Last year, I had the chance to write an article about the things that the employers need to know in computing for the annualized tax on compensation. The focus was the changes brought about by the Republic Act (RA) No. 10963 — Tax Reform for Acceleration and Inclusion (TRAIN) Law and recent Bureau of Internal Revenue (BIR) issuances. This year, I’ll tackle the recent changes in the reportorial requirements, especially now that we’re nearing towards the year-end.

Cessation of the submission of the Semestral List of Regular Suppliers (SRS). In Revenue Memorandum Circulars (RMC) No. 122-2019, the BIR removed the requirement for the top 20,000 private corporations (now included as part of the Top Withholding Agents, or TWAs) to submit a list of income payments subjected to 1% and 2% creditable withholding tax (CWT) on its purchases of goods and services, respectively, on the last day of the following month after the end of each semester due to the following reasons:

1. The information contained in the SRS is already reported in the Quarterly Alphalist of Payees (QAP);

2. The requirement cannot be applied to the Taxpayer Account Management Program (TAMP) taxpayers and medium taxpayers (included also as part of TWA) since the requirement was no longer mentioned in Revenue Regulations (RR) No. 11-2018; and

3. To be consistent with the policy of ease of doing business.

Revised Annual Information Returns for Withholding Taxes. New versions (January 2018 ENCS) of the annual information returns of creditable income taxes withheld (expanded)/ income payments exempt from withholding tax (BIR Form No. 1604-E), income taxes withheld on compensation (BIR Form No. 1604-C), and income payments subjected to final withholding taxes (BIR Form No. 1604-F) were circularized and made available in RMC No. 73-2019 in connection with the implementation of the TRAIN Law.

The revised annual information returns required the taxpayers to indicate: (1) whether the taxpayer is one of the TWAs; and (2) Payment Reference Number (Tax Remittance Advice or TRA/Electronic Revenue Official Receipt or eROR/Electronic Acknowledgment Receipt or eAR reference number). For BIR Form No. 1604-F, the withholding agent is also required to indicate if the income recipients are availing of tax relief under Special Law or International Tax Treaty.

Since the BIR is currently enhancing the Alphalist Data Entry and Validation Module (Version 6.1), the deadline for the submission of BIR Form No. 1604-C and 1604-F and corresponding Alphalists for the calendar year ending 2019 was extended from Jan. 31, 2020, to Feb. 28, 2020, pursuant to RMC No. 124-2019.

Revised Annual Alphalists. In RMC No. 73-2019, the Alphalist of Employees attached to BIR Form No. 1604-C was also revised and reduced from five schedules to two schedules only: (1) Schedule 1- Alphalist of Employees; and (2) Schedule 2- Alphalist of Minimum Wage Earners. In both schedules, the employer is required to indicate the following additional information:

