ドゥテルテ政権下における税制改革の中で、個人所得税の課税テーブルの変更が注目を集めている。この変更はフィリピン法人で働く日本人駐在員の個人所得税にも大きな影響を与える。現在、フィリピンの税務調査の対象は法人が中心であり、個人に及ばないことが多いため、日本人駐在員の確定申告を行っていない企業も散見されるが、各国の税務調査の動向を考慮すると、数年後にはフィリピンでも個人所得税の税務調査が本格化すると考えられる。

前回は納税義務者と適用税率について解説をした。今回は、留意点と計算イメージについて解説をする。

日本人駐在員が確定申告を実施する場合、毎年1月1日から12月31日の所得について、翌年の4月15日までに申告を行う必要がある。また、該当する申告書は、BIR Form No. 1700であり、フィリピン法人からの所得と日本、その他海外関係会社からの所得が合算されて申告される。なお、既にフィリピン法人が納めている源泉徴収額についてBIR Form No. 2316 – Certificated of Compensation Payment / Tax Withheld (源泉徴収票)を申告時に添付資料として提出する必要がある。

確定申告に際しての留意点として、下記を紹介する。

・付加給付税(FBT :Fringe Benefit Tax)

管理者の立場にある従業員が受け取る住宅や車などに対する手当については、支給しているフィリピン法人が付加給付税を納税する義務がある。

・デ・ミニミス(非課税)手当(De Minims Benefits)

有給休暇買取代、医療・ユニフォーム等の手当に関して一定の課税対象外の金額が定められている。当該手当てについては非課税手当とされる。

・受取利息・配当等その他収入

受取利息・配当、株式の売買や譲渡から発生した所得等は、最終源泉税として納税することで完了となっているため、確定申告による追加の納税は発生しない。

・控除額

下記の非課税枠・控除が定められている。

賞与非課税枠(Nontaxable bonus):82,000 ペソ

基礎控除(Personal exemption):50,000ペソ

扶養控除(Additional exemption):1名につき25,000ペソ(フィリピンで一緒に生活している21歳までの子ども4人まで)

・フィリピン人従業員への情報開示

日本人駐在員とフィリピン人従業員の間の給与格差が大きいため、駐在員の保安上の観点等から、フィリピン人従業員に対しては駐在員が親会社等から支給されている給与額は開示しないことが多い。また、確定申告業務を会計事務所が行い、当該業務契約自体を日本親会社と会計事務所間で契約することにより、フィリピン人従業員には駐在員が確定申告自体をしていることすら知られないという形をとることが多い。

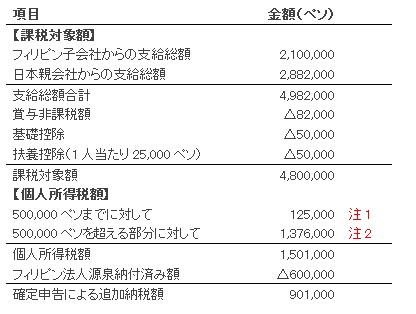

下記の条件の場合の確定申告の具体的な計算について説明していく。

対象:A氏(40歳) 日本の親会社からフィリピン子会社へ出向

家族:フィリピンで妻・子供2名(10歳・8歳)と同居

フィリピン滞在期間:1月1日から12月31日

給与等情報:

・フィリピン

給与月額150,000ペソ・13ヶ月及び14ヶ月ボーナスあり

支給総額150,000ペソ×14=2,100,000ペソ

月次の源泉所得にて納税済みの金額:600,000ペソ

・日本

給与月額400,000円・賞与夏・冬2回 賞与支給総額1,750,000円

支給総額400,000円×12+1,750,000 =6,550,000円

6,550,000円×為替レート(JPY-PHP):0.44=2,882,000ペソ

なお、計算の便宜上、社会保険については考慮しない。

注

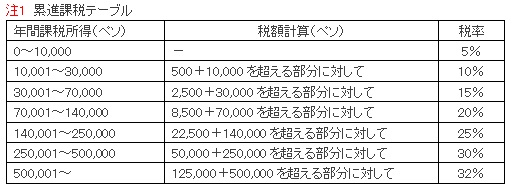

*1 累進課税テーブル

*2 (課税対象額4,800,000ペソ△500,000ペソ)×32%=1,376,000ペソ

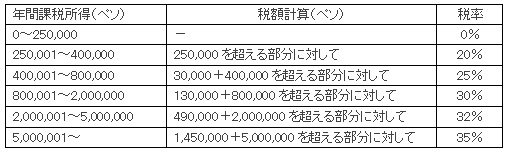

最後に、現在審議中税制改革の一環として見直しが検討されている改正個人所得税枠をご紹介する。

この税改革により、増税となるのは、課税所得が約9百万ペソ(約2千万円)以上の場合であり、また、年課税所得が5百万ペソ以上の割合は、納税者の0.1%の為、ほぼ全納税者の個人所得税が減税となる。

2017年8月現在、上記の改正個人所得税枠については、税改革のパッケージ1として、下院を通過した上記の所得税は下院を通過している。今後の上院で審議に注目が集まっている。

以上

P&Aジャパンデスク(Japan.Desk@ph.gt.com )まで。