The pandemic caused by this coronavirus has tax implications for employers and employees. What are they?

Several questions have arisen since the beginning of this pandemic that prompted many companies to opt for telework:

- What can employees deduct on their income tax return for their tax refund?

- What about home office expenses for employees?

- Will their internet subscription be deductible?

- What expenses can employers reimburse?

- What is included in the $500 non-taxable amount to reimburse telework expenses?

- As an employer, what are my new compliance requirements?

Our experts stay abreast of the main changes and will follow developments in the measures concerning your 2020 and 2021 tax returns and taxes.

Here are the answers to the main questions about deductible expenses for employees and the treatment of reimbursements, allowances and other benefits that may be granted.

Telework equipment

Employer’s supplies refund

An employer may compensate employees for home office expenses incurred. Generally, reimbursing employees for supplies used in the course of their work, such as paper, ink or long-distance calls, does not trigger a taxable benefit for the employees. It is therefore preferable to reimburse such expenses, upon presentation of supporting evidence, rather than granting employees an allowance, which would be taxable.

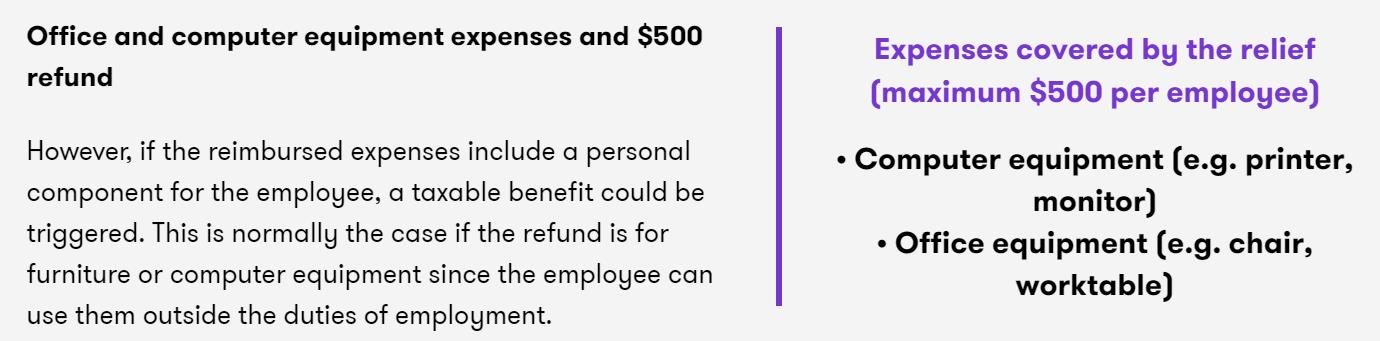

However, in the exceptional context of COVID-19, the Canada Revenue Agency (CRA) and Revenu Québec both consider that repayment, on presentation of supporting documentation, of a maximum of $500 to offset the cost of purchasing personal computer and office equipment so employees can perform their work duties at home is not a taxable benefit for the employee.

Home office expenses not reimbursed by the employer

Employees can deduct an amount for home office expense and supplies used directly in performing their duties if their employment contract requires them to pay the expenses and if they are not reimbursed by their employer. These conditions must be certified in a declaration signed by your employer.

Eligible home office expenses employees can deduct include electricity, heating and maintenance but not property taxes, home insurance premiums and insurance.

Internet, cell phone and other expenses

The tax authorities have issued several guidelines governing the expenses that are deductible as home office expenses, including cell phone and Internet charges and GST-QST costs. For full details on the treatment of these expenses and to find out which deductions and expenses are eligible, consult our publication on taxes and telework during the COVID-19 era, which will be updated as government guidelines evolve.

Do not hesitate to contact our experts, who will be pleased to accompany you through this at times complex process.

The document below is updated over time according to the measures’ evolution. Download it to find out the details of these measures.

Published from Raymond Chabot Grant Thornton