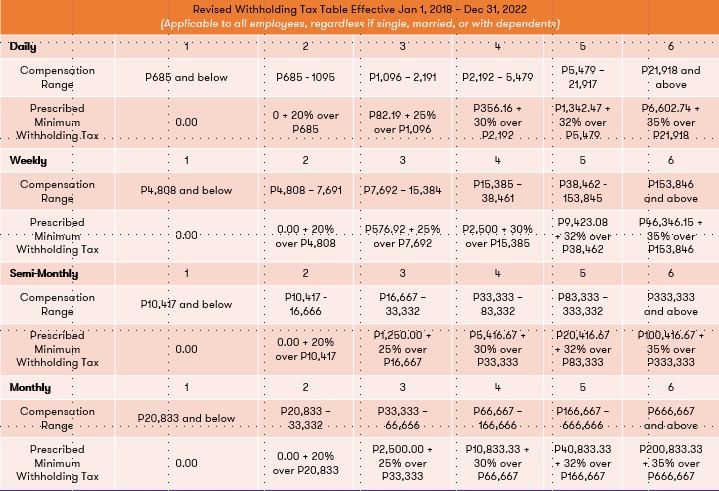

昨年12月19日に承認された税制改革パッケージ1(TRAIN法)に基づき、2018年1月1日より適用される給与源泉テーブルがBIRより発表された。

今後、月次所得が以下の者については源泉の対象外となり、今後は基礎控除及び扶養控除は撤廃される。

a. P685 daily wage

b. P4,808 weekly wage

c. P10,417 semi-monthly wage

d. P20,833 monthly wage

TRAIN法の下では、年間所得が25万以下の者は所得税免税となり、

また、非課税賞与枠は、82,000ペソから90,000ペソに変更となった。

TRAIN法のまとめは、別記事を確認下さい。

資料

①BIR:新給与源泉テーブル

②新所得税枠及び給与源泉テーブル

.