1. Nationality/Resident (for foreigners only);

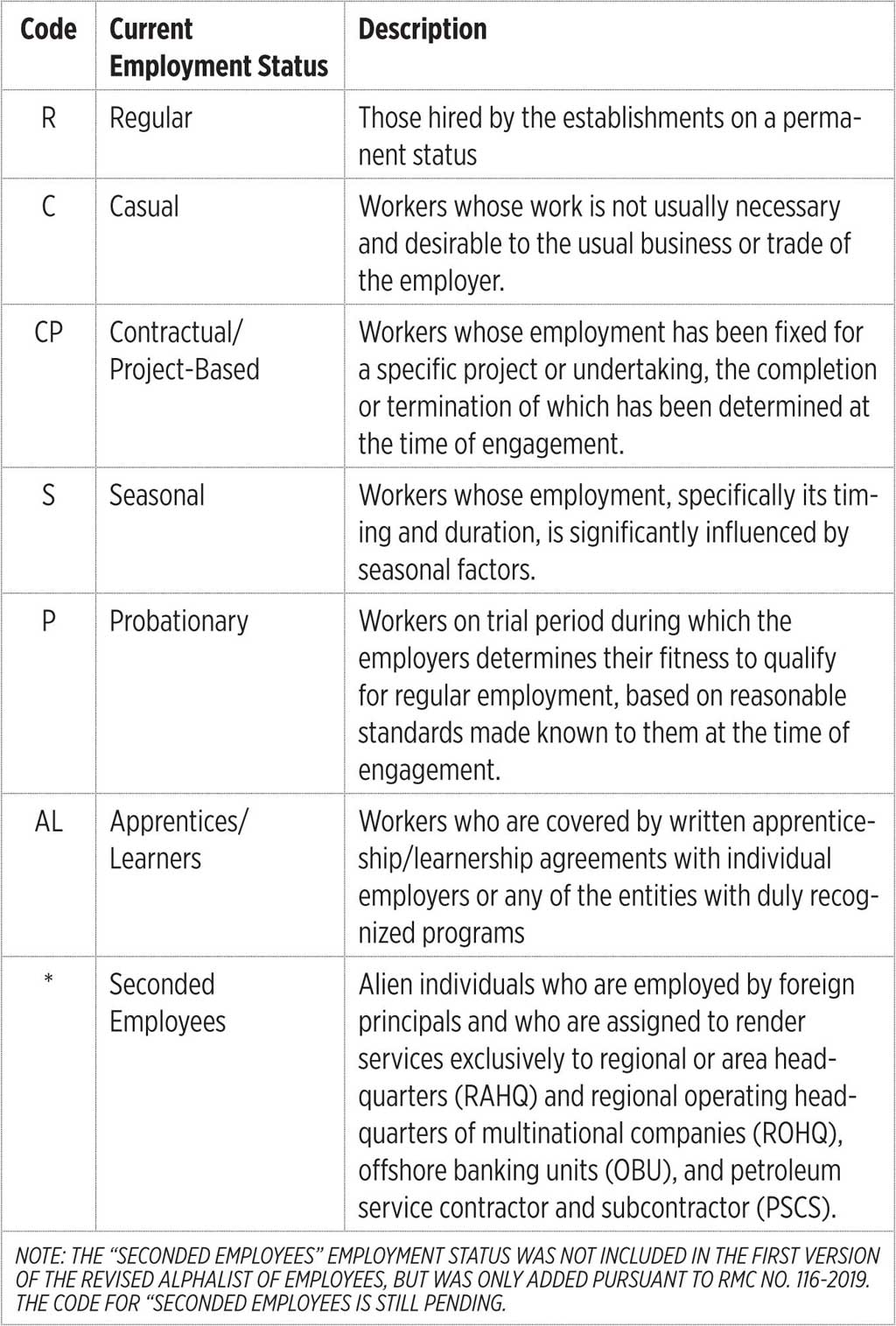

2. Current Employment Status

3. TIN of previous employer (if applicable);

4. Employment period from previous and present employer (if applicable); and

5. Reason of Separation from Previous and Present Employer (if applicable).

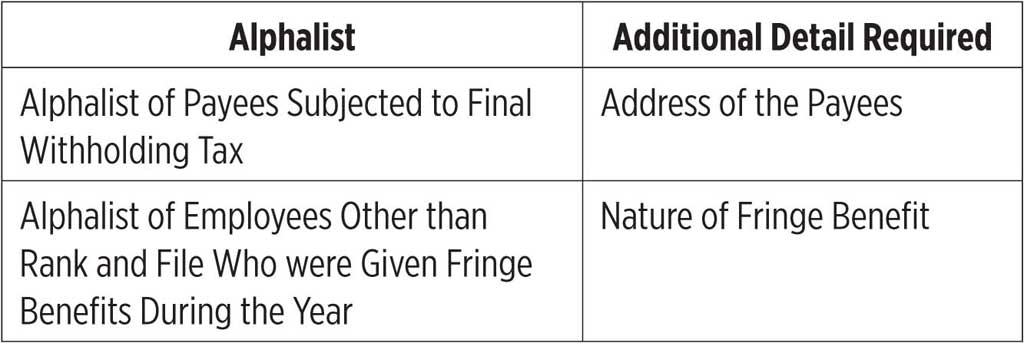

Further, the same RMC provides a revised Alphalist of Payees attached to BIR Form No. 1604-F to include the following details of the transaction:

Revised Withholding Tax Certificates. The BIR also issued new versions (January 2018 ENCS) of the withholding tax certificates (BIR Form No. 2307/2306/2316). This was circularized in RMC No. 74-2019 and RMC No. 100-2019.

In RMC No. 26-2019, the BIR allowed the withholding agents issuing computer/system generated BIR Certificates to use and issue the old versions of the above mentioned BIR Certificates for all transactions covering the taxable year ending Dec. 31, 2019. This is to give taxpayers ample time to reconfigure their computerized accounting system (CAS) to reflect revisions and changes in the certificates as provided in the above RMCs.

It should be noted that the extension to use the old versions of the forms are only for those withholding agents who issue computer/system generated BIR Certificates to its payees/employees. All other withholding agents are required to use and issue the new versions of the withholding tax certificates.

Further, RMC No. 116-2019 provides that in all copies of BIR Form No. 2316 to be issued to seconded employees assigned to RAHQ/ROHQ/OBU/PSCS entities, the phrase “For Seconded Employee” shall be typed or printed in bold capital letters enclosed in open and close parenthesis immediately under the form’s title “Certificate of Compensation Payment/Tax Withheld.”

Submission of BIR Form No. 2316 and Certified List of Employees. For employers/withholding agents mandated or who opted to submit the scanned copies of BIR Form No. 2316 of its employees qualified for substituted filing of income tax return (ITR), RMC No. 24-2019 provides that a Universal Storage Bus (USB) memory stick or other similar storage devices may be used in the absence or unavailability of the DVDs provided that the scanned copies of the forms shall be made in uneditable format.

Aside from the manner of submission of scanned copies of BIR Form No. 2316, the RMC also introduced changes in the format of the “Certified List of Employees Qualified for Substituted Filing of ITR.” While the number of employees in the format prescribed in Annex “F” of RR No. 11-2018 is only limited to 18 employees, the RMC prescribed the procedure if the employer will attach additional pages or prepare a separate list to accommodate additional employees. A reference statement shall be clearly indicated in the certification to refer the attachments and such attachments must be signed by the certifying employer or its duly authorized representative at the bottom of all the pages.

The certification is not required to be notarized provided that all pages attached to the certification are duly signed by the certifying employer or its duly authorized representative to be consistent with the policy of ease of doing business.

“I’ve had my adventure, I don’t need something new, I’m afraid of what I’m risking if I follow you, Into the unknown!” I imagine taxpayers singing these lines from the song “Into the Unknown” from the movie “Frozen 2” not only because of its catchy lyrics but also because of its message about change, which is very relevant to our lives. Since one of the goals of the TRAIN Law and other tax reform packages is to enhance the progressivity of our tax system, we can only expect a lot of changes in the coming years. Yes, change is never really easy but without it, there will be no progress.

Let’s Talk Tax is a weekly newspaper column of P&A Grant Thornton that aims to keep the public informed of various developments in taxation. This article is not intended to be a substitute for competent professional advice.

Christian Derick D. Villafranca is a senior of Tax Advisory & Compliance division of P&A Grant Thornton, the Philippine member firm of Grant Thornton International Ltd.

As published in BusinessWorld, dated 17 December 2019