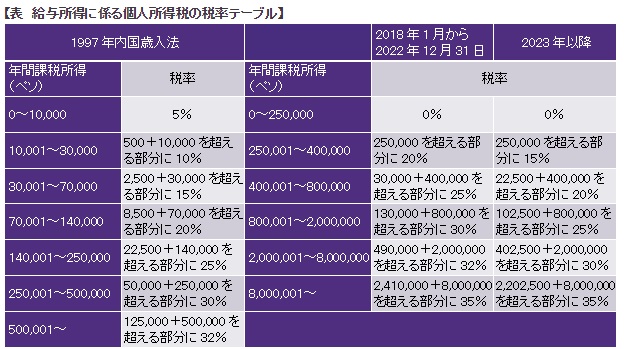

昨年の記事で駐在員の確定申告に関する記事を投稿したが、2017年12月19日に税制改革法案が承認され、2018年1月1日より施行された。2017課税年度においては旧ルールによる計算・納税となるが、2018年課税年度からは新ルールに対応しなければならない。今回は、個人所得税の累進課税テーブルに絞って駐在員の確定申告においてどのような影響が表れるのか解説する。

※駐在員確定申告の過去記事

フィリピンの税制改革は、Tax Reformfor Acceleration and Inclusion:加速と内包的成長のための税制改革 (通称TRAIN)と呼ばれ、TRAINは、1997年以来改正がされていない1997年内国歳入法を改正、一般国民の税負担を減らしつつ、他の税項目の見直しを実施し、インフラや社会保障の充実のための税収の増加を目指している。パッケージが複数に分けられ、第一弾であるパッケージ1は約1年間の財務省案の提出から上下院の承認、インパクトを受ける各産業界との調整や攻防を経て、大統領が2017年12月19日に共和国法第10963号として承認され、2018年1月1日に施行された。

ドゥテルテ政権下における税制改革の中で、個人所得税の課税テーブルの変更が注目を集めている。この変更はフィリピン法人で働く日本人駐在員の個人所得税にも大きな影響を与える。現在、フィリピンの税務調査の対象は法人が中心であり、個人に及ばないことが多いため、日本人駐在員の確定申告を行っていない企業も散見されるが、各国の税務調査の動向を考慮すると、数年後にはフィリピンでも個人所得税の税務調査が本格化すると考えられる。

旧法では、5%~32%の累進課税テーブルが採用されていたが、その課税テーブルが20年来見直されず、年間50万ペソ(約100万円)の所得収入を得ていた人は、所得が50万ペソを超える部分に最高税率である32%が課されていた。フィリピンの給与基準で、マネージャークラスの中間所得層でこの税率の対象となる人が多く、中間所得層者に対して大きな負担となっていた。

変更後のテーブルでは、一部の高額給与所得者を除き減税となり、2023年以降はさらに減税となる。

上記の大幅変更に加え、以下の変更が実行された。

今まで規定されていた細かな控除がなくなり、世帯、扶養家族の有無にかかわらず25万ペソ以下の所得者は免税となり非常に分かりやすいシステムになったと言える。

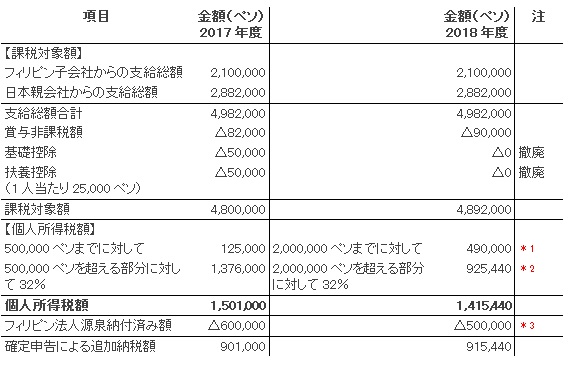

下記の条件の場合の確定申告の具体的な計算について説明していく。

給与等情報

・フィリピン

・日本

なお、計算の便宜上、社会保険については考慮しない。

*1,*2:表1の累進課税テーブルに基づく

*3:月次源泉徴収額も、ルールに基づき2018年度より変更

改正により、給与計算事務が非常にシンプルになり、個人所得税額が減少する駐在員が増えると考えられる。

以上

お問い合わせ、相談は:

P&Aジャパンデスク(Japan.Desk@ph.gt.com )まで。