When our loved ones pass away, we do not concern ourselves immediately with the transfer of properties they left behind. We tend to forget the obligation to settle the so-called “estate tax” with the Bureau of Internal Revenue (BIR) until we intend to sell or transfer these properties. As a result, we will have incurred penalties such as surcharges, interest and compromise penalties. The lack of interest in the estate tax is mirrored in its very low revenue performance.

The estate tax is a tax on the right of the dead to transfer his estate to the lawful heirs and beneficiaries. It is not a tax on property but a tax imposed on the privilege of transferring property upon the death of the owner. It is based on the laws in force at the time of death.

When should we settle the estate tax? The lawful heirs, administrator or executor are required to file the return within six months of the decedent’s death. However, the Commissioner of the BIR may, in meritorious cases, grant an extension not exceeding 30 days. The estate tax imposed shall be paid at the time the return is filed by the lawful heirs, administrator or executor.

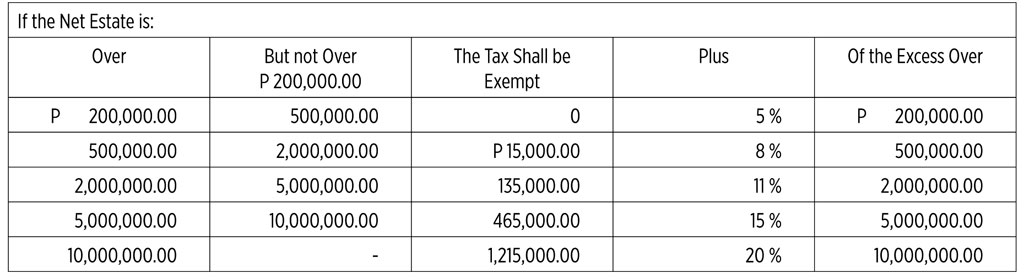

Currently, the estate tax is computed based on the net estate using the graduated rates of 5% to 20% under Section 84 of the National Internal Revenue Code (NIRC), as shown below:

The net estate is computed as gross estate less the allowable deductions provided by the regulations law such as expenses, losses, indebtedness and taxes, a property previously taxed (vanishing deduction), transfers for public use, family home, standard deduction, and medical expenses, to name a few.

Recently, the estate tax came back to the consciousness of the public as the current administration is pushing for the amendment of the rates of the estate tax and the grant of amnesty to delinquent estates.

As part of the Tax Reform Package, House Bill (HB) No. 5636 proposed a flat rate of estate tax at 6% of the net estate instead of the graduated rates. The maximum amount of deduction for the family home will be increased from the current maximum amount of one million pesos to three million pesos. This ceiling in the fair market value of the family home shall be subject to adjustment for inflation every three years beginning 2018.

Congress is also pushing for the grant of amnesty in the payment of estate tax under HB No. 4814. The tax amnesty shall cover estate taxes payable for the taxable year 2016 and prior years, with or without assessment duly issued therefor. Any person who wishes to avail of the estate tax amnesty shall file an Estate Tax Amnesty Return, which would be prescribed by the BIR, and pay the 6% amnesty tax on the net estate, same as the proposed rate in the tax reform package. The amnesty tax shall be in lieu of all interest and penalties due on the estate.

Not everyone can avail of the tax amnesty. The exceptions are the following: (a) those estates with pending cases falling under jurisdiction of the Presidential Commission on Good Government (PCGG) involving unexplained or unlawfully acquired wealth, the Anti-Graft and Corrupt Practices Act, the Anti-Money Laundering Act, (b) those with filed cases for tax evasion and other criminal offenses under the NIRC, and the felonies of fraud, illegal exactions and transactions, and malversation of public funds and property under Chapters III and IV of Title VII of the Revised Penal Code, and (c) those subject for final and executory judgment by the courts.

In the proposals granting amnesty in payment of outstanding estate taxes, reducing the rates, adjusting the deductions and simplifying, the goal of the government is to increase tax collection and increase compliance of taxpayers, to promote the settlement of estates, and, in turn, to free up properties of unsettled estates, with the end view of generating financial transactions and stimulating economic activity.

With the effort of the government to maximize the collection of taxes by identifying possible sources of income, I wonder whether estate tax will indeed fill that void. Even though it would be a good reminder to the taxpayers regarding their obligations, the question remains on how the government can efficiently collect the said taxes.

The revival of the estate tax as a revenue source cannot rely on the increased compliance being expected from the simplification and rate reduction alone. A lot would depend on the processes to be applied by the government in monitoring the property records and in ensuring that the transfers subjected to estate tax are timely and properly implemented.

Ed Warren L. Balauag is a senior associate with the Tax Advisory and Compliance division of P&A Grant Thornton.

As published in BusinessWorld, dated on 20 June 2017