(Revenue Regulations No. 11-2018)

BIR歳入規則No. 11-2018により、専門家報酬支払などに係る源泉のルールが再度変更となりました。

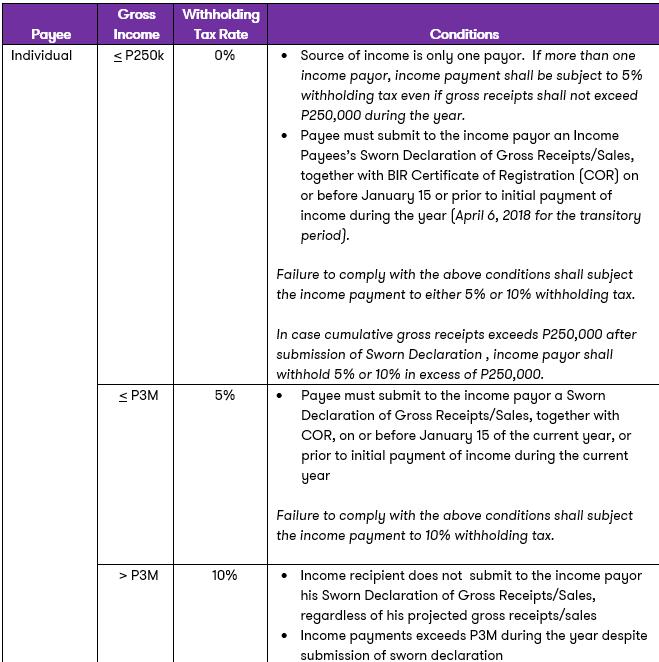

個人の専門家報酬、タレント報酬、コンサル報酬に関し、支払者は5%か10%の源泉徴収しなければならないとされました(2018年に通達されたRMC No. 01-2018で8%との通達, 2017年までは従来10%あるいは15%のルール)。また、25万ペソ以下の所得者で単一の支払者からの所得しかない場合、当該源泉税は対象となりません。ただし、支払の受取者が支払者の社員である場合、それは給与源泉対象となります。

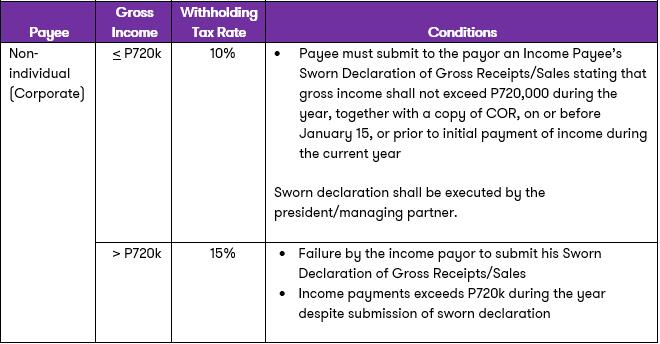

個人以外への支払は継続して10%、あるいは15%が源泉徴収率となります。

以下、専門家報酬支払い等の源泉のルールの表、源泉徴収者による宣誓書提出の要件をご確認ください。