ドゥテルテ政権下における税制改革の中で、個人所得税の課税テーブルの変更が注目を集めている。この変更はフィリピン法人で働く日本人駐在員の個人所得税にも大きな影響を与える。現在、フィリピンの税務調査の対象は法人が中心であり、個人に及ばないことが多いため、日本人駐在員の確定申告を行っていない企業も散見されるが、各国の税務調査の動向を考慮すると、数年後にはフィリピンでも個人所得税の税務調査が本格化すると考えられる。以下、フィリピンにおける確定申告のポイントについて説明する。

フィリピンで日本人駐在員の個人所得税の課税対象となる所得は、フィリピン源泉所得(Philippine-sourced income)である。これは、給料・賞与・手当等のフィリピンで行った労働の対価である。留意点としては、どこで支払いがされたかどうかは無関係にフィリピン源泉所得とみなされるということである。駐在員がフィリピン法人とは別に、出向元の親会社や他の関係会社からフィリピンで行った労働の対価として所得を受け取っている場合、その所得はフィリピンで課税対象となる。

この親会社や他の海外関係会社から支払われる給与は、フィリピンではなく日本やシンガポール等、フィリピン以外の銀行口座へ振込まれ支払われるケースがほとんどであるため、フィリピン法人を通さずに支払いが行われ、フィリピン法人では毎月の給与源泉が行われていない。フィリピン法人で給与源泉がされていない給与・賞与等に対する申告・納税を行うために、駐在員はフィリピンで確定申告を行う必要となる。 逆にフィリピン源泉所得ではない所得(日本での役員報酬、家賃収入、配当、利息等)については、フィリピンでの申告・納税の義務はないこととなる。

なお、現地採用等の場合で、フィリピン法人とのみ雇用契約を結び、その法人からの給与のみ発生している者については、フィリピン法人からの給与源泉をもって納税が確定しているため、確定申告によって新たに納税すべき所得税額はない。

フィリピンの税法では、外国人の納税義務者は以下の3つに分類されている。

非居住外国人であり、フィリピンで事業に従事する外国人のことであり、1年間でフィリピン滞在日数が180日を超える。一般的な日本人駐在員はこれに該当すると考えられる。

非居住外国人であり、1年間でフィリピン滞在日数が180日以下。

外国人については、上記の区分ごとに適用される税率が異なる。

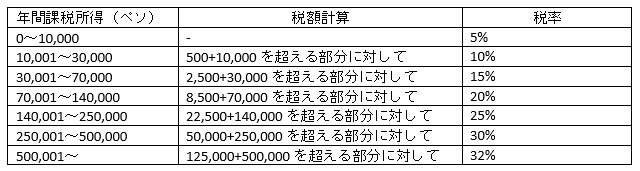

「フィリピン居住者」及び「フィリピンで事業に従事する非居住者 滞在期間180日超」の場合、フィリピン人と同様に5%~32%の累進課税が適用される。

なお、上記の表は20年前のフィリピンの給与水準を基準とした累進課税テーブルとなっているため、現在の給与水準では税負担が重く、中間所得層が育たず、人材の海外流出や、消費が伸びないといった問題があるため、現在、ドゥテルテ政権下において、見直しが検討されている。

「フィリピンで事業に従事していない非居住者 滞在期間180日以下」に対しては、一律25%の税率が適用される。フィリピン法人から当該非居住者に対して給与等が支払われる際に、

25%を最終源泉税としてBIR(内国歳入庁)に納税し、残りの75%を非居住者に支払う形となる。当該最終源泉税の支払で納税が完了することになるため、確定申告は不要である。

なお、日比租税条約において、短期滞在者の免除規定が定められていて、フィリピンの滞在期間が1年間で183日を超えず、かつ、給与等の報酬がフィリピン法人から支払われない場合には、フィリピンにおける納税義務が免除されている。

特例として、地域統括本部(RHQ:Regional Head quarters)及び地域経営統括本部(ROHQ:Regional Operating Headquarters)の従業員、石油関連事業の従業員、オフショアバンクユニットの従業員には15%の優遇税率が適用される。

今回は納税義務者と適用税率について解説をした。次回は、留意点と計算イメージについて解説をする。

以上

P&Aジャパンデスク(Japan.Desk@ph.gt.com )まで。