The Court’s ruling in G.R. No. 271261 adds a crucial layer of clarity to the interpretation of the two-year prescriptive period for tax refund claims under Section 229 of the Tax Code. By reaffirming that the reckoning point may be either the actual payment of the tax or the filing of the adjusted final tax return, the Court underscores its commitment to substantial justice and equitable treatment of taxpayers. This decision not only harmonises previous jurisprudence but also delineates the boundaries between claims under Sections 229 and 112, providing clearer guidance for taxpayers navigating the complexities of applications for claims for refund of taxes. As tax laws continue to evolve, the Decision serves as a timely reminder of the importance of precision in statutory interpretation and the enduring role of jurisprudence in shaping tax administration.

Let's Talk Tax is a weekly newspaper column of P&A Grant Thornton that aims to keep the public informed of various developments in taxation. This article is not intended to be a substitute for competent professional advice.

As published in BusinessWorld, dated 15 July 2025