Last week, we discussed the definition of financial instrument and how it was categorized both for accounting and tax perspectives.

In this second and last part of my article, I will discuss the transaction flow of financial assets from the initial measurement, subsequent measurement, to its final disposal. I shall provide the treatment both for accounting and tax for each stage.

INITIAL MEASUREMENT OF FINANCIAL ASSET

For Accounting, all financial assets (FAs) are measured at fair value plus transaction costs except for those classified as Fair Value Through Profit or Loss (FVPL) and trade receivables that do not contain significant financing components in accordance with Philippine Financial Reporting Standards 15. The fair value of an FA is normally the transaction price which is equivalent to the consideration given. As a rule, the transaction costs that are directly attributable to the acquisition of the FA are to be capitalized as part of the consideration. For FVPL, the related transaction costs are expensed outright.

For Tax, FAs in general will be initially measured at the contracted amount or transaction value. Thus, any related transaction cost such as commissions paid to agents, advisers, brokers, dealers, and any related taxes paid may be recognized separately as an outright expense or in certain cases, part of the acquisition cost.

SUBSEQUENT MEASUREMENT OF FINANCIAL ASSET

Philippine Financial Reporting Standard (PFRS) 9 provides that after the initial recognition, the entity is to measure the FA at:

a. Amortized Cost;

b. Fair value through profit or loss (FVPL); and

c. Fair value through other comprehensive income (FVOCI).

PFRS 9 states that FA shall be measured at amortized cost if the investment (e.g. investment in bonds) is intended for collecting contractual cash flows solely for the payment of principal and interest.

Where the FA is measured at fair value, it is expected that the entity will be recognizing a gain or loss on the changes in fair value. Such gain or loss are either recognized entirely in the profit or loss (FVPL) or other comprehensive income (FVOCI).

Under PFRS 9, paragraph 5.7.1, gain or loss on FA measured at fair value shall be recognized in the profit or loss statement, except:

a. When the financial asset is an investment in a non-trading equity instrument and the entity has irrevocably elected to present unrealized gains or losses in other comprehensive income; and

b. When the financial asset is a debt investment that is measured at fair value through other comprehensive income.

The determination of the gain or loss is the difference between the fair value against the carrying amount of the FA at the closing reporting date. The change in fair value may result in the impairment loss or reversal, foreign exchange if the FA is denominated in foreign currencies. Note, however, that the equity instruments measured at fair value are not subject to impairment. Such reduction in FV is completely recognized in the P&L as a fair value loss.

For tax, any interim changes in accounting value are not recognized for tax purposes. As such, the gain or loss recognized in the subsequent measurement is considered an “unrealized” gain or loss. Hence, it should be considered a reconciling item in the tax computation on the income tax return.

On the other hand, the holder of the FA may receive income in the form of dividend income on the equity securities and/or interest income from debt securities. Such income reported on the financial statements would be subject to different tax treatments.

Dividend income. Cash and/or property dividend received by a domestic corporation or resident foreign corporation (i.e. a Philippine branch of foreign corporation doing business in the Philippines) from a domestic corporation is exempt from Philippine income tax. If the dividend is paid by a foreign corporation to a domestic corporation, it is subject to the regular corporate income tax. If a resident foreign corporation receives dividends from a foreign corporation, such dividends are generally not subject to Philippine tax as a foreign-sourced income. Dividends received by individuals from a domestic corporation are subject to tax at 10%. Dividends received by nonresidents from treaty countries may be subject to the tax treaty rate.

Interest income. In general, interest income is reported as part of the taxable income subject to regular corporate income tax unless the interest is subject to a final withholding tax or such interest is exempt under a special law.

Revenue Regulation No. 14-2012 provides the tax treatment of interest income earned on financial instruments and other related transactions.

Section 2. Tax Treatment of Interest Income Derived from Government Debt Instruments and Securities.

Interest income derived therefrom is subject to final withholding tax (FWT) at the rate of twenty percent (20%) pursuant to Sections 24(B)(1), 25(A)(2), 27(D)(1) and 28(A)(7)(a) or twenty-five percent (25%) pursuant to Section 25(B) or thirty percent (30%) pursuant to Section 28(B)(1) of the NIRC of 1997, as amended, payable upon original issuance of the deposit substitutes.

Based on the above regulations, interest shall be subject to the following rates:

• The final tax of 20% is imposed on interest from any currency bank deposit and yield or any other monetary benefits from deposit substitutes and from trust funds and similar arrangements as derived in sources within the Philippines as received by an individual citizen or individual alien;

• The final tax of 25% is imposed on the income such interest and dividends received by a nonresident alien individual not engaged in trade or business within the Philippines; and

• The final tax of 30% is imposed on the income such as interest and dividends as received by a nonresident foreign corporation.

Interest income exempt from income tax covered by special laws are:

• Agri-Agra ERAP Bonds (Executive Order No. 83)

• Bonds issued by the National Power Corp. (Republic Act No. 6395)

• Bonds issued by the Home Guaranty Corp. (Republic Act No. 8763)

For tax, any income that was subjected to final tax or were exempted should be excluded in the computation of the regular income tax. Hence, these will be considered as reconciling items in the reported taxable income.

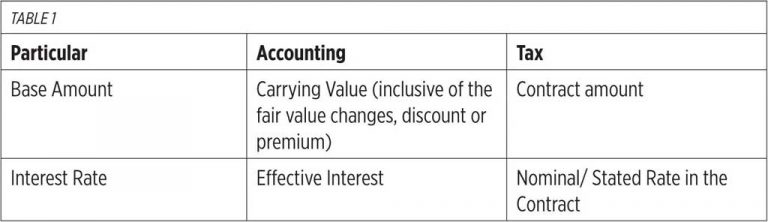

The computed interest income for tax may be different compared to the accounting income. The difference may result from the base amount and interest rate used. We present the comparison below in Table 1.

Such a difference in the computed interest income amount would create another temporary difference.

DISPOSAL OF FINANCIAL ASSET

For accounting, if the FA is sold, the entity will be recognizing a gain or loss. Such gain or loss is computed as the difference between the consideration received or selling price against the carrying value (i.e. inclusive of the cumulative gain or loss in the change of fair value) of the financial assets.

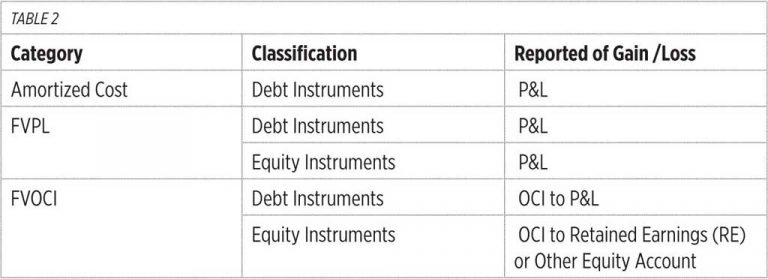

Note that the gain or loss recognized in the sale transaction will not absolutely be reflected in the profit & loss (P&L) statement. A table 2 is prepared above to summarize.

PFRS 9 par 5.7.10 states that “a gain or loss on financial asset measured at FVOCI shall be recognized in other comprehensive income, except for impairment gains or losses and of foreign exchange gains and, until the financial asset is derecognized or reclassified.” We take note, however, that any accumulated amount reported in the OCI will be recycled in the P&L and closed to RE for debt instrument and equity instrument, respectively.

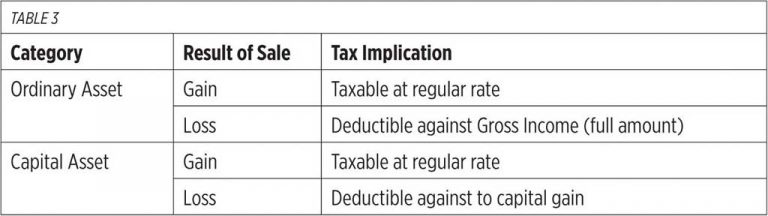

For tax, any gain or loss on the disposal is taxable and deductible in full or with limit depending on the characterization of the FA. It can be either an Ordinary Asset or a Capital Asset. (See Table 3).

If the capital asset (e.g. shares of stock) is subject to a final withholding tax or stock transaction tax, the income should not be included in the gross income subject to the regular tax.

Note that the changes in fair value of the FA as accumulated per accounting is not considered in the computation of the gain or loss for tax purposes. The disposal of the asset is taxable only upon actual sale or the happening of a closed and completed transaction.

Richard R. Ibarra is a senior manager of Tax Advisory & Compliance division of P&A Grant Thornton, the Philippine member firm of Grant Thornton International Ltd.

As published in BusinessWorld, dated 26 November 2019